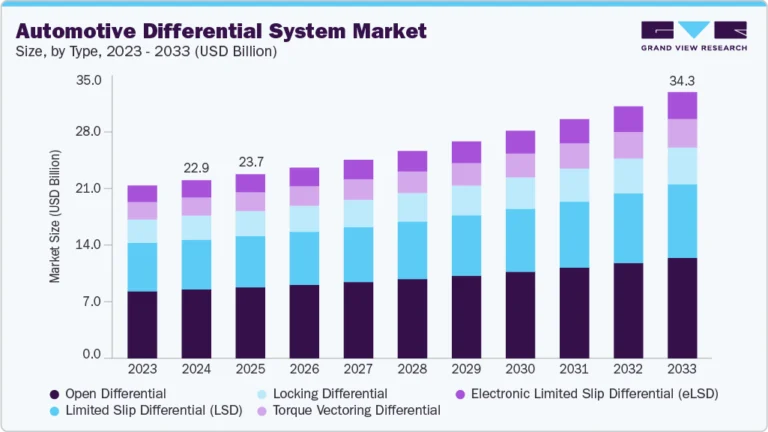

Ultra-short Reach Optical Interconnect growing at a CAGR of 20.2% from 2025 to 2030

The global ultra-short reach optical interconnect market size was estimated at USD 2.03 billion in 2024 and is projected to reach USD 5.95 billion by 2030, growing at a CAGR of 20.2% from 2025 to 2030. This growth is driven by rising demand for high-speed, low-latency data transfer in AI, cloud computing, and chip-to-chip communication, as organizations scale infrastructure to handle advanced workloads, cut energy use, and ease bandwidth bottlenecks in dense data centers.

Key Market Trends & Insights

- North America dominated the global ultra-short reach (USR) optical interconnect market with the largest revenue share of 30.8% in 2024.

- The USR optical interconnect industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the board-to-board interconnects segment led the market, holding the largest revenue share of 51.6% in 2024.

- By technology, the VCSEL-based interconnects segment was dominant in 2024.

- By data rate, the more than 100 Gbps segment held the dominant position in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.03 Billion

- 2030 Projected Market Size: USD 5.95 Billion

- CAGR (2025-2030): 20.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/ultra-short-reach-optical-interconnect-market-report/request/rs1

The current market state is shaped by the growth in data traffic, rapid expansion of data centers, and increasing adoption of artificial intelligence and high-performance computing. Enterprises and hyperscale service providers are deploying ultra-short reach (USR) optical solutions to meet the need for high-speed, low-latency communication between chips and system boards within modern data center architectures. The shift toward spine-and-leaf topologies, the proliferation of AI workloads, and the demand for energy-efficient, high-density connectivity drive ongoing investment in USR modules and transceivers. At the same time, advancements in silicon photonics, co-packaged optics, and modular form factors are making these technologies more accessible and cost-effective for a broader range of applications.

Moreover, market growth is propelled by continuous innovation in optical technologies, such as silicon photonics, co-packaged optics, and advanced transceiver designs. These advancements enable higher data rates, improved signal integrity, and reduced power consumption, making USR optical interconnects more accessible and cost-effective for a wider range of applications. The rollout of 5G networks, the proliferation of IoT devices, and the emergence of edge computing are increasing the demand for ultra-fast, short-reach optical links that handle dynamic workloads and real-time analytics. Leading technology companies are investing in next-generation optical solutions to enhance AI processing speeds and optimize network architectures for future needs.

The market is further supported by strong investment from the public and private sectors in digital infrastructure, including government initiatives to expand broadband and 5G networks across major regions. Strategic partnerships, mergers and acquisitions, and new product launches are enhancing market penetration and accelerating the adoption of USR optical interconnects worldwide. As digital transformation continues to reshape industries and drive up data volumes, USR optical interconnects are increasingly recognized as essential for enabling high-speed, reliable, and scalable data communication in modern IT environments.

Product Insights

The board-to-board interconnects segment led the market in 2024, accounting for over 51% of global revenue due to their essential role in enabling high-speed, low-latency data transfer within servers, switches, and network appliances. These connections are integral to the architecture of modern data centers, where dense packaging and rapid communication between system boards are necessary for efficient processing. The prevalence of modular server designs and the need for scalable, high-bandwidth internal links contribute to the strong demand for board-to-board solutions. Their compatibility with evolving server and storage technologies further reinforces their leadership in the market.

The rack-to-rack interconnects segment is expected to grow significantly during the forecast period as data centers scale up and require fast, reliable connections between racks to support distributed computing and high-performance workloads. The increasing adoption of spine-leaf network topologies and the rise of AI and machine learning clusters drive demand for efficient rack-level connectivity. These interconnects facilitate seamless data flow across multiple racks, reducing bottlenecks and enabling flexible resource allocation. As data center architectures become more complex, rack-to-rack solutions are increasingly favored for their ability to support rapid scaling and high-density deployments.

Ultra-short Reach Optical Interconnect Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.37 billion |

|

Revenue forecast in 2030 |

USD 5.95 billion |

|

Growth rate |

CAGR of 20.2% from 2025 to 2030 |

|

Actual data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Data rate, distance, technology, product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Amphenol Communications Solutions; Broadcom; Coherent Corp; Fujitsu Limited; Innolight; Lumentum Operations LLC; Molex; Nvidia Corporation; Sumitomo Electric Industries, Ltd; TE Connectivity |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |