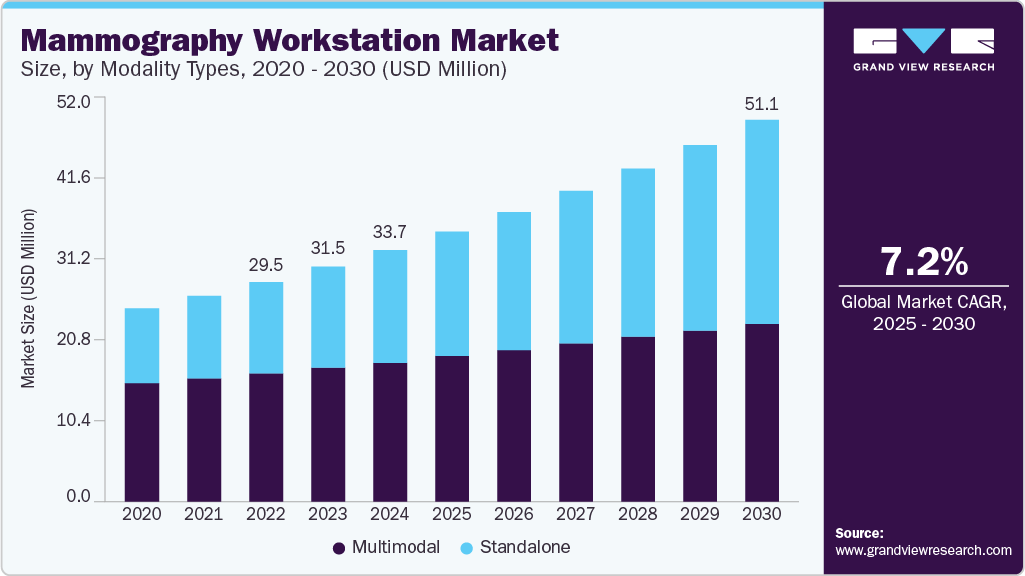

Mammography Workstation Market growing at a CAGR of 7.2% from 2025 to 2030

The global mammography workstation market size was valued at USD 33.7 million in 2024 and is expected to grow at a CAGR of 7.2% from 2025 to 2030. This growth is attributed to the rising incidence of breast cancer and growing awareness about the importance of early detection are major contributors, prompting increased adoption of advanced diagnostic technologies.

Key Highlights:

- North America’s mammography workstation market dominated the global market with the largest revenue share of 60.9% in 2024.

- The mammography workstation market in the U.S. led the North American market.

- In terms of modality types segment, the multimodal segment led the market and held the largest revenue share of 55.3% in 2024,

- In terms of end use segment, the hospital segment held the dominant position in the market and accounted for the largest revenue share of 46.7% in 2024,

- In terms of application segment, the diagnosis screening dominated the global mammography workstation market with the largest revenue share of 39.2% in 2024.

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/mammography-workstation-market/request/rs1

In addition, technological advancements, including integration of artificial intelligence and improved imaging solutions, are enhancing diagnostic accuracy and workflow efficiency. Furthermore, higher healthcare spending, government initiatives for breast cancer screening, and frequent product innovations by leading manufacturers are further accelerating market expansion worldwide.

A mammography workstation is a specialized digital platform used by radiologists and healthcare professionals to interpret, analyze, and manage mammographic images, primarily for the detection and diagnosis of breast cancer. The global mammography workstation market is experiencing robust growth, propelled by several interconnected factors.

As more people are diagnosed each year, the demand for advanced diagnostic solutions becomes increasingly urgent. According to the WHO breast cancer fact sheet, in 2022, 2.3 million women globally were diagnosed with breast cancer, making it the most common cancer in women in 157 out of 185 countries, with 670,000 deaths recorded that year.

The market also benefits from the frequent introduction of new and innovative products and swift regulatory approvals that quickly bring the latest technologies to healthcare providers. These advancements often result in minimally invasive procedures, enhancing patient comfort and clinical outcomes. Significant investments in research and development are fostering the creation of next-generation technologies that allow for earlier and more accurate diagnosis, empowering patients and clinicians to make informed decisions. Furthermore, rising healthcare spending, higher disposable incomes, and improvements in healthcare infrastructure are making advanced mammography solutions more accessible across different regions. Government incentives and supportive policies further encourage the adoption of cutting-edge diagnostic tools. Integrating artificial intelligence and machine learning into mammography workstations revolutionizes image analysis, increases efficiency, and opens new opportunities for market participants. For instance, as per an article published on National Library of Medicine in March 2025, between 2021 and 2023, integrating AI into mammography workstations increased the area under the curve (AUC) by 24.7% (from 0.73 to 0.91), accuracy by 15.6% (from 0.77 to 0.89), and sensitivity by 37.1% (from 0.62 to 0.85).

Moreover, expanding government screening programs, increased public awareness about breast health, and a growing elderly population are further fueling market expansion. As healthcare systems prioritize early detection and digital transformation, mammography workstations are reaching more remote and underserved communities, ensuring broader access to quality breast imaging.

Mammography Workstation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 36.1 million |

|

Revenue forecast in 2030 |

USD 51.1 million |

|

Growth rate |

CAGR of 7.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Modality types, application, end use, region. |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Siemens HealthCare, GE Healthcare, Phillips Healthcare, Fujifilm, Hologic, Analogic Corporation, Konica Minolta Business Solutions India Private Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |