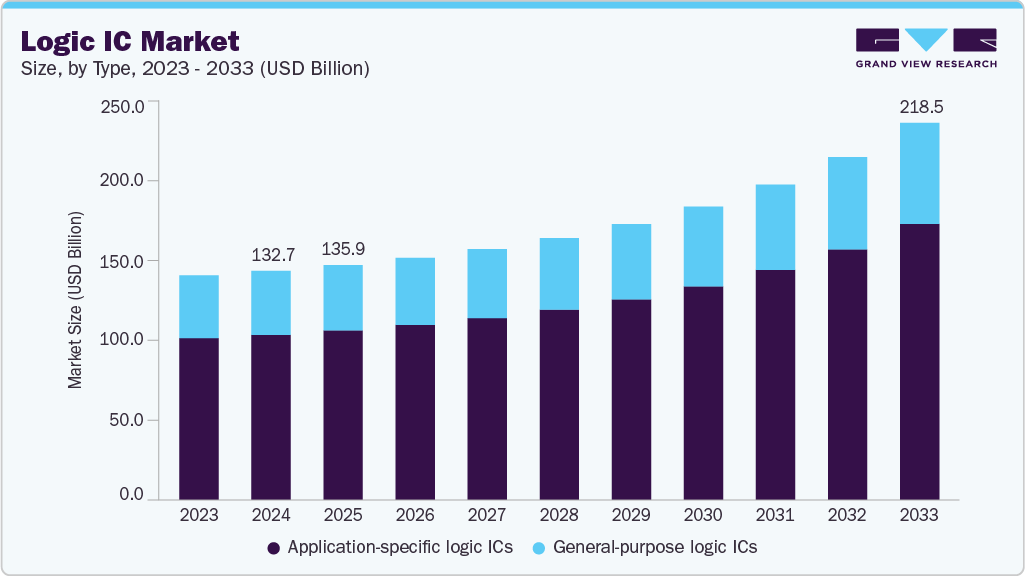

Logic IC Market growing at a CAGR of 6.1% from 2025 to 2033

The global logic IC market size was estimated at USD 132.68 billion in 2024, and is projected to reach USD 218.52 billion by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The market is witnessing steady growth, fueled by rising demand across diverse end-use sectors such as consumer electronics, automotive, industrial automation, IT & telecommunications, and computing.

Key Market Trends & Insights

- Asia Pacific logic IC market accounted for a 56.3% share of the overall market in 2024.

- The logic IC industry in China held a dominant position in 2024.

- By type, the application-specific logic ICs segment accounted for the largest share of 72.1% in 2024.

- By technology, the CMOS segment held the largest market share in 2024.

- By application, the consumer electronics segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 132.68 Billion

- 2033 Projected Market Size: USD 218.52 Billion

- CAGR (2025-2033): 6.1%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/logic-ic-market-report/request/rs1

The proliferation of smart devices, increasing connectivity, and the growing complexity of electronic systems are driving the adoption of both general-purpose and application-specific logic ICs. The market is experiencing rapid innovation, particularly in the development of application-specific integrated circuits (ASICs) and system-on-chip (SoC) designs. Advances in CMOS and BiCMOS fabrication, along with the migration to smaller nodes (7nm, 5nm, and below), are enabling higher performance and energy efficiency. Programmable logic devices such as FPGAs and PLDs are also gaining traction due to their flexibility in evolving applications such as AI, machine learning, and real-time data processing.

The market is supported by strong capital investments globally, with key players expanding R&D budgets and foundry capacities to meet growing demand. Countries such as the U.S., China, South Korea, and members of the EU have launched national semiconductor initiatives aimed at boosting domestic production capabilities. Leading companies such as Intel, TSMC, Samsung, and GlobalFoundries are building or expanding fabrication plants to address capacity shortages and diversify supply chains. These investments are not only intended to support near-term demand but also to enhance strategic autonomy and reduce reliance on external suppliers.

The regulatory landscape for logic ICs is evolving, shaped by government-led initiatives to strengthen semiconductor ecosystems, enforce export controls, and ensure supply chain transparency. For example, the U.S. CHIPS and Science Act, the EU Chips Act, and China’s Made in China 2025 program are all influencing the direction of semiconductor development and manufacturing. At the same time, compliance with environmental regulations such as RoHS and REACH, and adherence to cybersecurity and IP protection laws, is critical for manufacturers operating in global markets. Trade policies and restrictions, especially between the U.S. and China, are also reshaping the global flow of semiconductor technologies.

Despite favorable growth conditions, the market faces several challenges. The increasing complexity and cost of advanced node design and fabrication create significant barriers for smaller players and new entrants. Ongoing semiconductor supply chain disruptions, coupled with geopolitical tensions, continue to affect the availability of essential materials and manufacturing capacity. Moreover, the commoditization of general-purpose logic ICs exerts pricing pressure on suppliers, impacting profitability. Talent shortages in semiconductor design and process engineering further limit the pace of innovation, making workforce development a key strategic priority for the industry.

Logic IC Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 135.98 billion |

|

Revenue forecast in 2033 |

USD 218.52 billion |

|

Growth rate |

CAGR of 6.1% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Analog Devices, Inc.; Diodes Incorporated; Infineon Technologies AG; Intel Corporation; NXP Semiconductors; Renesas Electronics Corporation; Semiconductor Components Industries, LLC; STMicroelectronics; Texas Instruments Incorporated; TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |