Cold-active Enzymes Market Cold-active Enzymes Market

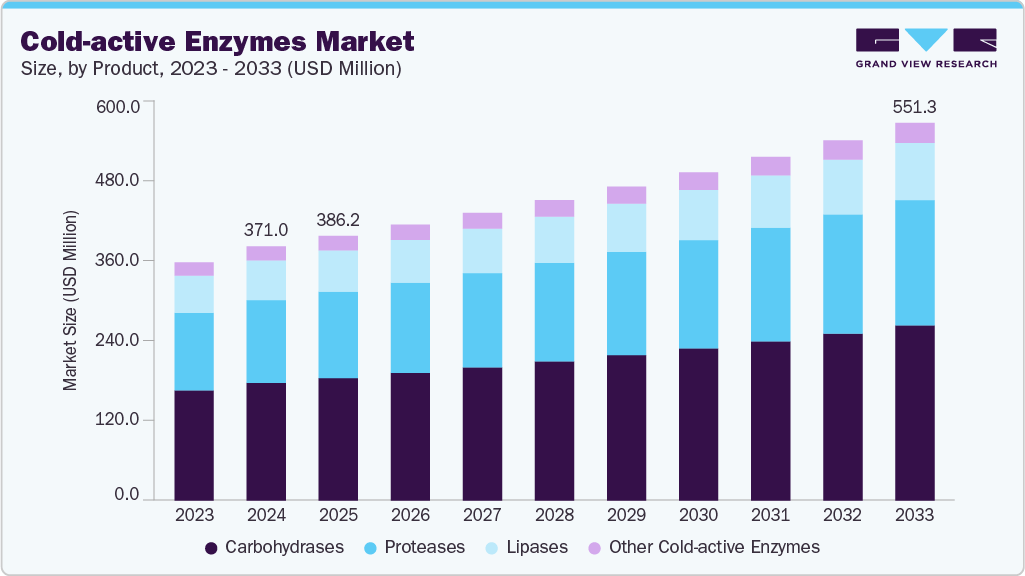

The global cold-active enzymes market size was estimated at USD 371.0 million in 2024 and is projected to reach USD 551.3 million by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The growth of the global market for cold-active enzymes is primarily driven by the rising demand for energy-efficient and sustainable biotechnological solutions across industries such as food & beverages, detergents, textiles, and biofuels.

Key Market Trends & Insights

- North America dominated the global cold-active enzymes industry with the largest revenue share of 37.8% in 2024.

- The market in China is expected to grow at a significant CAGR of 4.9% in terms of revenue from 2025 to 2033.

- By product, the proteases is expected to grow at the fastest CAGR of 4.8% from 2025 to 2033 in terms of revenue.

- By product, the carbohydrases segment held the largest revenue share of 46.3% in 2024 in terms of value.

- By application, the food & beverages segment held the largest revenue share of 37.3% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 371.0 Million

- 2033 Projected Market Size: USD 551.3 Million

- CAGR (2025-2033): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/cold-active-enzymes-market-report/request/rs1

Cold-active enzymes operate effectively at low temperatures significantly reducing energy consumption and operational costs compared to conventional enzymes. The increasing adoption of eco-friendly products in detergents and cleaning applications, coupled with the growing use of enzymatic bioprocesses in Arctic and Antarctic biotechnology research, is fueling market expansion. Technological advancements in enzyme engineering and metagenomics for developing highly stable and active enzymes at low temperatures are further propelling market growth.

The market presents substantial opportunities driven by expanding industrial applications in low-temperature bioprocessing, particularly within the food processing and detergent sectors. The growing focus on green chemistry and circular bioeconomy initiatives offers new avenues for the use of cold-active enzymes as environmentally sustainable alternatives to chemical catalysts. Emerging economies in Asia Pacific and Latin America are expected to witness increased adoption, supported by industrialization and government incentives promoting sustainable manufacturing. In addition, the integration of artificial intelligence (AI) and computational protein design in cold-active enzyme discovery and optimization is opening pathways for customized enzyme formulations with enhanced activity and stability, creating lucrative opportunities for enzyme manufacturers and biotechnology firms.

Despite their promising potential, the commercialization of cold-active enzymes faces several challenges, including high production costs and stability issues under industrial-scale conditions. The extraction and purification of enzymes from psychrophilic microorganisms require sophisticated bioprocessing techniques, which increase the overall cost of production. Furthermore, limited awareness and technical expertise in developing economies hinder large-scale adoption. The market also encounters difficulties related to maintaining enzyme activity during storage and transport at fluctuating ambient temperatures. The stringent regulatory frameworks governing enzyme applications, particularly in food and pharmaceutical sectors, may delay product approvals and market entry, thereby constraining growth in the short to medium term.

Market Concentration & Characteristics

The competitive landscape of the cold-active enzymes industry is characterized by a two-tier structure in which large, diversified enzyme and chemical players compete alongside specialized biotechnology firms. Global incumbents such as Novozymes and BASF leverage deep R&D pipelines, extensive IP portfolios, and broad commercial footprints to defend share across high-volume applications (detergents, food processing and industrial biocatalysis). Formulation and application specialists, IFF and Amano Enzyme, compete by bundling enzymes with formulation science and customer-facing product development, enabling faster adoption by detergent and food manufacturers. Regional and cost-focused players such as Advanced Enzyme Technologies and KDN Biotech provide manufacturing scale and price competitiveness for commodity and semi-specialty enzyme products in Asia, while innovators like Takara Bio and Enzymatica carve niche positions with cold-active molecular biology and therapeutic/medical enzyme offerings. This mix creates a market where breadth of portfolio, proven low-temperature performance, regulatory credentials, and distribution partnerships are as important as raw enzyme activity metrics.

Competition is increasingly shifting from simple product substitution to value-added services and customized solutions. Winning strategies include proprietary enzyme engineering (to improve activity/stability at low temperatures), co-development partnerships with formulators and OEMs, and regional manufacturing to reduce logistics and cold-chain complexity.

Cold-active Enzymes Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 386.2 million |

|

Revenue forecast in 2033 |

USD 551.3 million |

|

Growth Rate |

CAGR of 4.5% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Middle East & Africa; Latin America |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Advanced Enzyme Technologies; Novozymes A/S; BASF SE; Amano Enzyme Inc.; Enzymatica AB; International Flavors & Fragrances Inc.; KDN Biotech (Shanghai) Co., Ltd.; Takara Bio Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |