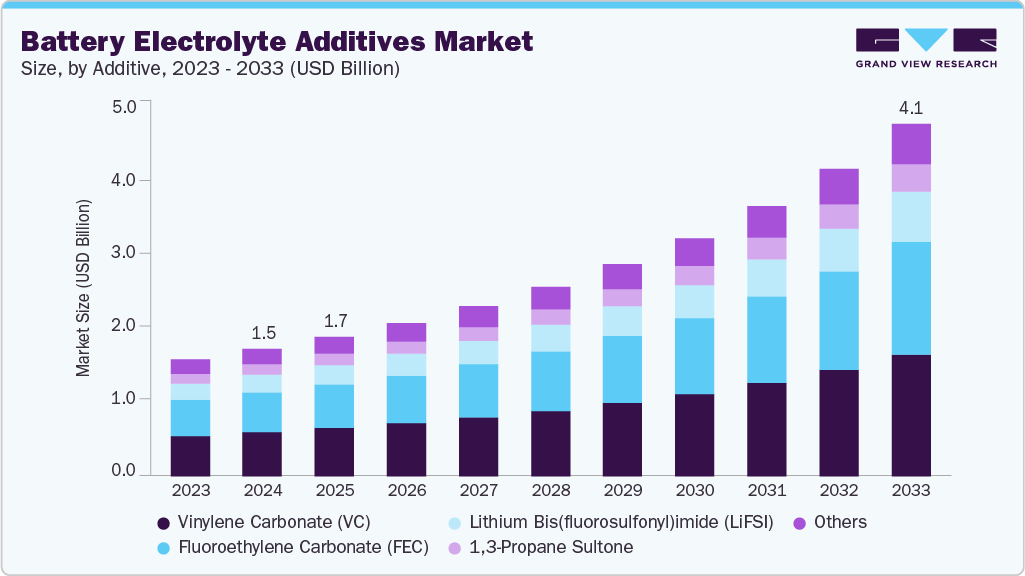

Battery Electrolyte Additives growing at a CAGR of 12.2% from 2025 to 2033

The global battery electrolyte additives market size was estimated at USD 1,518.6 million in 2024 and is projected to reach USD 4,190.1 million by 2033, growing at a CAGR of 12.2% from 2025 to 2033. The market’s growth is primarily driven by the accelerating adoption of electric vehicles (EVs), advancements in lithium-ion battery technology, and increasing demand for high-performance energy storage systems.

Key Market Trends & Insights

- Asia Pacific dominated the global battery electrolyte additives market with the largest revenue share of 54.7% in 2024.

- The battery electrolyte additives market in the Europe is expected to grow at a robust CAGR of 12.7% from 2025 to 2033.

- By additive, the vinylene carbonate (VC) segment led the market with the largest revenue share of 34.9%% in 2024.

- By application, the energy storage systems segment is expected to grow at a significant CAGR of 12.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,518.6 Million

- 2033 Projected Market Size: USD 4,190.1 Million

- CAGR (2025 – 2033): 12.2%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/battery-electrolyte-additives-market-report/request/rs1

Growing emphasis on enhancing battery safety, stability, and cycle life is propelling the use of specialized electrolyte additives such as SEI-forming agents, film-forming additives, and overcharge protection compounds. In addition, government incentives and large-scale investments in EV infrastructure and renewable energy storage are further fueling market expansion.

The global battery electrolyte additives industry is witnessing robust growth due to the rising demand for high-performance lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid energy storage systems. As EV adoption accelerates globally, manufacturers are increasingly focusing on improving energy density, battery efficiency, and cycle stability-driving the use of additives that enhance the solid electrolyte interphase (SEI), suppress gas formation, and improve overall battery performance. In addition, the growing transition toward renewable energy and the expansion of energy storage solutions are reinforcing the need for stable, long-lasting batteries that depend heavily on advanced electrolyte formulations.

However, the market faces challenges related to high formulation costs, limited raw material availability, and complex regulatory frameworks governing the chemical composition of additives. The synthesis of advanced electrolyte additives such as lithium difluoro(oxalato)borate (LiDFOB) and fluoroethylene carbonate (FEC) requires high-purity precursors, which increase production costs. Furthermore, stringent environmental and safety standards-especially in the U.S. and Europe limit the adoption of certain solvent and additive chemistries. Supply chain disruptions and the need for continuous compatibility testing with new electrode materials also hinder widespread commercialization.

On the other hand, technological innovation presents a strong opportunity for market growth. The increasing focus on solid-state and high-voltage battery chemistries opens new avenues for next-generation additives capable of providing better ionic conductivity and thermal stability. Strategic partnerships between additive manufacturers and battery OEMs are emerging to co-develop tailored additive packages optimized for specific chemistries. Moreover, the rapid expansion of EV production in Asia Pacific, coupled with investments in localized lithium-ion battery manufacturing, is expected to accelerate demand for electrolyte additives that enhance performance while ensuring sustainability and regulatory compliance.

Market Concentration & Characteristics

The battery electrolyte additives industry is moderately consolidated, with a mix of large multinational chemical companies and specialized regional players dominating the landscape. Key global participants include BASF SE, Evonik Industries AG, UBE Industries, Solvay, and LG Chem, which leverage strong R&D capabilities, extensive distribution networks, and long-standing relationships with battery manufacturers. These leading players focus on developing high-performance additive formulations that improve battery life, safety, and efficiency, giving them a competitive edge in both mature and emerging markets.

Battery Electrolyte Additives Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1,664.9 million |

|

Revenue forecast in 2033 |

USD 4,190.1 million |

|

Growth rate |

CAGR of 12.2% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Additive, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Tinci Materials; Capchem Technology; Guangzhou Tinci Materials Technology Co., Ltd.; ENCHEM Co., Ltd.; Mitsubishi Chemical Group Corporation; Shenzhen Capchem Technology Co., Ltd.; Zhejiang Yongtai Technology Co., Ltd.; Shandong Genyuan New Materials Co., Ltd.; Chunbo Fine Chem. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Market characteristics are defined by high technological intensity, stringent quality requirements, and rapid innovation cycles. Additive performance is closely tied to battery chemistry, requiring continuous optimization for compatibility with anodes, cathodes, and electrolyte solvents. The industry also exhibits regional variations, with Asia Pacific emerging as a production and consumption hub due to strong EV adoption and government support, while North America and Europe emphasize high-performance, specialty additives for automotive and industrial applications. This combination of technological complexity and regional demand patterns shapes the competitive dynamics and growth trajectory of the market.