Potassium Hydroxide Market growing at a CAGR of 3.7% from 2025 to 2033

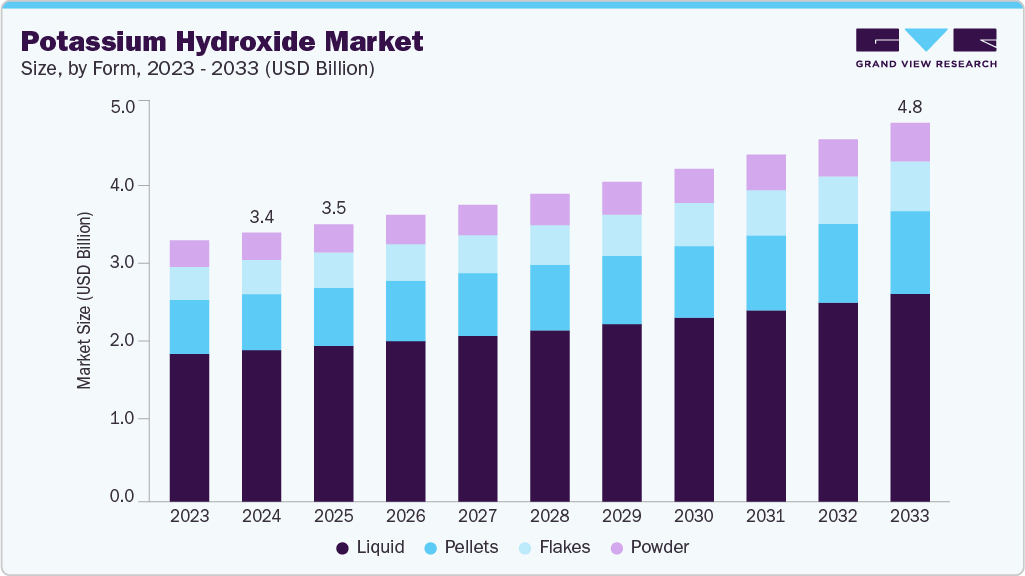

The global potassium hydroxide market size was estimated at USD 3,438.7 million in 2024 and is projected to reach USD 4,844.9 million by 2033, growing at a CAGR of 3.7% from 2025 to 2033. Market growth is mainly fueled by rising demand in agriculture, pharmaceuticals, and specialty chemicals.

Key Market Trends & Insights

- Asia Pacific dominated the global potassium hydroxide market with the largest revenue share of 39.8% in 2024.

- The potassium hydroxide market in the U.S. is expected to grow at a substantial CAGR of 3.6% from 2025 to 2033.

- By form, the pellets segment is expected to grow at a considerable CAGR of 4.3% from 2025 to 2033 in terms of revenue.

- By grade, the food grade segment is expected to grow at a considerable CAGR of 4.1% from 2025 to 2033 in terms of revenue.

- By application, the biodiesel production segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3,438.7 Million

- 2033 Projected Market Size: USD 4,844.9 Million

- CAGR (2025-2033): 3.7%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/potassium-hydroxide-market-report/request/rs1

Its essential role in producing potassium-based compounds and liquid soaps drives consistent consumption. Regulatory shifts toward sustainable chemical processes are prompting manufacturers to adopt cleaner technologies.

The global market is primarily driven by its wide-ranging industrial applications. As a strong alkaline compound, potassium hydroxide is essential in producing potassium-based fertilizers in high demand due to intensive agricultural practices and the need for high-yield crops. The chemical also plays a critical role in manufacturing liquid soaps, detergents, and alkaline batteries. Its use as a pH regulator, catalyst, and intermediate in numerous chemical syntheses underpins demand across pharmaceuticals, textiles, and petroleum refining sectors. The transition toward bio-based and eco-friendly products further boosts demand, particularly in biodiesel production. Consistent expansion of food processing and water treatment sectors also contributes to the strong consumption of potassium hydroxide globally.

Despite its versatile industrial utility, the market faces several challenges. One major restraint is the hazardous nature of the compound potassium hydroxide, which is highly caustic and poses significant health, environmental, and handling risks. Stringent regulatory requirements from agencies such as the United States Environmental Protection Agency and the European Chemicals Agency for safe manufacturing, storage, and transport increase operational complexity and compliance costs. In addition, fluctuations in raw material availability, especially chlorine and potassium salts, impact production economics. Market saturation in developed regions and limited awareness in emerging markets further restrict growth. Price volatility and competition from sodium hydroxide, a functional substitute in many applications, also hinder wider market penetration.

The market holds significant growth potential amid the global push toward sustainability and green chemistry. Increasing the adoption of potassium hydroxide in the production of biofuels, particularly biodiesel, is a notable opportunity as governments and industries target carbon neutrality and energy diversification. Demand for potassium hydroxide in electrochemical applications, especially in alkaline batteries and next-generation energy storage systems, is expected to rise with the electric vehicle and renewable energy transitions. The compound’s use in carbon capture technologies and water purification systems aligns with expanding environmental remediation initiatives. The rising demand for high-purity potassium hydroxide in pharmaceutical and food-grade formulations also opens pathways for specialized, high-margin product segments in the global market.

Market Concentration & Characteristics

The global potassium hydroxide industry exhibits moderate to high concentration, with a few major players securing a significant share of production capacity and influencing pricing dynamics. Key multinational chemical giants, including Olin Corporation, Occidental Petroleum (OxyChem), Evonik Industries, UNID Co., Tessenderlo Chemie, and Asahi Glass, benefit from vertically integrated chlor-alkali facilities and expansive distribution systems. Industry reports suggest that the top five producers control approximately forty to forty-five percent of global output. In contrast, the top three alone hold nearly thirty percent of the market share. This concentration gives them pricing power and economies of scale, making competition difficult for regional or niche suppliers. Emerging partnerships and strategic acquisitions among these leaders further solidify a competitive landscape marked by high entry barriers and robust supply chain integration.

Potassium hydroxide’s market dynamics are defined by a diversified product ecosystem featuring both solid and liquid forms, with solid potassium hydroxide (KOH) favored in regions with less developed infrastructure and liquid grades commanding greater demand in industrial settings. Product differentiation is highly pursued, with manufacturers offering tailored grades ranging from industrial-grade to ultra‑high‑purity variants for specialized applications in electronics, pharmaceuticals, biodiesel, and battery technologies. Key market characteristics include a strong emphasis on purity, stringent regulatory compliance, and technological innovation, such as membrane-cell production and low-impurity purification processes. Distribution is supported by chemical logistics leaders like Brenntag and Univar, emphasizing storage and handling infrastructure vital for maintaining quality and safety in high-value segments.

Potassium Hydroxide Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3,547.0 million |

|

Revenue forecast in 2033 |

USD 4,844.9 million |

|

Growth rate |

CAGR of 3.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Form, grade, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Solvay; BASF; Dow; Occidental Petroleum Corporation (OxyChem); Olin Corporation; UNID; Merck KGaA; American Elements; Airedale Chemical Company Limited; Altair Chemical S.r.l.; Gujarat Alkalies and Chemicals Limited; INEOS KOH Inc.; ERCO Worldwide; HAINAN HUARONG CHEMICAL CO., LTD. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |