Drilling Rig growing at a CAGR of 6.0% from 2025 to 2033

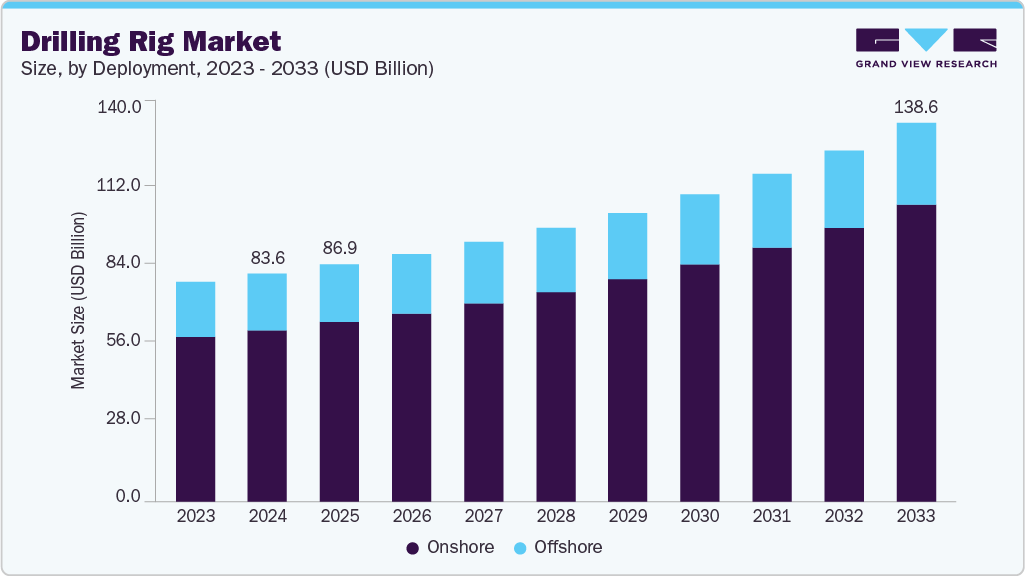

The global drilling rig market size was estimated at USD 83.58 billion in 2024 and is projected to reach USD 138.61 billion by 2033, growing at a CAGR of 6.0% from 2025 to 2033. One of the most prominent drivers of the global market is the growing demand for oil and gas, particularly in emerging economies.

Key Market Trends & Insights

- North America dominated the drilling rig market with the largest revenue share of 38.5% in 2024.

- The drilling rig market in the U.S. accounted for the largest market revenue share in 2024.

- By deployment, the onshore segment led the market with the largest revenue share of 75.2% in 2024.

- By type, the jack-ups segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 83.58 Billion

- 2033 Projected Market Size: USD 138.61 Billion

- CAGR (2025-2033): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/drilling-rig-market-report/request/rs1

The economics of deepwater drilling are improving as oil prices stabilize above breakeven levels for high-spec offshore projects. Moreover, governments in resource-abundant regions are incentivizing offshore exploration with favorable regulatory and licensing regimes, further boosting demand. As a result, the deepwater and ultra-deepwater segment is becoming one of the most critical growth engines for the drilling rigs industry.

Technological innovation is reshaping drilling operations by making rigs more efficient, safer, and cost-effective. Automation tools are increasingly being integrated into rig systems, reducing human intervention in hazardous environments and enabling remote-controlled drilling operations. The adoption of real-time data analytics and digital twins allows operators to simulate drilling environments, optimize well planning, and improve drilling precision. Predictive maintenance powered by artificial intelligence (AI) and advanced sensors helps minimize unplanned downtime, thereby extending rig life and reducing operational expenses. Robotics and machine learning are also transforming repetitive tasks such as pipe handling, further enhancing efficiency.

Environmental sustainability has emerged as a major theme in the global drilling rigs industry. With mounting pressure from regulators, investors, and the public, drilling contractors are under increasing scrutiny to reduce the carbon footprint of their operations. Hybrid power systems that integrate conventional diesel with battery storage, more fuel-efficient engines, and emission-reducing rig designs are being adopted to align with global climate goals. Technologies aimed at reducing flaring, capturing methane, and supporting carbon capture and storage (CCS) initiatives are being implemented alongside drilling projects. Offshore operators, in particular, are exploring synergies with renewable energy sources such as offshore wind to partially power rig operations.

Nations such as China, India, and several African countries are experiencing rapid industrialization and urbanization, which is pushing up energy consumption across transportation, manufacturing, and power generation sectors. While developed economies are accelerating their transition toward renewable energy, fossil fuels remain a critical part of the global energy mix, especially in regions with expanding middle-class populations and infrastructure needs. Offshore drilling is evolving rapidly, with the industry increasingly targeting deepwater and ultra-deepwater reserves. Traditional shallow-water exploration is gradually giving way to projects located in water depths exceeding 1,500 meters, particularly in resource-rich regions such as Brazil’s pre-salt fields, Guyana, and West Africa. These frontier basins hold vast untapped hydrocarbon reserves that require highly advanced rigs, such as drill ships and semisubmersibles, equipped with dynamic positioning, advanced blowout preventers, and robust safety features.

Drilling Rig Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 86.97 billion |

|

Revenue forecast in 2033 |

USD 138.61 billion |

|

Growth rate |

CAGR of 6.0% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report frequency |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Nabors Industries Ltd.; Transocean Ltd.; SAIPEM SpA; Seadrill Limited; Schlumberger NV (SLB); Valaris Limited; Noble Corporation; China Oilfield Services Ltd. (COSL); Baker Hughes; ADNOC Drilling |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |