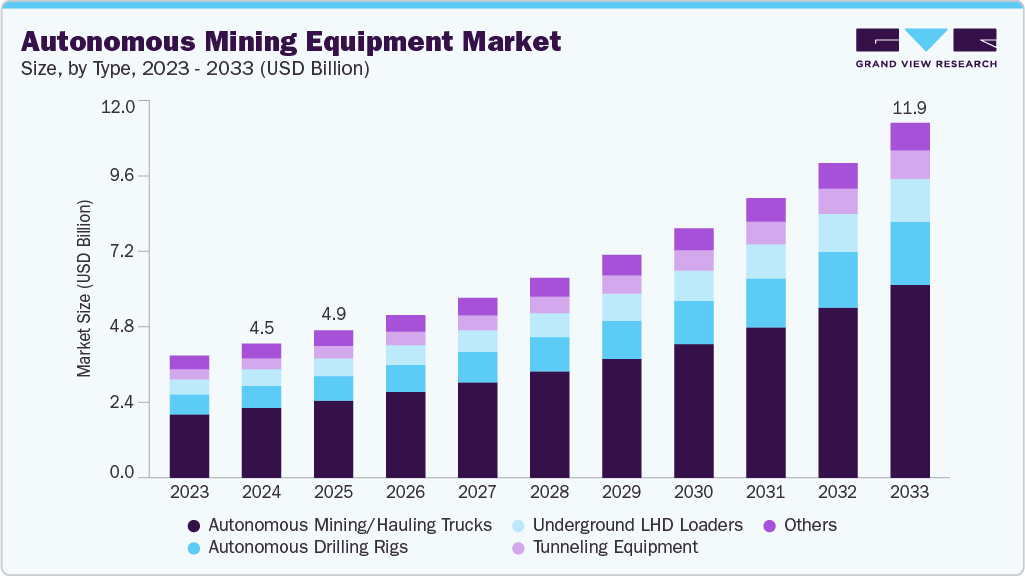

Autonomous Mining Equipment growing at a CAGR of 11.6% from 2025 to 2033

The global autonomous mining equipment market size was estimated at USD 4.48 billion in 2024, and is projected to reach USD 11.86 billion by 2033, growing at a CAGR of 11.6% from 2025 to 2033. The market growth is driven by the increasing demand for operational efficiency, enhanced worker safety, rising labor shortages, and the growing deployment of AI-powered automation in surface and underground mining operations.

Key Market Trends & Insights

- The Asia Pacific autonomous mining equipment market held the largest share of 39.0% in 2024.

- The China autonomous mining equipment market is projected to grow over the forecast period.

- By type, the autonomous mining/hauling trucks segment held the largest share of 52.2% in 2024.

- By mining, the surface mining segment held the largest market share in 2024.

- By application, the metal segment dominated the autonomous mining equipment market in 2024 and is projected to grow at a significant CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.48 Billion

- 2033 Projected Market Size: USD 11.86 Billion

- CAGR (2025-2033): 11.6%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/autonomous-mining-equipment-market-report/request/rs1

A game-changing trend boosting the autonomous mining equipment industry is the emergence of AI-based critical mineral assessments. In 2024, the U.S. Geological Survey (USGS), in collaboration with DARPA and ARPA‑E, launched the CriticalMAAS initiative. This AI-enabled system drastically reduced mineral resource mapping time from several months to just 2.5 days, supporting fast, data-driven decision-making in resource planning. As demand for critical minerals like lithium, nickel, and rare earths rises, especially for EVs and energy storage, mining companies are increasingly turning to autonomous drills and haul trucks to capitalize on these quickly identified deposits. This data-centric automation workflow is propelling the market growth by aligning exploration with real-time autonomous deployment capabilities.

Government-enforced safety regulations are another strong driver boosting the adoption of autonomous mining systems. The U.S. Mine Safety and Health Administration (MSHA) has issued multiple directives emphasizing remote-control technologies, proximity detection systems, and collision avoidance for surface and underground mining equipment. With mobile equipment accounting for a significant percentage of mining injuries, MSHA’s advocacy for system-level safety evaluations has led companies to invest in autonomous and semi-autonomous systems to ensure compliance. As a result, the mining industry views automation not just as a technological advancement but as a regulatory necessity, significantly propelling the market forward.

The development of open standards such as OPC UA Companion Specification for Mining, led by the OPC Foundation and supported by the Global Mining Guidelines Group (GMG), is boosting the market by enabling seamless communication between autonomous systems from different manufacturers. These standards are critical for integrating diverse equipment like autonomous haul trucks, loaders, and drills into centralized command systems. By promoting vendor-neutral infrastructure, these frameworks are propelling market growth by encouraging scalable, multi-vendor deployment of autonomous fleets across surface and underground operations.

While autonomous systems have historically been concentrated in large-scale operations, the World Bank’s 2024 ASM Framework supports technology infusion into Artisanal and Small-Scale Mining (ASM) through safety reforms, formalization, and sustainable practices. This shift opens new frontiers for modular autonomous systems, especially in regions where infrastructure and manpower challenges exist. By enabling safer working conditions and operational efficiency, these modernization efforts are boosting the autonomous equipment market, particularly in mineral-rich developing nations.

Autonomous Mining Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.93 billion |

|

Revenue forecast in 2033 |

USD 11.86 billion |

|

Growth rate |

CAGR of 11.6% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, mining, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Caterpillar; Komatsu Ltd.; Hitachi Construction Machinery Co., Ltd.; Epiroc AB; Sandvik AB; Liebherr Group; AB Volvo; BELAZ-HOLDING; XCMG Group; Sany Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |