Osteoarthritis Therapeutics Market growing at a CAGR of 9.0% from 2025 to 2033

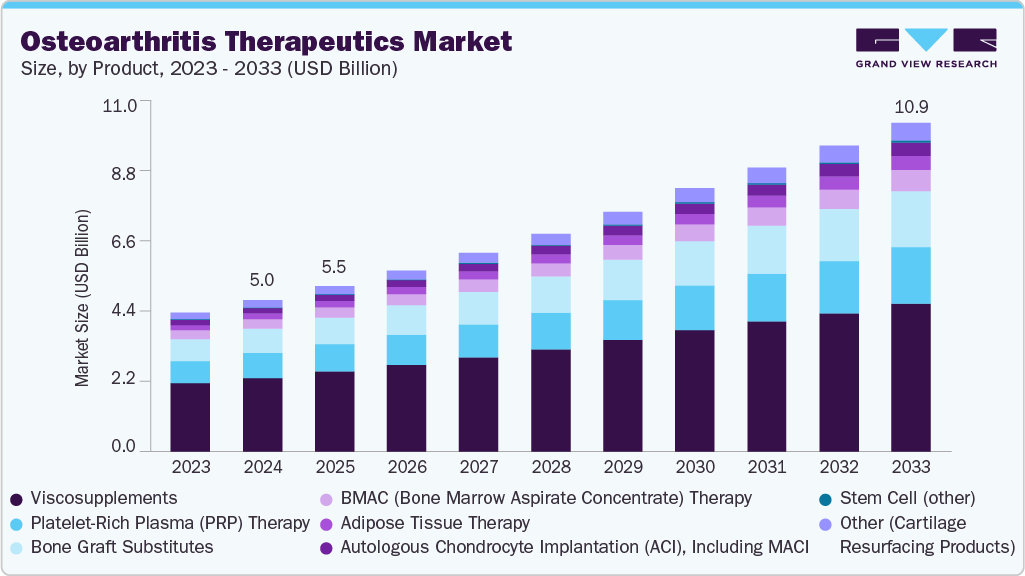

The global osteoarthritis therapeutics market size was estimated at USD 5.02 billion in 2024 and is projected to reach USD 10.89 billion by 2033, growing at a CAGR of 9.0% from 2025 to 2033. The osteoarthritis (OA) treatment market is witnessing significant growth, driven by the increasing prevalence of the condition and its profound impact on individuals’ quality of life.

Key Market Trends & Insights

- North America dominated the global market with a share of 35.05% in 2024.

- By product, the viscosupplements segment dominated the market with a share of 48.85% in 2024.

- By application, the knee osteoarthritis segment held the majority share of 59.82% in 2024.

- By primary user, the orthopedic surgeons segment held the majority share of 37.67% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.02 Billion

- 2033 Projected Market Size: USD 10.89 Billion

- CAGR (2025-2033): 9.0%

- North America: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/osteoarthritis-therapeutics-market-report/request/rs1

According to the Global Burden of Disease (GBD) Study 2020, approximately 595 million people worldwide were living with osteoarthritis, representing 7.6% of the global population. This number continues to rise, primarily due to demographic shifts and lifestyle factors such as aging and obesity. The GBD report, published in November 2024, noted a sharp increase in OA cases, with approximately 466.3 million new cases recorded in 2021 alone. The condition most commonly affects weight-bearing joints, particularly the knee, making it a growing concern for healthcare systems worldwide. The rise in OA prevalence is particularly pronounced among older populations, with data from the Centers for Disease Control and Prevention (CDC) published in February 2024 indicating that arthritis rates increase substantially with age. In adults aged 75 and older, the prevalence of arthritis is as high as 53.9%, underscoring the strong correlation between aging and OA.

The growing geriatric population is a major driver of market growth, with the World Health Organization (WHO) projecting that by 2050, 16% of the global population is expected to be aged 65 or older. As the elderly population expands, particularly in regions such as Japan and Europe where the aging demographic is more pronounced, the demand for age-specific OA treatments is rising. According to the WHO’s July 2023 report, 73% of individuals living with osteoarthritis are aged 55 or older, highlighting the increasing prevalence of OA in older age groups. This demographic shift has prompted the healthcare industry to focus on therapies that address the unique needs of elderly patients, many of whom also have multiple comorbidities. As of October 2024, healthcare systems are focusing more on geriatric care, emphasizing the development of treatments that improve mobility and overall quality of life for elderly OA patients. Moreover, the growth of the elderly population is catalyzing investments in clinical research to develop innovative therapies, such as biologics and regenerative treatments, aimed at slowing disease progression and enhancing joint function.

Another significant factor driving the osteoarthritis therapeutics market is the rising incidence of sports injuries and accident-related joint damage. As participation in sports and physical activities continues to increase, so does the risk of injuries that lead to joint damage and accelerate the onset of OA. In addition to the direct impact on treatment modalities, these injuries contribute to a growing awareness of the need for joint health management. The International Labour Organization (ILO), in its 2024 report, estimated that 395 million workers worldwide sustain non-fatal work injuries annually, many of which result in long-term joint damage and subsequent OA. Furthermore, the World Health Organization (WHO) reported in 2024 that injuries account for around 4.4 million deaths annually, with a significant portion of these fatalities linked to road accidents. This growing awareness has led to increased interest in preventative measures, such as nutritional supplements, physical therapy, and the development of novel OA treatments aimed at maintaining joint health and improving recovery outcomes. As a result, the osteoarthritis therapeutics market is experiencing an uptick in the development of therapies designed to address both the prevention and treatment of OA, further contributing to market growth.

Market Concentration & Characteristics

The osteoarthritis (OA) treatment market is evolving with significant innovation, particularly in disease-modifying treatments (DMOADs), biologics, and regenerative therapies. Advancements include stem cell therapies such as StemOne, launched by Alkem Laboratories in September 2022, which aims to repair knee joint cartilage, and the development of tissue-engineered implants. Moreover, biologics, such as monoclonal antibodies, are being tested to target disease pathways. AI-driven diagnostics for joint degeneration are also emerging, offering personalized care options. However, much of this innovation is still in the trial phase, and long-term efficacy remains unproven, making it a high-risk, high-reward area for the industry.

Entering the OA treatment market is challenging due to high development costs, long clinical timelines, and regulatory hurdles. For instance, stem cell therapies such as CARTISTEM are facing regulatory delays, with companies investing over a decade in development. Even after regulatory approval, market access involves establishing distribution networks and navigating reimbursement policies. The rise of generic drugs and biosimilars, such as ABP-980 for arthritis, adds further competition, making it difficult for new players to differentiate their products and capture market share without offering innovative solutions or significant improvements.

Osteoarthritis Therapeutics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.49 billion |

|

Revenue forecast in 2033 |

USD 10.89 billion |

|

Growth rate |

CAGR of 9.0% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, application, primary user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key company profiled |

Stryker; Zimmer Biomet Holdings, Inc.; Medtronic; Anika Therapeutics, Inc.; Bioventus; Vericel Corporation; Smith & Nephew; Fidia Farmaceutici S.p.A.; SEIKAGAKU CORPORATION; Sanofi |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |