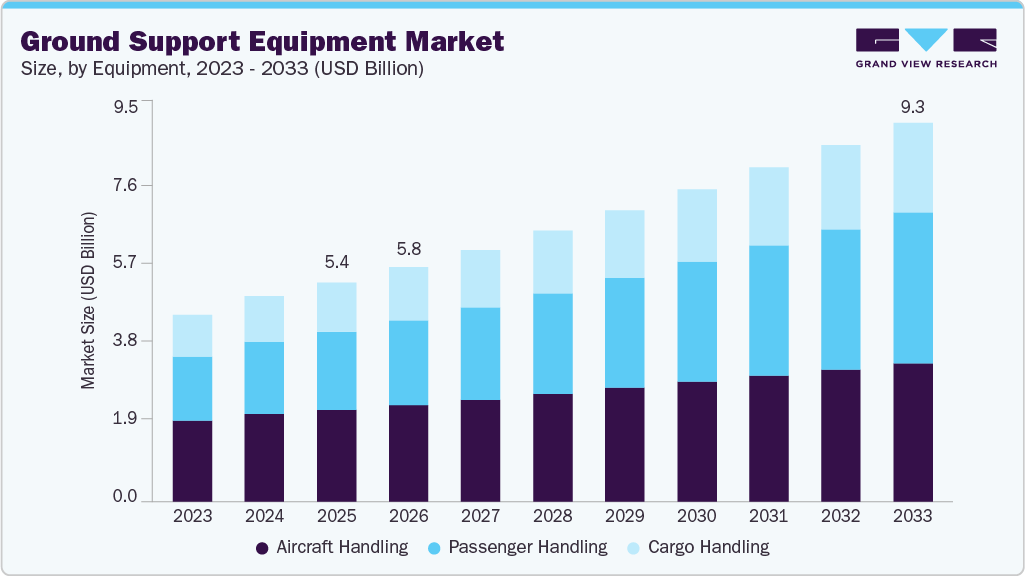

Ground Support Equipment Market growing at a CAGR of 7.1% from 2026 to 2033

The global ground support equipment market size was estimated at USD 5,406.1 million in 2025 and is projected to reach USD 9,336.5 million by 2033, growing at a CAGR of 7.1% from 2026 to 2033. This market expansion is driven by increasing air passenger traffic, the expansion of airport infrastructure, and a rising demand for efficient aircraft turnaround operations.

Key Market Trends & Insights

- North America dominated the global ground support equipment industry with the largest revenue share of over 33% in 2025.

- The ground support equipment industry in the U.S. led the North America market and held the largest revenue share in 2025.

- By equipment, the non-electric segment led the market and held the largest revenue share of over 65% in 2025.

- By application, the aircraft handling segment led the market and held the largest revenue share of over 42% in 2025.

- By ownership, the airport owned segment led the market and held the largest revenue share of over 38% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5,406.1 Million

- 2033 Projected Market Size: USD 9,336.5 Million

- CAGR (2026-2033): 7.1%

- North America: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/ground-support-equipment-market-report/request/rs1

Growing adoption of electric and hybrid GSE to reduce emissions and operational costs, coupled with technological advancements in automation and safety systems, is further fueling demand. The growth of the ground support equipment industry is driven by the convergence of digitalization, automation, and sustainable technologies that redefine operational efficiency across airport ecosystems. The adoption of electric and hybrid-powered GSE units is accelerating as airports and airlines align with global carbon-neutral targets, reducing fuel dependency and maintenance costs. Advanced telematics, IoT sensors, and edge computing enable real-time fleet monitoring, predictive maintenance, and data-driven decision-making, minimizing downtime and enhancing turnaround efficiency.

Artificial intelligence (AI) and machine learning integration further enhance ground operations by enabling autonomous towing, baggage handling, and aircraft servicing systems. These intelligent platforms continuously learn from operational data to optimize routing, improve safety standards, and reduce human error. The integration of AI-based analytics also supports adaptive scheduling and resource allocation, ensuring faster aircraft turnaround times and improved asset utilization.

In addition, the market is witnessing a significant shift toward digital twins and remote management technologies that are revolutionizing equipment lifecycle management. By simulating operational conditions and predicting wear patterns, digital twin models enable operators to make informed decisions regarding maintenance and procurement. This transition to connected, intelligent infrastructure supports airports’ goals for higher throughput and reliability amid growing air traffic volumes.

Moreover, the increasing adoption of 5G connectivity and advanced communication systems enhances coordination between ground crews, aircraft systems, and airport operations centers. This ultra-low latency network infrastructure supports the synchronization of automated ground handling, smart parking, and cargo tracking systems, ensuring efficient workflows and real-time visibility across operations.

Furthermore, sustainability mandates and regulatory frameworks are key drivers of growth for the adoption of green technologies in the ground support equipment industry manufacturing and operations. Companies are increasingly investing in battery-electric, hydrogen-fueled, and solar-powered GSE fleets to comply with emissions standards and achieve environmental certifications. This evolution toward sustainable and connected ground support infrastructure is positioning airports as smart, efficient, and environmentally responsible hubs of future aviation.

Ground Support Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 5,776.3 million |

|

Revenue forecast in 2033 |

USD 9,336.5 million |

|

Growth rate |

CAGR of 7.1% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report Product |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Equipment, application, ownership, end use, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Oshkosh Aerotech LLC; Textron Inc.; TCR Group; Tronair; Weihai Guangtai Airport Equipment Co., Ltd.; China International Marine Containers (Group) Co. Ltd.; TLD Group; Cavotec Group; Toyota Material Handling, Inc.; TREPEL Airport Equipment GmbH; Global Ground Support LLC; Mallaghan; Jalux Inc.; Rheinmetall AG |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet you exact research needs. Explore purchase options |