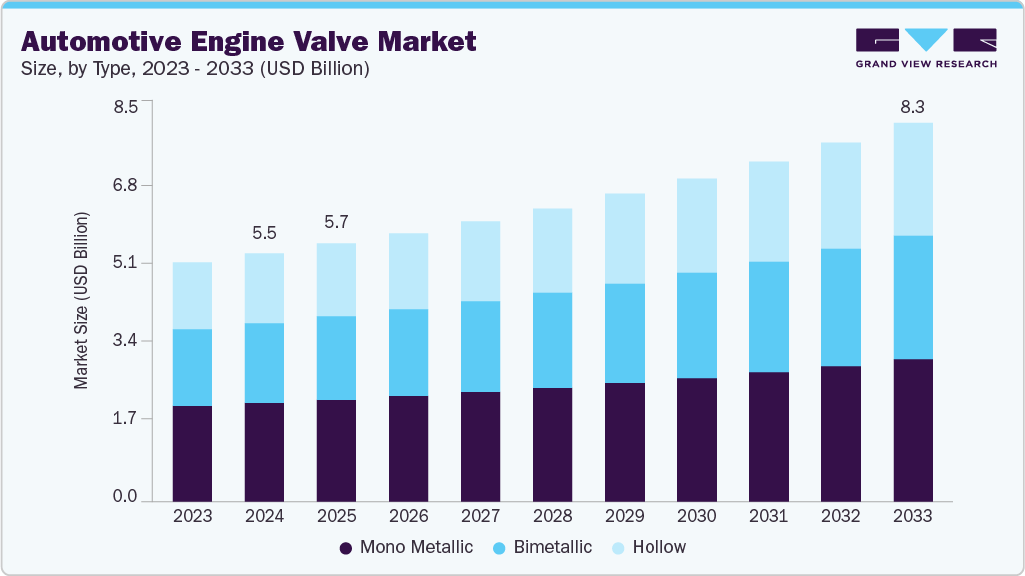

Automotive Engine Valve growing at a CAGR of 4.9% from 2025 to 2033

The global automotive engine valve market size was estimated at USD 5.45 billion in 2024 and is projected to reach USD 8.32 billion by 2033, growing at a CAGR of 4.9% from 2025 to 2033. Increasing vehicle production in global emerging markets is fueling demand for engine valves as automakers strive to meet growing consumer preferences for performance and efficiency.

Key Market Trends & Insights

- Asia Pacific dominated the automotive engine valve industry and accounted for a share of 42.3% in 2024

- By type, the mono metallic segment dominated the market in 2024, with the largest revenue share of 39.8%.

- By vehicle type, the passenger cars segment held the largest market share in 2024.

- By distribution channel, the OEMs segment dominated the market in 2024.

- By material, the steel segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.45 Billion

- 2033 Projected Market Size: USD 8.32 Billion

- CAGR (2025-2033): 4.9%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/automotive-engine-valve-market-report/request/rs1

Advancements in engine technology, such as the widespread adoption of turbocharged and direct injection engines, are necessitating more advanced valve systems capable of withstanding higher stresses and temperatures. In addition, stringent emissions regulations are forcing manufacturers to innovate and develop valves that contribute to reducing carbon footprints without compromising engine power.

Automotive manufacturers are increasingly adopting lightweight materials such as titanium and hollow-stem valves to improve fuel efficiency and reduce emissions. These materials offer better heat resistance and durability, contributing to longer valve life and enhanced engine performance. With emissions regulations becoming stricter, lighter valves help automakers in meeting rigorous environmental standards while maintaining engine power levels. Thus, the increasing adoption of lightweight engine valves to meet the evolving requirements of modern vehicles for improved economy and reduced environmental footprint is driving the market’s growth.

With the growing popularity of hybrid and plug-in hybrid electric vehicles (HEVs and PHEVs), there’s a shift in demand towards specialized valves that cater to the unique requirements of these engines. Valves designed for these vehicles focus on reducing friction, enhancing efficiency, and minimizing wear in the absence of traditional combustion-related stresses. Hybrid vehicles also drive demand for valves that can operate seamlessly between electric and combustion modes, requiring innovative valve designs. This trend highlights the automotive industry’s adaptation to evolving technologies aimed at improving sustainability and efficiency in vehicle propulsion systems.

Continuous advancements in Variable Valve Timing (VVT) technology are shaping the design and functionality of engine valves. VVT systems optimize engine performance by adjusting valve timing and lift according to driving conditions, improving fuel efficiency and power output. This trend is encouraging manufacturers to develop valves that can operate efficiently across a wider range of speeds and loads, contributing to more responsive and environmentally friendly engines. Thus, the adoption of VVT technology, turbocharging, and hybrid systems is further driving demand for advanced engine valves in the automotive industry.

Automotive Engine Valve Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.66 billion |

|

Revenue forecast in 2033 |

USD 8.32 billion |

|

Growth rate |

CAGR of 4.9% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, vehicle type, distribution channel, material, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

BorgWarner Inc.; NITTAN Corporation; Eaton; MAHLE GmbH; Fuji Oozx Inc.; Ferrea Racing Components; supertechperformance.com; Eminent Engitech Pvt. Ltd.; Renex Valves; Guangzhou Wellfar Engine Parts Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |