Waste Management growing at a CAGR of 5.9% from 2025 to 2033

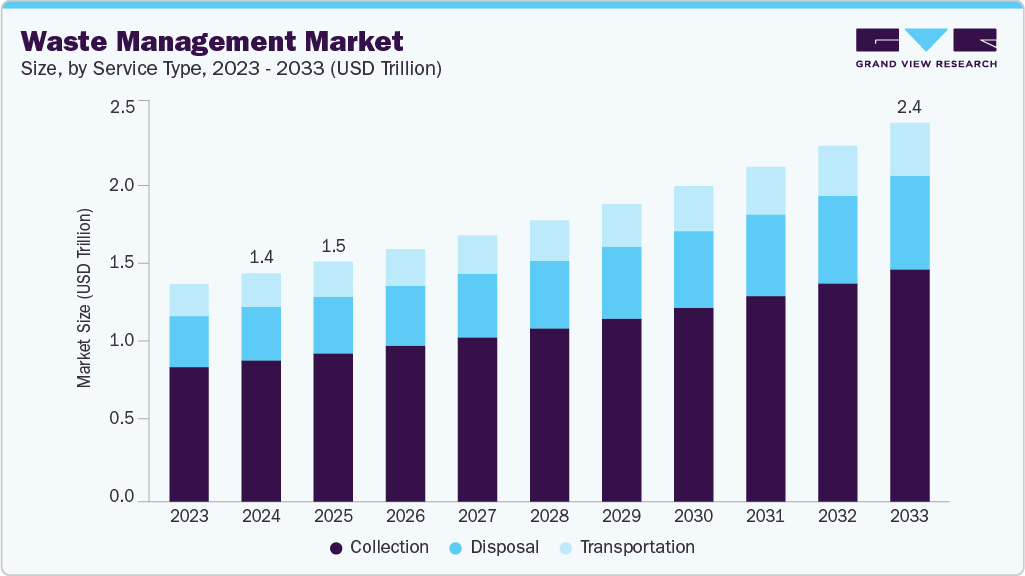

The global waste management market size was estimated at USD 1,424.35 billion in 2024 and is projected to reach USD 2,365.14 billion by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The growth is driven by the rapid rise in urbanization and industrialization, leading to a significant increase in solid waste generation.

Key Market Trends & Insights

- North America dominated the waste management market with the largest revenue share of 33.3% in 2024.

- The waste management industry in India is expected to grow at a substantial CAGR of 7.1% from 2025 to 2033.

- By service type, the disposal service segment is expected to grow at a considerable CAGR of 6.4% from 2025 to 2033.

- By waste type, the E-waste segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,424.35 Billion

- 2033 Projected Market Size: USD 2,365.14 Billion

- CAGR (2025-2033): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/global-waste-management-market/request/rs1

Expanding populations, especially in emerging economies, are straining existing waste infrastructure. Another major growth driver is the growing emphasis on environmental sustainability and circular economy practices. Industries and municipalities are investing in waste-to-energy technologies, advanced recycling methods, and digital waste tracking systems. Rising consumer awareness and corporate ESG commitments are further encouraging responsible waste disposal. These trends are accelerating the adoption of smart and sustainable waste management solutions worldwide.

Market Concentration & Characteristics

The global waste management industry is moderately fragmented, with a mix of large multinational players and numerous regional and local service providers. While major companies dominate in developed markets through integrated solutions and advanced technologies, smaller firms are prevalent in emerging regions. The industry’s structure varies by service segment, such as collection, recycling, or waste-to-energy. Ongoing consolidation and strategic acquisitions are gradually increasing market concentration.

The waste management market is experiencing steady innovation, particularly in areas like smart waste tracking, automated sorting, and waste-to-energy technologies. Companies are investing in AI, robotics, and IoT to improve efficiency and environmental outcomes. Innovation is also driving the shift toward circular economy models and resource recovery. These advancements are critical to meet rising sustainability expectations and reduce landfill dependency.

The industry has seen a high level of mergers and acquisitions, as larger players seek to expand market share, enter new geographies, and acquire advanced capabilities. M&A activity is especially prominent in recycling, hazardous waste, and medical waste segments. Strategic acquisitions also help firms achieve operational scale and enhance service integration. This consolidation trend is reshaping competition and raising entry barriers.

Regulatory frameworks strongly influence the waste management sector, particularly in developed markets with strict environmental laws. Policies related to landfill restrictions, emissions limits, and recycling mandates shape service delivery models. Governments are also pushing for extended producer responsibility and waste diversion goals. Compliance with these regulations drives investment in cleaner technologies and infrastructure upgrades.

Waste Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1,497.17 billion |

|

Revenue forecast in 2033 |

USD 2,365.14 billion |

|

Growth rate |

CAGR of 5.9% from 2025 to 2033 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD billion/trillion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, waste type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; UAE; South Africa |

|

Key companies profiled |

WM Intellectual Property Holdings, L.L.C.; Suez; Valicor; Veolia; Waste Connections; Republic Services; Biffa; CLEAN HARBORS, INC.; Reworld; DAISEKI CO., Ltd.; Stericycle, Inc.; Casella Waste Systems, Inc.; CECO ENVIRONMENTAL; Cleanaway; GFL Environmental Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |