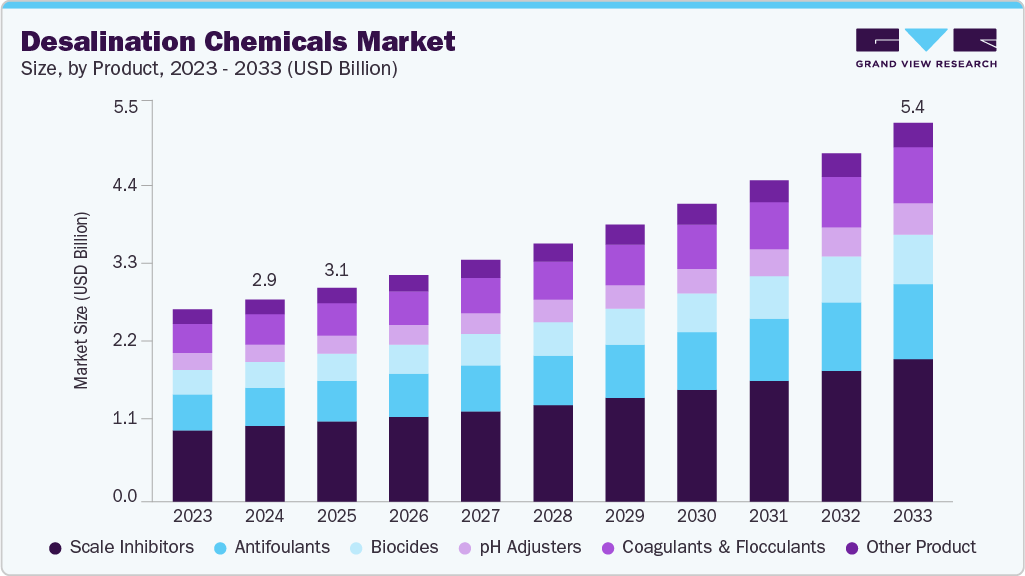

Desalination Chemicals growing at a CAGR of 7.4% from 2025 to 2033

The global desalination chemicals market size was estimated at USD 2,895.1 million in 2024 and is projected to reach USD 5,424.1 million by 2033, growing at a CAGR of 7.4% from 2025 to 2033. The demand is rising as water-stressed regions expand desalination capacity to secure reliable freshwater; chemical formulations that prevent scale, control biofouling, and enable membrane longevity directly influence plant performance and operating costs, making these products essential for efficient, continuous desalination operations across coastal and inland sites.

Key Market Trends & Insights

- The desalination chemicals market in North America is expected to grow at the fastest CAGR of 7.4% from 2025 to 2033.

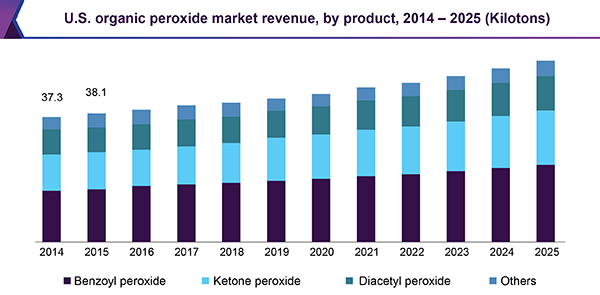

- By product, the scale inhibitors segment led the market with the largest revenue share of 37.3% in 2024.

- By application, the industrial water treatment segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2033.

Market Size & Forecasts

- 2024 Market Size: USD 2,895.1 Million

- 2033 Projected Market Size: USD 5,424.1 Million

- CAGR (2025-2033): 7.4%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/desalination-chemicals-market-report/request/rs1

Growth in this desalination chemicals industry reflects expanding desalination projects and stricter water quality standards that push operators to adopt advanced pretreatment and cleaning regimens. Suppliers tailor antiscalants, biocides, corrosion inhibitors, and membrane cleaners to varied feedwaters, while service models increasingly bundle chemical supply with monitoring to reduce downtime. Cost pressures encourage formulations that extend membrane life and cut cleaning frequency, creating value through lower total lifecycle expenses. Improvements in membranes and energy integration lower operating costs, making smaller plants economically viable and widening the customer base.

Market dynamics are shaped by regulatory limits on brine discharge and reuse targets, fluctuations in energy prices that influence overall desalination economics, and collaboration between chemical producers and plant engineers to optimize system integration. The Middle East supports large-scale seawater plants, coastal industrial users require continuous high-quality supply, and remote communities prioritize low-maintenance solutions. Supply-chain resilience and local presence affect vendor selection, especially where rapid replenishment is critical. Environmental scrutiny raises demand for chemicals with clear ecotoxicity profiles and for vendors who can document lifecycle impacts; manufacturers that provide transparent efficacy data, third-party validations, and tailored training increase operator confidence and lock in longer contracts.

Market Concentration & Characteristics

The desalination chemicals industry demonstrates moderate concentration, with a mix of global producers and specialized regional suppliers. Large multinational firms dominate through established product portfolios, technical expertise, and long-standing relationships with desalination plant operators. At the same time, smaller companies focus on customized formulations, niche applications, and rapid service delivery, creating a balanced competitive landscape where innovation and performance often determine market share rather than size alone.

The market’s characteristics are defined by high technical requirements, consistent demand stability, and a strong emphasis on operational reliability. Product performance is closely linked to system efficiency, making quality assurance and compatibility critical in supplier selection. Environmental compliance, product safety, and supply continuity increasingly shape purchasing decisions. Continuous R&D in membrane compatibility, eco-friendly formulations, and integrated dosing systems defines the evolving competitive edge, while collaboration between chemical manufacturers and plant operators reinforces long-term partnerships and shared performance objectives.

Desalination Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3,063.8 million |

|

Revenue forecast in 2033 |

USD 5,424.1 million |

|

Growth rate |

CAGR of 7.4% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa |

|

Key companies profiled |

Italmatch Chemicals; Solenis LLC; American Water Chemicals, Inc.; Genesys International Ltd.; Omya International AG; Ecolab Inc.; Veolia Environnement SA; Kurita Water Industries Ltd.; Dow Chemical Company; BASF SE |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |