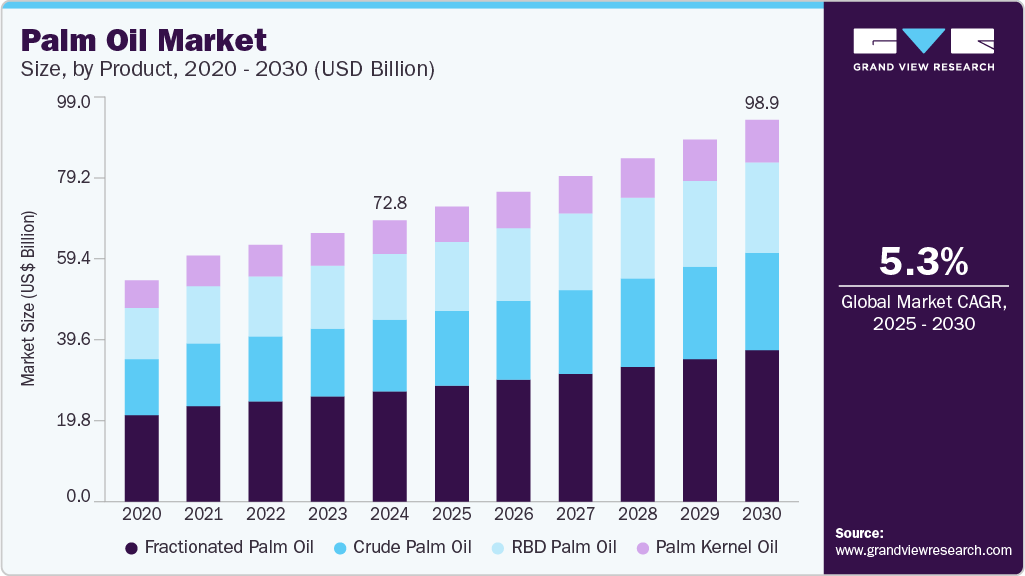

Palm Oil growing at a CAGR of 4.2% from 2025 to 2035

The global palm oil market size was estimated at USD 74.5 billion in 2024 and is projected to reach USD 113.9 billion by 2035, growing at a CAGR of 4.2% from 2025 to 2035. The global market for palm oil is primarily driven by the growing demand from the food and beverage sector.

Key Market Trends & Insights

- Asia-Pacific palm oil industry dominated the global market with the largest revenue share of 74.5% in 2024.

- Indonesia palm oil industry dominated the Asia Pacific market with a revenue share of 42.1% in 2024.

- By nature, the conventional segment dominated the market with a revenue share of 93.4% in 2024.

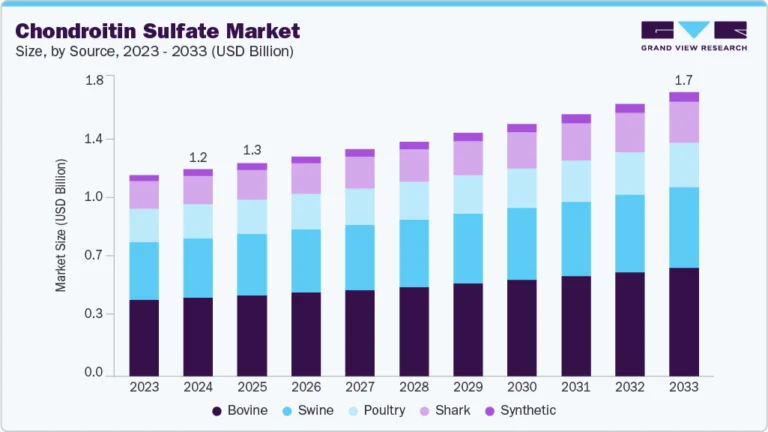

- By product, the crude palm oil segment dominated the market with a revenue share of 76.7% in 2024.

- By application, the food & beverage sector dominated the market with a revenue share of 72.7% in 2024.

Market Size & Forecasts

- 2024 Market Size: USD 74.5 Billion

- 2035 Projected Market Size: USD 113.9 Billion

- CAGR (2025-2035): 4.2%

- Asia Pacific: Largest Market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/palm-oil-market/request/rs1

Palm oil’s versatility, low cost, and long shelf life make it a preferred ingredient in bakery, confectionery, and processed food products. Its widespread use as a cooking oil and in margarine and instant noodles continues to support market growth. The expanding global population and rising consumption of packaged foods are further amplifying this demand.

Another key driver for the global palm oil industry is the increasing use of palm oil in biodiesel production. Governments across Asia, Europe, and Latin America are promoting biofuel blending mandates to reduce carbon emissions and dependence on fossil fuels. Palm oil’s high yield and energy efficiency make it a popular feedstock choice for biodiesel manufacturers. This trend is creating strong demand from the energy sector, especially in Indonesia and Malaysia.

A major opportunity in the global palm oil industry lies in the growing demand for sustainably sourced and certified palm oil. Increasing consumer awareness about environmental and social impacts is pushing companies to adopt RSPO-certified and traceable supply chains. This trend is opening new growth avenues for producers investing in eco-friendly cultivation, deforestation-free sourcing, and transparent trade practices. As global brands prioritize sustainability commitments, the market for certified palm oil is expected to expand significantly.

Market Concentration & Characteristics

The global palm oil industry is moderately concentrated, with a few major players such as Wilmar International, ADM holding a significant share. These companies dominate due to their integrated operations, from cultivation and processing to refining and global distribution. However, the presence of several regional producers and smallholders across Southeast Asia, Africa, and Latin America maintains a competitive balance in the market.

The market is characterized by high production volumes, cost efficiency, and strong trade flows across developing and developed economies. It is highly influenced by agricultural productivity, climatic conditions, and government policies on exports and sustainability. Additionally, the market exhibits cyclical price trends linked to supply fluctuations and crude oil prices, while growing emphasis on traceability and sustainability is reshaping operational standards globally.

Palm Oil Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 75.50 billion |

|

Revenue forecast in 2035 |

USD 113.9 billion |

|

Growth rate |

CAGR of 4.2% from 2025 to 2035 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2035 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2035 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Nature, product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Indonesia; Malaysia; China; India; Japan; South Korea; Brazil; Argentina; Colombia; Saudi Arabia; South Africa |

|

Key companies profiled |

ADM; Wilmar International Ltd.; IOI Corporation Berhad; Kuala Lumpur Kepong Berhad; United Plantations Berhad; Kulim (Malaysia) Berhad; PT Sampoerna Agro Tbk; Univanich Palm Oil Public Company Ltd.; PT. Bakrie Sumatera Plantations tbk; Asian Agri; Oleopalma; Natural Habitats; Agropalma; Cargill, Incorporated; AEN Parm Oil |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |