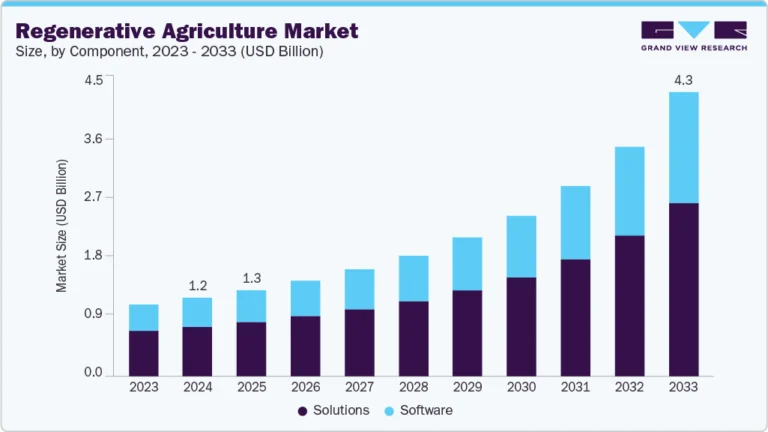

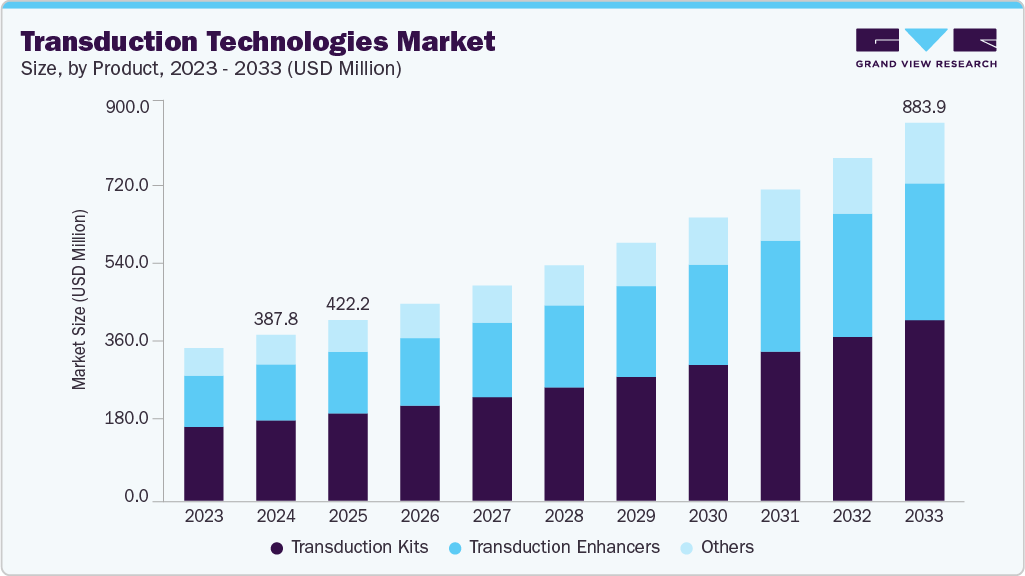

Transduction Technologies growing at a CAGR of 9.67% from 2025 to 2033

The global transduction technologies market size was estimated at USD 387.8 million in 2024 and is projected to reach USD 883.9 million by 2033, growing at a CAGR of 9.67% from 2025 to 2033. The market is expanding due to the growing use of sophisticated gene and cell therapy methods, the need for effective delivery methods, and ongoing advancements in transduction platform technology.

Key Market Trends & Insights

- North America dominated the transduction technologies market with the largest revenue share of 41.29% in 2024.

- The transduction technologies industry in the U.S. accounted for the largest market revenue share in 2024.

- By product, the transduction kits segment led the market with the largest revenue share of 48.34% in 2024.

- Based on target cell type, the immune cells segment accounted for the largest market revenue share in 2024.

- By application, the gene therapy segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 387.8 Million

- 2033 Projected Market Size: USD 883.9 Million

- CAGR (2025-2033): 9.67%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/transduction-technologies-market-report/request/rs1

The market is also anticipated to grow over the forecast period due to rising research investments and expanding applications in biotechnology, pharmaceuticals, and regenerative medicine.

Rise of Gene Editing and Synthetic Biology

One of the main factors propelling the market for transduction technologies in the life sciences is the rapid development of gene editing and synthetic biology. Because they allow for precise DNA-level modifications, advanced genetic engineering tools like CRISPR-Cas9, TALENs, and base editors have completely changed research and therapeutic development. They enable scientists to monitor genetic material changes in real time, verify editing results, and optimize protocols for various uses, including metabolic engineering and functional genomics.

Market Concentration & Characteristics

The transduction technologies industry is highly innovative due to ongoing developments in molecular detection platforms, nanotechnology, microfabrication, and biosensing materials. Traditional signal detection has been transformed into automated, high-throughput, multiplexed platforms by integrating AI, lab-on-a-chip systems, and microfluidic devices. Furthermore, using new biocompatible materials and nanostructured surfaces improves signal-to-noise ratios and makes single-molecule detection possible.

The transduction technologies industry has a moderate to high level of mergers and acquisitions (M&A) activity, which reflects increasing consolidation among major players looking to broaden their product and technological offerings. Major life science and biotechnology companies are aggressively acquiring businesses that specialize in biosensors, nanomaterials, and microfluidic-based detection systems to improve their position in the quickly changing fields of genetic engineering and molecular diagnostics. For example, in January 2021, Thermo Fisher Scientific expanded its European cell and gene therapy production capacity for commercial and clinical customers by completing the acquisition of Novasep’s viral vector manufacturing business.

These technologies guarantee that engineered cells display the intended characteristics free from unwanted mutations by enabling the ongoing evaluation of genetic alterations in living cells. Furthermore, transducers facilitate automation and high-throughput testing, both of which are becoming increasingly crucial for extensive synthetic biology initiatives.

Transduction Technologies Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 422.2 million |

|

Revenue forecast in 2033 |

USD 883.9 million |

|

Growth rate |

CAGR of 9.67% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, target cell type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; Merck KGaA; Takara Bio; Revvity, Inc.; OZ Biosciences; Mirus Bio; System Biosciences; Miltenyi Biotec; Applied Biological Materials; Akron Biotech |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |