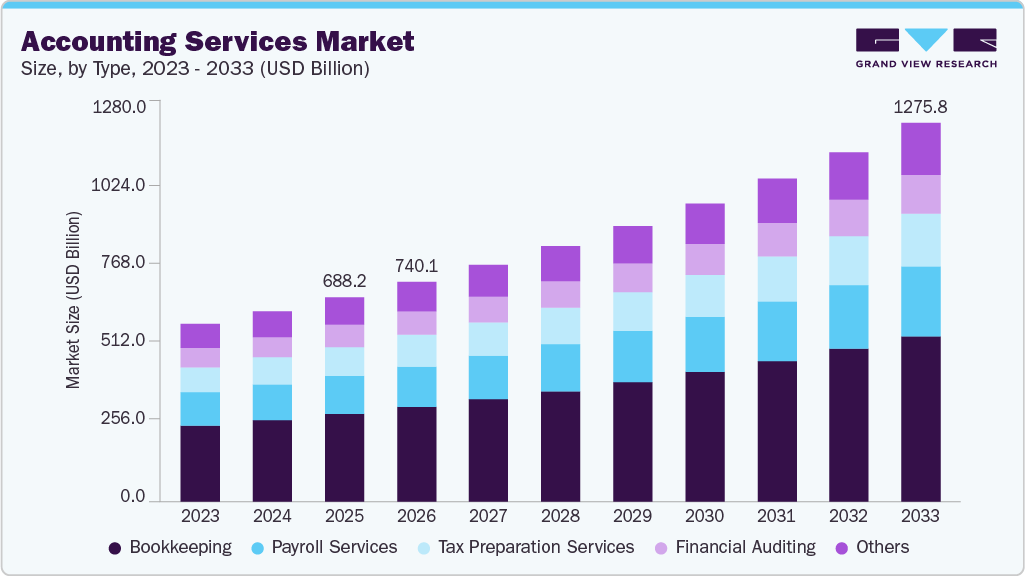

Accounting Services Market growing at a CAGR of 8.1% from 2026 to 2033

The global accounting services market size was estimated at USD 688.17 billion in 2025, and is projected to reach USD 1,275.84 billion by 2033, growing at a CAGR of 8.1% from 2026 to 2033, driven by the rapid digitalization of financial operations, expanding regulatory compliance requirements, and the rising adoption of AI-enabled accounting tools that streamline auditing, tax management, and real-time financial reporting. Additional growth momentum comes from the increasing outsourcing of finance and accounting (F&A) functions by SMEs and large enterprises, the global shift toward cloud-based accounting platforms, and the growing need for advisory services as businesses navigate complex tax reforms, sustainability reporting mandates, and evolving global financial standards.

Key Market Trends & Insights

- The North America accounting services market accounted for a 38.0% share of the overall market in 2025.

- The accounting services industry in the U.S. held a dominant position in 2025.

- By type, the bookkeeping segment accounted for the largest share of 43.2% in 2025.

- By delivery model, the traditional segment held the largest market share in 2025.

- By end use, the e-commerce segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 688.17 Billion

- 2033 Projected Market Size: USD 1,275.84 Billion

- CAGR (2026-2033): 8.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest Growing Market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/accounting-services-market-report/request/rs1

The widespread adoption of digital tax systems by national revenue agencies is propelling the market growth of accounting services worldwide. Government-backed initiatives such as API-linked e-filing platforms, automated data-exchange frameworks, and digital audit trails are enabling authorities to collect and analyze financial data with unprecedented speed. OECD documentation notes that most tax administrations now operate advanced data-management strategies, pushing businesses to upgrade their accounting processes, migrate to cloud-led systems, and rely more heavily on professional accounting firms that can manage continuous compliance, real-time reporting, and integrated bookkeeping. This rapid digital transformation is boosting the market as companies increasingly seek expert partners to navigate these modern tax ecosystems.

The rising complexity of global regulatory landscapes is driving strong momentum across the accounting services industry. With authorities such as the U.S. Securities and Exchange Commission introducing enhanced disclosure rules, including climate-related financial information and expanded audit documentation requirements, organizations are compelled to implement far more structured, data-rich reporting frameworks. These mandates require specialized technical accounting expertise, sophisticated internal controls, and robust assurance practices. As a result, businesses are turning to accounting firms for guidance on compliance implementation, disclosure preparation, and verification processes. This surge in regulation-led advisory work is significantly propelling the market expansion.

The deeper integration of AI, machine learning, and automation into financial workflows is boosting the market by reshaping how accounting services are delivered. National standards bodies, such as NIST, have established frameworks for safe and responsible AI use, enabling firms to adopt automated tools for transaction categorization, irregularity detection, forecasting, and audit sampling. As routine tasks become machine-led, accounting firms are shifting their service mix toward high-value advisory, risk governance, and analytics support. This transformation is accelerating market growth as clients increasingly demand AI-enabled accuracy, faster cycle times, and predictive financial insights, functions best supported by professional accounting partners.

Escalating cyber threats and stringent data-privacy standards are driving the expansion of specialized accounting services. Government agencies such as CISA are issuing detailed sector-specific cybersecurity guidance, urging organizations to reinforce controls over financial data flows across cloud systems, tax portals, and third-party processors. As compliance expectations grow, accounting firms are being engaged to design secure audit trails, implement encrypted workflows, strengthen identity and access controls, and assess vendor-risk exposure. This heightened focus on financial data protection is boosting the market by positioning accounting providers as essential partners in resilience planning and secure financial operations.

Increasing global trade in professional and digitally delivered services is propelling the market growth, as organizations expand their outsourcing of tax, payroll, and financial reporting activities. Government labor statistics show an ongoing rise in highly skilled accounting and advisory roles, even as routine bookkeeping roles decline due to automation. This changing occupational landscape, supported by international trade data from bodies such as the OECD and World Bank, is driving accounting firms to scale operations through hybrid delivery models, combining onshore advisory with offshore/nearshore processing. The combination of workforce shifts and digital trade acceleration is boosting industry expansion by enabling firms to deliver broader, more cost-efficient global accounting solutions.

Accounting Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 740.12 billion |

|

Revenue forecast in 2033 |

USD 1,275.84 billion |

|

Growth rate |

CAGR of 8.1% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, delivery model, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Deloitte; PricewaterhouseCoopers (PwC); Ernst & Young (EY); KPMG; BDO Global; RSM International; Grant Thornton International; Crowe Horwath International (Crowe); Baker Tilly International; Forvis Mazars |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |