2D Materials Beyond Graphene Market growing at a CAGR of 3.2% from 2025 to 2033

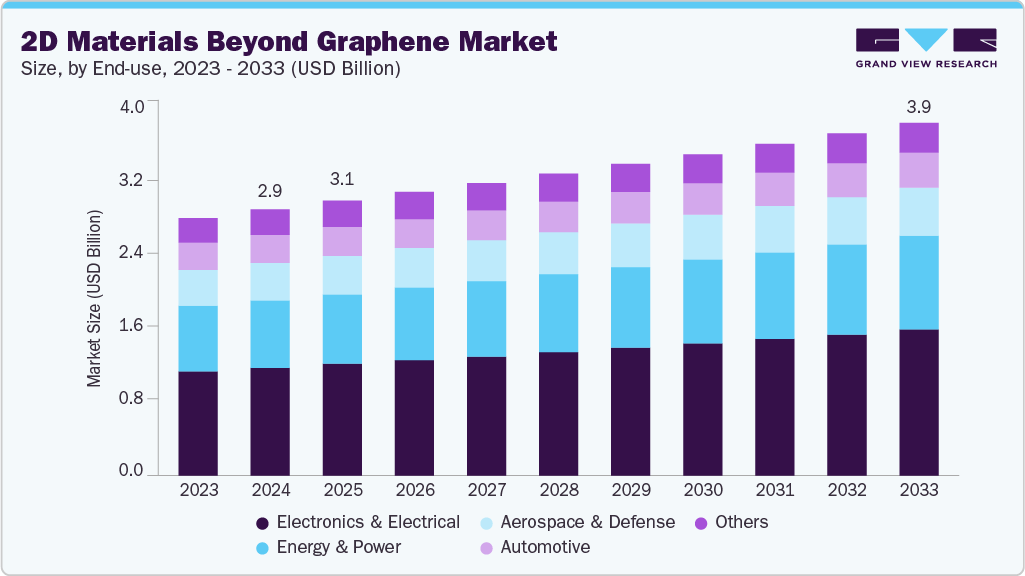

The global 2D materials beyond graphene market size was estimated at USD 2.96 billion in 2024 and is projected to reach USD 3.93 billion by 2033, growing at a CAGR of 3.2% from 2025 to 2033, driven by increasing research and development activities aimed at discovering advanced materials with superior electrical, optical, and mechanical properties. Materials such as molybdenum disulfide (MoS₂), hexagonal boron nitride (h-BN), and transition metal dichalcogenides (TMDs) are being widely explored for their potential in next-generation electronics, flexible displays, and photonic devices.

Key Market Trends & Insights

- North America dominated the 2D materials beyond graphene market with the largest revenue share of 33.2% in 2024.

- By material, transition metal dichalcogenides (TMDs) segment is expected to grow at fastest CAGR of 3.6% from 2025 to 2033 in terms of revenue.

- By end use, energy & power segment is expected to grow at fastest CAGR of 3.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2.96 Billion

- 2033 Projected Market Size: USD 3.93 Billion

- CAGR (2025-2033): 3.2%

- North America: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/2d-materials-beyond-graphene-market-report/request/rs1

The growing demand for miniaturized and energy-efficient components in consumer electronics has further accelerated the exploration and adoption of these materials. Governments and private organizations increasingly fund nanotechnology research, contributing significantly to market expansion. The energy and storage sector represents another strong market growth avenue. These materials exhibit exceptional surface area, mechanical strength, and electrical conductivity, making them suitable for batteries, supercapacitors, and fuel cells. The rising focus on clean and renewable energy solutions has driven the adoption of advanced materials that enhance storage devices’ energy density and charge-discharge efficiency. Moreover, the ability of these materials to act as efficient catalysts in hydrogen evolution reactions is boosting their demand in sustainable energy generation. Ongoing research into their electrochemical properties continues to expand potential end uses across the green energy ecosystem.

In addition, the market is benefiting from the expanding scope of end uses in the biomedical and sensing sectors. 2D materials beyond graphene possess excellent biocompatibility, high surface reactivity, and tunable optical properties, which make them promising candidates for biosensing, drug delivery, and imaging technologies. Their use in detecting highly sensitive environmental pollutants and biological molecules is gaining traction in healthcare and environmental monitoring. The convergence of nanotechnology, material science, and biotechnology creates new opportunities to commercialize these materials. As industrial players move from laboratory-scale experiments to scalable production, the market is poised for significant long-term growth.

Market Concentration & Characteristics

The global 2D materials beyond graphene industry is characterized by a high degree of innovation, driven by intensive research efforts and collaborations between academic institutions, startups, and established technology firms. The market remains nascent yet rapidly evolving, with continuous breakthroughs in synthesis methods, scalability, and material quality. Although commercialization is still limited, emerging patents and pilot-scale production reflect growing industrial interest. The sector has witnessed a moderate level of mergers and partnerships, primarily aimed at combining material expertise with end use development in semiconductors, energy storage, and flexible electronics. These strategic collaborations are crucial for bridging the gap between research and large-scale industrial deployment.

Regulatory frameworks also significantly shape the market dynamics, particularly concerning environmental safety, nanomaterial handling, and sustainable manufacturing practices. Compliance with international standards and nanomaterial safety regulations ensures responsible development and enhances market credibility. There are limited direct substitutes for 2D materials beyond graphene, given their unique physical and chemical properties. However, competition exists from advanced nanomaterials such as carbon nanotubes and perovskites in certain end uses. End-user concentration is relatively diversified, spanning electronics, energy, healthcare, and aerospace industries, though semiconductor and energy sectors currently account for the largest share. As standardization and production scalability improve, the market is expected to witness higher consolidation and broader adoption across industries.

2D Materials Beyond Graphene Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.05 billion |

|

Revenue forecast in 2033 |

USD 3.93 billion |

|

Growth rate |

CAGR of 3.2% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

End Use, material, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; India; China; Japan |

|

Key companies profiled |

2D Semiconductors Inc.; Graphenea S.A.; NanoXplore Inc.; Sixth Element Materials Technology Co., Ltd.; Versarien plc; 2D Layer Materials Pte. Ltd.; XG Sciences, Inc.; ACS Material, LLC; Thomas Swan & Co. Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |