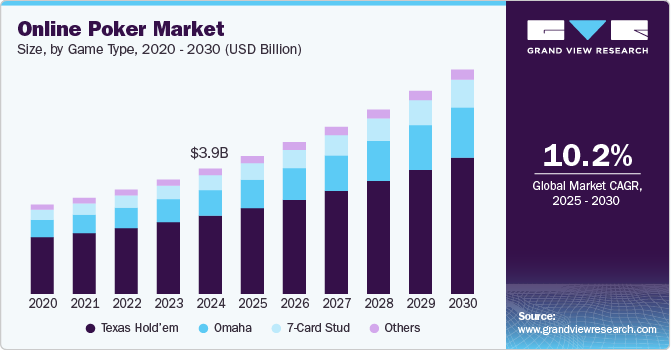

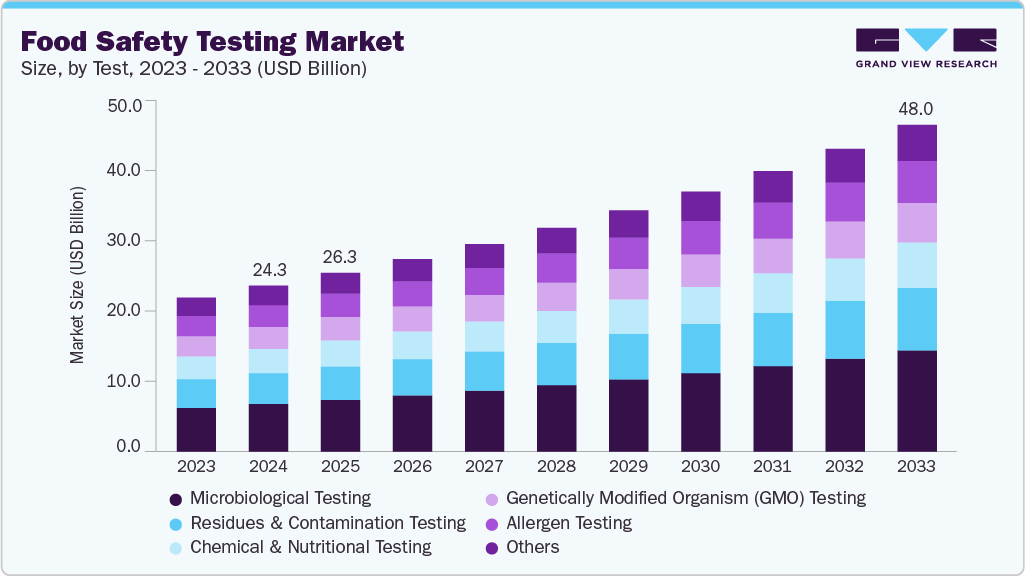

Food Safety Testing Market growing at a CAGR of 7.8% from 2025 to 2033

The global food safety testing market size was estimated at USD 24,366.5 million in 2024 and is projected to reach USD 48,012.7 million by 2033, growing at a CAGR of 7.8% from 2025 to 2033. Major factors propelling market growth are the increase in cases of food-borne illnesses, increased consumer awareness of food safety, implementation of strict food safety regulations, and rising consumer desire for convenience and packaged food products.

Key Market Trends & Insights

- Europe dominated the food safety testing market with the largest revenue share of 34.2% in 2024.

- Germany food safety testing market is a key growth driver in Europe due to its strong regulatory oversight and advanced food processing sector.

- By test, the microbiological testing segment led the market and accounted for 28.6% of the global revenue share in 2024.

- By application, the meat, poultry, & seafood products segment is accounted for 30.6% of the global revenue share in 2024.

- By technology, the traditional testing methods continue to dominate the food safety testing market and accounted for 55.5% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24,366.5 Million

- 2030 Projected Market Size: USD 48,012.7 Million

- CAGR (2025-2030): 7.8%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/food-safety-testing-industry/request/rs1

Technological advancements in testing techniques, such as PCR-based assays and biosensors, have enhanced the speed and accuracy of food safety diagnostics. The growing adoption of rapid testing tools by food processing companies ensures compliance and reduces product recalls. In addition, the increasing implementation of safety standards like HACCP and ISO 22000 drives market growth. Together, these innovations and regulatory frameworks stimulate the global food safety testing industry.

Market Concentration & Characteristics

The food safety testing industry is moderately concentrated, with a mix of established players and regional companies. Leading firms hold significant market shares due to their advanced technologies and global reach. However, the presence of numerous small and medium-sized laboratories creates competitive fragmentation in certain regions. This blend results in a market where innovation and compliance drive competition.

The industry shows a high degree of innovation, driven by the need for faster and more accurate detection methods. Technologies such as next-generation sequencing, biosensors, and AI-integrated platforms are gaining traction. Companies invest heavily in R&D to stay ahead in compliance and efficiency. These innovations help reduce testing time while improving sensitivity and reliability.

Mergers and acquisitions are common as major players seek to expand capabilities and geographic reach. Larger firms acquire smaller, specialized laboratories to enhance their service portfolios. This consolidation trend strengthens global presence and accelerates technology adoption. M&A activity also helps in standardizing practices across borders.

Stringent food safety regulations globally have a significant influence on market operations. Regulatory bodies like the FDA, EFSA, and Codex Alimentarius enforce strict guidelines on testing protocols. Compliance with these standards drives demand for certified and validated testing solutions. Non-compliance risks include product recalls, legal penalties, and reputational damage.

Global Food Safety Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 26,268.2 million |

|

Revenue forecast in 2033 |

USD 48,012.7 million |

|

Growth rate |

CAGR of 7.8% from 2024 to 2033 |

|

Base year for estimation |

2024 |

|

Actual estimates/Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Segments covered |

Test, application, technology, region |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia |

|

Key companies profile |

SGS S.A.; NSF International; Bureau Veritas; Eurofins Scientific SE; Intertek Group PLC; Thermo Fisher Scientific Inc.; Merieux Nutrisciences; TUV SUD; UL LLC; AsureQuality Ltd; Agilent Technologies, Inc.; QIAGEN; Bio-Rad Laboratories, Inc.; ALS; Eurofins Scientific |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |