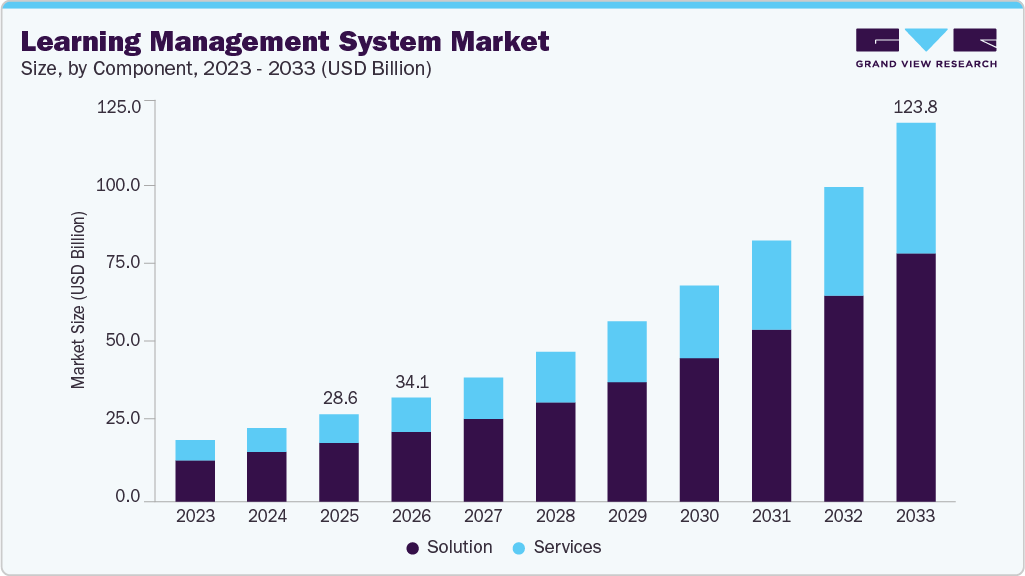

Learning Management System Market growing at a CAGR of 20.2% from 2026 to 2033

The global learning management system market size was estimated at USD 28.58 billion in 2025 and is projected to reach USD 123.78 billion by 2033, growing at a CAGR of 20.2% from 2026 to 2033. The rising adoption of AI-driven personalized learning, increased demand for mobile-first and microlearning platforms, growing integration of analytics for performance tracking, expanding use of LMS solutions in corporate upskilling and compliance training, and higher preference for cloud-based and scalable deployment models.

Key Market Trends & Insights

- North America dominated the global learning management system market with the largest revenue share of over 36% in 2025.

- The learning management system market in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, solution segment led the market and held the largest revenue share of over 67% in 2025.

- By delivery mode, distance learning segment held the dominant position in the market and accounted for the leading revenue share of over 40% in 2025.

- By End Use, academic segment is expected to grow at the fastest CAGR of over 20% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 28.58 Billion

- 2033 Projected Market Size: USD 123.78 Billion

- CAGR (2026-2033): 20.2%

- North America: Largest Market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/learning-management-systems-market/request/rs1

Microlearning is gaining traction as companies prioritize short, focused lessons that fit into busy schedules. Learners complete five to ten-minute modules that deliver essential information without overload, improving retention and encouraging frequent engagement. Organizations use microlearning to efficiently deliver updates, product knowledge, and compliance training. It also supports flexible hybrid and remote work models. As a result, microlearning offers a practical solution for continuous learning across diverse workforce environments.

Gamification is increasingly motivating learners through features such as badges, points, and leaderboards. These elements foster progress and achievement, encouraging greater participation. More interactive training reduces drop-off rates and increases engagement. Companies report higher course completion when gamified elements are integrated into the LMS. Vendors are expanding these tools to support team challenges and individual skill development. As a result, organizations can deliver learning programs that are both effective and engaging.

Skills mapping enhances the strategic value of LMS platforms by linking training content to specific competencies. Organizations use this approach to identify skill gaps and create targeted learning paths aligned with workforce needs. Employees better understand how training supports their career progression. LMS platforms with integrated skills mapping enable managers to track proficiency and plan development initiatives more effectively. Companies leverage this capability to support upskilling and reskilling during business transformation. This trend is shifting learning from a compliance activity to a structured talent development tool.

Component Insights

The solution segment led the market in 2025, accounting for over 67% of global revenue. Growth is driven by demand for advanced learning platforms that support personalized training, progress tracking, and efficient content delivery. Organizations are adopting feature-rich LMS solutions to enhance employee development and ensure compliance. As digital learning expands, companies are investing in platforms with integrated analytics, automation, and mobile access. Vendors are offering scalable solutions for large learner groups and complex training needs. The need for measurable learning outcomes is accelerating investment in LMS solutions, positioning the solution segment as a key driver of market growth.

The services segment is expected to see significant growth due to rising demand for implementation, integration, and ongoing support that optimize learning platforms. Companies rely on professional services to customize LMS features for their training structures, compliance needs, and workflows. The shift to remote and hybrid work is increasing demand for expert guidance in deployment and user onboarding. Service providers offer consulting, migration assistance, and training support to maximize system value from the start. Many enterprises also use managed services to maintain platform performance and reduce IT workload. These factors position the services segment as a critical enabler of successful LMS adoption across industries.

Learning Management System Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2026 |

USD 34.09 billion |

|

Revenue forecast in 2033 |

USD 123.78 billion |

|

Growth rate |

CAGR of 20.2% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, delivery mode, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Cornerstone.; Anthology Inc.; D2L Corporation; PowerSchool; Instructure, Inc.; Adobe.; Oracle; SAP; Moodle; McGraw Hill |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |