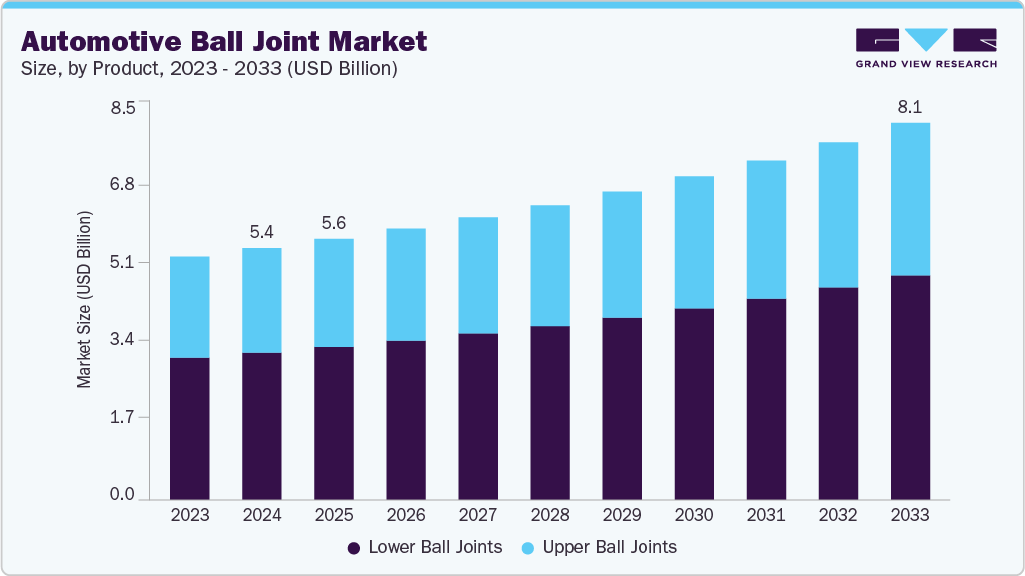

Automotive Ball Joint growing at a CAGR of 4.7% from 2025 to 2033

The global automotive ball joint market size was estimated at USD 5.40 billion in 2024, and is projected to reach USD 8.09 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The steady growth of the industry is attributed to the rising production of passenger and commercial vehicles, the growing demand for durable suspension systems to improve ride comfort and safety, and the increasing adoption of lightweight yet high-strength materials in ball joint manufacturing.

Key Market Trends & Insights

- Asia Pacific automotive ball joint market accounted for a 34.7% share of the overall market in 2024.

- The automotive ball joint industry in China held a dominant position in 2024.

- By product, the lower ball joints segment accounted for the largest share of 58.5% in 2024.

- By vehicle type, the passenger vehicles segment held the largest market share in 2024.

- By material, the steel segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.40 Billion

- 2033 Projected Market Size: USD 8.09 Billion

- CAGR (2025-2033): 4.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/automotive-ball-joint-market-report/request/rs1

Additionally, the shift toward electric vehicles (EVs) and hybrid vehicles, which require advanced suspension components for handling and stability, further drives market expansion. Aftermarket demand from regular replacement due to wear and tear, coupled with stricter vehicle safety regulations, also contributes significantly to sustained growth. The rapid global adoption of battery electric vehicles (BEVs) and plug-in hybrids is reshaping vehicle layouts, axle loads, and suspension tuning, thereby propelling the market growth for specialized ball joints. Heavier battery packs positioned low in the chassis alter weight distribution and increase stress on suspension sub-assemblies, pushing OEMs to adopt ball joints with enhanced material strength, sealing, and fatigue resistance to ensure ride stability and durability. According to the U.S. Environmental Protection Agency (EPA), the accelerating penetration of EVs into the new-vehicle fleet underscores the need for reengineered suspension components, thereby boosting market demand for advanced ball joint solutions.

Stricter regulatory focus on safety and driver assistance systems has been propelling the market growth of steering and suspension components, including ball joints. NHTSA’s recent New Car Assessment Program (NCAP) updates, alongside its Standing General Order for ADAS/ADS crash reporting, require higher component reliability and transparent post-market data. These policies are pushing OEMs and suppliers to prioritize ball joints with proven durability, corrosion resistance, and supplier traceability. As a result, validated quality control and performance assurance, rather than just cost, are becoming key procurement drivers, thereby boosting the adoption of advanced ball joints.

Government initiatives promoting fuel efficiency and emissions reduction continue to boost the market for lightweight automotive components. A 10% curb-weight reduction can yield measurable efficiency gains, prompting OEMs to seek lighter yet durable suspension solutions. Supported by the U.S. Department of Energy (DOE), R&D efforts into high-strength steels, engineered coatings, and hybrid material systems are propelling advancements in ball joint designs that balance strength, fatigue resistance, and recyclability. These material innovations are directly driving the market growth of advanced ball joint solutions as suppliers align with lightweighting targets.

As the automotive industry emerged from pandemic disruptions between 2021 and 2024, shifting production volumes and re-shoring initiatives highlighted the importance of resilient sourcing strategies. Data from the U.S. Bureau of Transportation Statistics (BTS) indicates fluctuating fleet activity, pushing OEMs and Tier-1s to strengthen supplier networks and implement dual sourcing for critical components like ball joints. This renewed emphasis on supplier reliability and conservative design safety margins is boosting demand for ball joints that meet stringent quality standards, thereby propelling overall market growth.

Automotive Ball Joint Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.60 billion |

|

Revenue forecast in 2033 |

USD 8.09 billion |

|

Growth rate |

CAGR of 4.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, vehicle type, material, sales channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

CTR (Central Corporation / Korea); Delphi Technologies; FRAP; GMB; Hyundai Mobis; Mevotech; Meyle; MOOG (Federal-Mogul / DRiV / Tenneco); NSK Ltd.; Somic Ishikawa; ZF Friedrichshafen AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |