Urinary Incontinence Therapeutics Market growing at a CAGR of 5.4% from 2025 to 2033

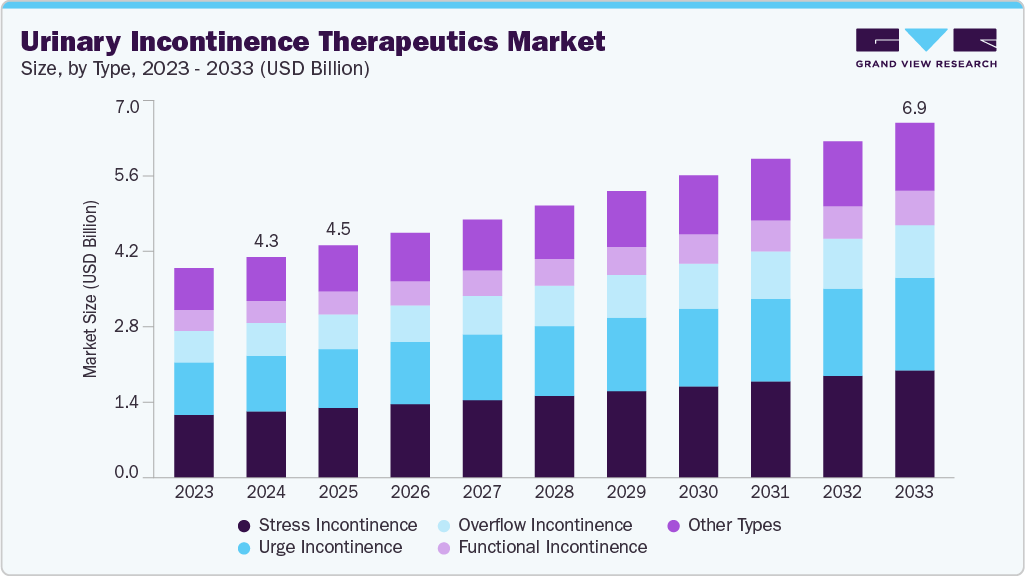

The global urinary incontinence therapeutics market size was estimated at USD 4.32 billion in 2024 and is projected to reach USD 6.95 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. This growth is primarily driven by the increasing prevalence of urinary incontinence among aging populations and the growing demand for effective therapeutic interventions that address bladder dysfunction.

Key Market Trends & Insights

- North America urinary incontinence therapeutics market held the largest share of 40.08% of the global market in 2024.

- The urinary incontinence therapeutics industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the stress incontinence segment held the largest market share of 30.05% in 2024.

- By drug class, the anticholinergics segment held the largest market share in 2024.

- By gender, the female segment held the largest market share in 2024.

- By distribution channel, the retail pharmacies segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.32 Billion

- 2033 Projected Market Size: USD 6.95 Billion

- CAGR (2025-2033): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/urinary-incontinence-therapeutics-market-report/request/rs1

According to a May 2023 report by Dovepress, the prevalence of female urinary incontinence was found to be 24.8%, with stress incontinence accounting for 12.7%, mixed incontinence for 8.0%, and urgency incontinence for 4.1%. The study indicated that prevalence increased progressively with age and body mass index, emphasizing the need for early diagnosis and effective therapy. Rising awareness among patients and healthcare providers has improved diagnosis and management rates, supporting higher treatment adoption. Advancements in β3-adrenoceptor agonists and antimuscarinic agents are improving outcomes across patient groups, while wider access to oral and non-invasive options is enhancing adherence. Expanding retail and online pharmacy networks are ensuring consistent medication availability, reinforcing market performance across regions.

The market is expanding as pharmaceutical companies focus on developing targeted and safer therapies addressing persistent unmet needs. For instance, in April 2024, Lupin Ltd introduced Mirabegron, a generic alternative to Myrbetriq, aimed at managing overactive bladder in the U.S. The introduction of such generics and novel mechanisms of action is diversifying treatment options and improving accessibility. Investments in research programs to enhance efficacy and minimize side effects are creating opportunities for the development of differentiated therapies. The presence of branded and generic drugs ensures cost flexibility, improving treatment compliance. Strategic collaborations between leading players and research organizations are accelerating development timelines and expanding the therapeutic pipeline. Continuous lifecycle management and post-approval studies are reinforcing product positioning, sustaining long-term competitiveness, and revenue stability.

Market Concentration & Characteristics

The urinary incontinence therapeutics industry demonstrates moderate to high innovation, driven by ongoing advancements in β3-adrenoceptor agonists, antimuscarinic combinations, and sustained-release formulations. Research efforts focus on improving safety, tolerability, and patient adherence through novel mechanisms of action and precision-targeted therapies. Pharmaceutical companies are emphasizing data-driven development and validating real-world outcomes. Digital health integration and formulation enhancements are creating differentiation within established drug classes. Innovation remains a key competitive factor supporting long-term therapeutic evolution.

The market presents moderate entry barriers due to high R&D costs, lengthy clinical validation, and complex regulatory requirements. Established players possess significant brand recognition and distribution strength, making market penetration challenging for new entrants. Intellectual property protection further limits generic competition for newer molecules. Achieving physician trust and patient acceptance requires substantial clinical evidence and marketing investment. Capital intensity and compliance obligations restrict smaller firms from large-scale commercialization.

Regulatory frameworks emphasize stringent clinical evaluation, pharmacovigilance, and quality assurance throughout the product lifecycle. Compliance with safety and efficacy standards from authorities such as the FDA and EMA extends approval timelines and development costs. Post-marketing surveillance requirements ensure consistent monitoring of therapeutic performance. Regulatory harmonization across regions is promoting transparency and standardization in product quality. Companies with established regulatory expertise maintain a competitive advantage through timely approvals and efficient documentation processes.

Urinary Incontinence Therapeutics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.55 billion |

|

Revenue forecast in 2033 |

USD 6.95 billion |

|

Growth rate |

CAGR of 5.4% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, drug class, gender, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key company profiled |

Pfizer Inc.; AbbVie Inc.; Astellas Pharma Inc.; Johnson & Johnson; Viatris Inc.; Teva Pharmaceutical Industries Ltd.; Sanofi S.A.; GlaxoSmithKline plc; Boehringer Ingelheim Pharmaceuticals, Inc.; Bayer AG; Ferring Pharmaceuticals |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |