Liquid Packaging Cartons Market growing at a CAGR of 5.4% from 2025 to 2033

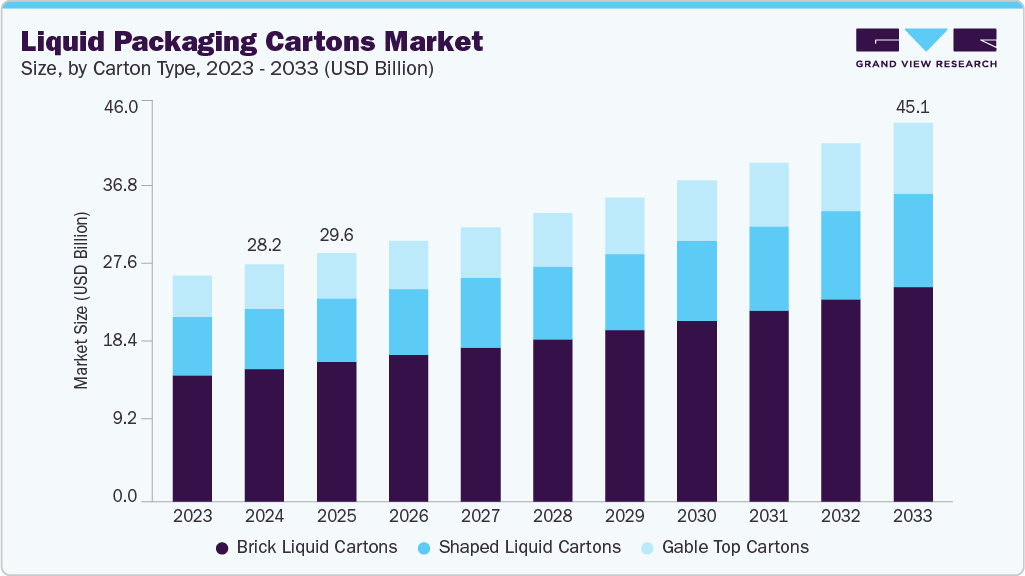

The global liquid packaging cartons market size was estimated at USD 28.17 billion in 2024 and is projected to reach 45.11 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market is driven by the rising demand for sustainable and eco-friendly packaging solutions and the growing consumption of packaged beverages such as milk, juices, and plant-based drinks.

Key Market Trends & Insights

- Asia Pacific dominated the liquid packaging cartons market with the largest revenue share of over 37.0% in 2024.

- The liquid packaging cartons market in China is expected to grow at a substantial CAGR of 6.1% from 2025 to 2033.

- By carton type, the brick liquid cartons segment recorded the largest market revenue share of over 56.0% in 2024.

- By shelf life, the long shelf-life cartons segment recorded the largest market revenue share of over 68.0% in 2024.

- By end-use, the liquid dairy products segment recorded the largest market share of over 55.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.17 Billion

- 2033 Projected Market Size: USD 45.11 Billion

- CAGR (2025-2033): 5.4%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/liquid-packaging-cartons-market/request/rs1

Technological advancements in aseptic packaging and increased urbanization further boost market growth. Consumers and regulatory bodies alike are pushing for a reduction in plastic usage, prompting manufacturers to adopt renewable and recyclable materials. Liquid cartons, often made from paperboard with thin layers of polyethylene and aluminum for barrier protection, are perceived as an eco-friendlier alternative to plastic bottles and pouches. For instance, companies such as Tetra Pak have introduced plant-based cartons with reduced carbon footprints, meeting consumer demand for green packaging. This sustainability appeal is a key factor propelling market growth, especially in regions such as Europe, where environmental consciousness is high.

The growing consumption of ready-to-drink (RTD) beverages, dairy products, and non-carbonated drinks. As lifestyles become busier, consumers increasingly prefer portable, lightweight, and easy-to-store packaging formats. Liquid cartons are ideal for products like milk, fruit juices, iced tea, and functional beverages, offering convenience without compromising on shelf stability. For example, brands such as Tropicana and Minute Maid utilize aseptic carton packaging for their juice lines, ensuring long shelf life without refrigeration. The growth of the health and wellness trend is also fueling demand for nutrient-rich beverages, further boosting the use of liquid cartons.

The expansion of organized retail and e-commerce platforms has also played a pivotal role in boosting the liquid packaging cartons market. With the growing penetration of supermarkets, hypermarkets, and online grocery channels, there’s increased visibility and accessibility of packaged beverages. Liquid cartons, being stackable and lightweight, are cost-effective to transport and display. This is especially beneficial in emerging economies such as India, Brazil, and Indonesia, where modern trade channels are expanding rapidly. The ability to print high-quality graphics on cartons also enhances shelf appeal, making them a preferred choice for brand differentiation and marketing.

Market Concentration & Characteristics

The market experiences continuous innovation, particularly in sustainability and barrier technology. Companies are developing bio-based coatings, fully recyclable cartons, and advanced aseptic filling systems. For instance, Tetra Pak and Elopak are introducing plant-based polymers and paperboard alternatives to improve environmental performance.

Mergers and acquisitions are occurring as key players aim to strengthen their global reach and diversify product portfolios. Strategic partnerships between packaging converters, filling machine manufacturers, and beverage producers are also common. For instance, in August 2022, SIG acquired Evergreen Asia, Pactiv Evergreen’s chilled carton business, for USD 335.0 million, expanding its presence in China, Taiwan, and South Korea. The deal boosts SIG’s growth in Asia’s dairy market and strengthens its sustainable packaging offerings.

Liquid Packaging Cartons Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 29.56 billion |

|

Revenue forecast in 2033 |

USD 45.11 billion |

|

Growth rate |

CAGR of 5.4% from 2025 to 2033 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Carton type, shelf-life, end-use, region |

|

States scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Key companies profiled |

Tetra Pak International S.A.; SIG; Elopak; Mondi; Nippon Paper Industries Co., Ltd.; UFlex Limited; IPI S.r.l.; Greatview Aseptic Packaging Company Limited; WestRock Company; Heli Packaging Technology (Qingzhou) Co., Ltd.; Parksons Packaging Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |