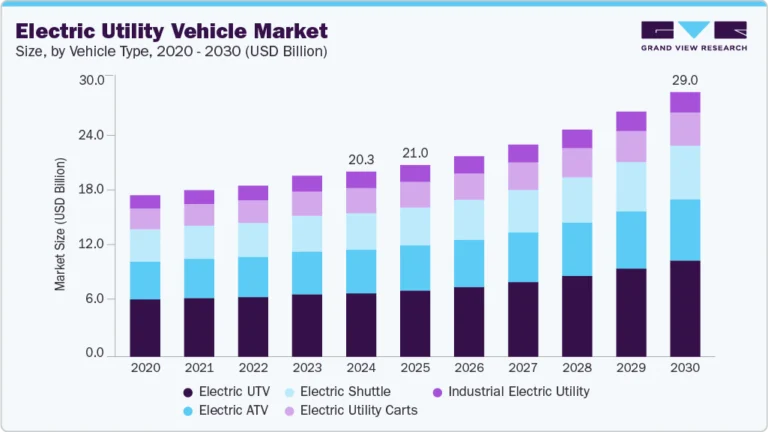

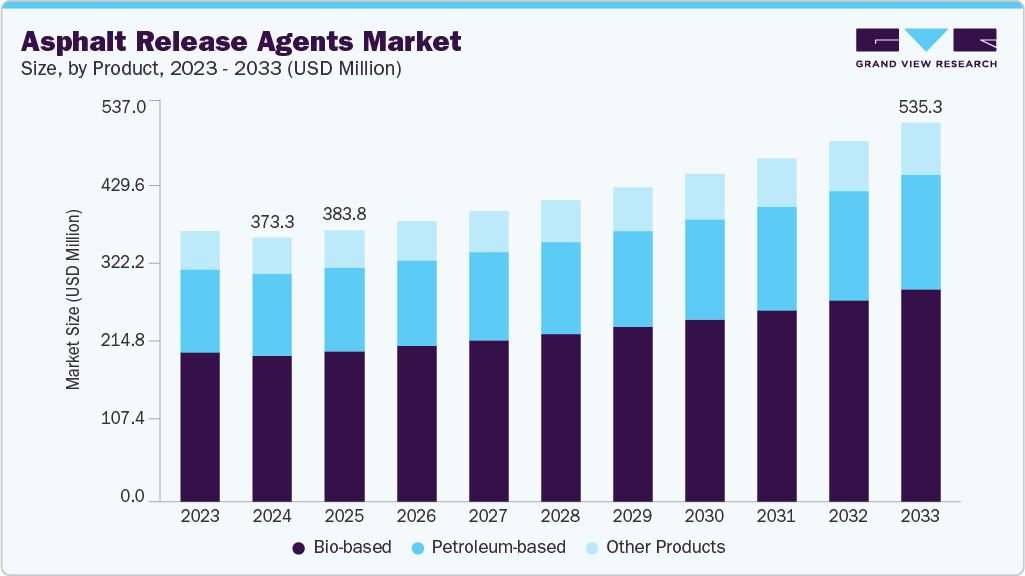

Asphalt Release Agents Market growing at a CAGR of 4.2% from 2025 to 2033

The global asphalt release agents market size was estimated at USD 373.3 million in 2024 and is projected to reach USD 535.3 million by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The market is primarily driven by the strong growth in road construction and maintenance activities, supported by public infrastructure spending and urban expansion projects across emerging and developed economies.

Key Market Trends & Insights

- Asia Pacific dominated the asphalt release agents market with the largest revenue share of 34.5% in 2024.

- The market in China is expected to grow at the fastest CAGR of 4.7% from 2025 to 2033.

- By product, the bio-based segment is expected to grow at the fastest CAGR of 4.4% from 2025 to 2033 in terms of revenue.

- By product, the bio-based segment held the largest revenue share of 55.3% in 2024 in terms of value.

- By application, the truck beds segment held the largest revenue share of 44.2% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 373.3 Million

- 2033 Projected Market Size: USD 535.3 Million

- CAGR (2025-2033): 4.2%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/asphalt-release-agents-market-report/request/rs1

The rising emphasis on equipment efficiency and lifecycle cost reduction is prompting contractors and municipalities to adopt high-performance release agents that prevent asphalt build-up, reduce downtime, and lower maintenance costs. The stringent environmental and occupational safety regulations in North America and Europe are accelerating the shift from petroleum-based to biodegradable, water-based formulations, thereby boosting demand for eco-friendly solutions. Continuous innovation by manufacturers, such as the development of non-hazardous emulsions and bio-solvent blends, further supports market expansion.

Significant market opportunities lie in the rapid adoption of bio-based and non-label formulations aligned with green procurement policies and sustainability targets of road agencies and contractors. Manufacturers offering customized, ready-to-use concentrates designed for specific asphalt mixtures, temperature ranges, and equipment types are well-positioned to gain a competitive advantage. The infrastructure modernization programs in Asia Pacific, Latin America, and the Middle East, driven by national highway and smart-city initiatives, are expected to create strong long-term demand for asphalt release solutions. The integration of digital monitoring and automated spraying systems in paving equipment also opens avenues for premium, high-margin products tailored to next-generation construction technologies.

Despite growth prospects, the market faces challenges related to raw material price volatility, particularly for petroleum derivatives and certain bio-solvents, which can affect product margins. The lack of standardized performance benchmarks for biodegradable formulations leads to variability in product efficacy, occasionally limiting end-user confidence. Furthermore, low awareness and cost sensitivity among small and mid-sized contractors in developing regions often result in the continued use of unregulated or locally blended agents, restraining the penetration of compliant commercial formulations. Lastly, stringent chemical labeling and transportation regulations (such as REACH and EPA guidelines) add to compliance costs and complexity for international suppliers.

Market Concentration & Characteristics

The market is moderately consolidated, with leading players such as FUCHS, Zeller+Gmelin, ArrMaz, and Quaker holding a significant share, while regional specialists like Zep, SoySolv, Rhomar Industries, Meyer Lab, and Miller-Stephenson cater to localized demand. The top companies collectively account for around half of global revenues, leveraging strong R&D, established distribution networks, and long-term supply partnerships with asphalt plant OEMs and road construction contractors. Product portfolios span petroleum-based, bio-based, and water-emulsion formulations, reflecting a strategic shift toward sustainable and compliant chemistries.

Competition centers on formulation performance, environmental compliance, and pricing efficiency. Vendors are increasingly focusing on low-VOC, biodegradable products, ready-to-use concentrates, and OEM-integrated solutions to differentiate in a price-sensitive market. However, smaller players face pressure from raw material cost fluctuations, limited standardization, and high regulatory compliance costs. To strengthen competitiveness, leading manufacturers are investing in green chemistry innovation, regional expansion through partnerships, and digitalized application systems that enhance operational efficiency and customer retention.