Fuel Cell Powertrain Market Size, Share & Trends Analysis growing at a CAGR of 48.3% from 2025 to 2033

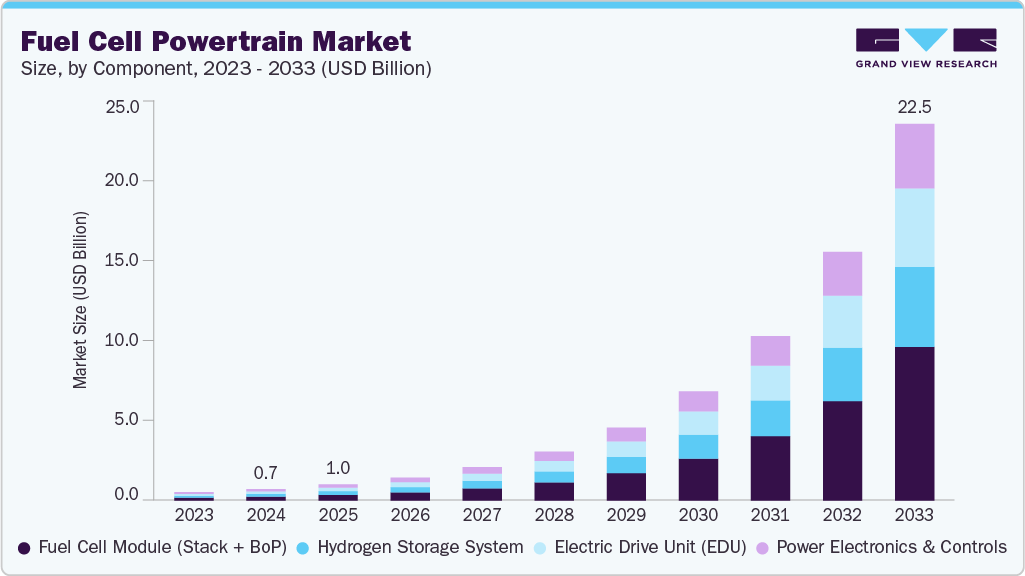

The global fuel cell powertrain market size was estimated at USD 685.3 million in 2024, and is projected to reach USD 22,498.1 million by 2033, growing at a CAGR of 48.3% from 2025 to 2033. The market is gaining momentum, driven by growing government incentives for zero-emission vehicles and the rising demand for fuel cell-powered trucks and buses across logistics and public transport sectors.

Key Market Trends & Insights

- The Asia Pacific fuel cell powertrain market accounted for a revenue share of 46.2% in 2024.

- By component, the fuel cell module segment held the largest market share in 2024.

- By product, the fuel cell electric powertrain segment accounted for the largest share of 37.9% in 2024.

- By application, the commercial trucks & buses segment held the largest market share in 2024.

- By end user, the commercial vehicle manufacturers & fleets segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 685.3 Million

- 2033 Projected Market Size: USD 22,498.1 Million

- CAGR (2025-2033): 48.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest Growing Market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/fuel-cell-powertrain-market-report/request/rs1

Continuous cost reductions in fuel cell systems and hydrogen storage technologies are also supporting broader adoption, alongside the steady expansion of green hydrogen production infrastructure worldwide. Emerging markets in the Middle East & Africa and Latin America are creating new opportunities for deploying fuel cell-based heavy-duty fleets, particularly in regions seeking alternatives to diesel engines. However, high upfront costs of fuel cell systems compared to battery-electric alternatives remain a significant challenge, hindering faster commercialization across cost-sensitive segments.

Government incentives have played a pivotal role in accelerating the deployment of fuel cell powertrains by reducing upfront costs and supporting infrastructure development. These policy measures are aimed at fostering the transition away from internal combustion engines and promoting the adoption of zero-emission mobility solutions across commercial and public sectors. Incentives typically include purchase subsidies, tax exemptions, research and development funding, and direct support for fleet retrofitting or replacement. These initiatives are particularly critical for high-cost segments like fuel cell-powered trucks and buses, where operating economics remain a barrier without government intervention.

For instance, in July 2025, Germany’s Federal Ministry for Transport launched a new funding round to promote the adoption of zero-emission bus fleets. The initiative covers battery-electric and hydrogen-powered buses, as well as the retrofitting of existing diesel vehicles, with the goal of expediting the decarbonization of public transport systems nationwide. In May 2023, the UK government, along with industry partners, announced USD 104.43 million (GBP 77 million) in funding for zero-emission vehicle initiatives. The program included support for the HYER POWER hydrogen fuel cell range extender designed for emergency service vehicles. These developments reinforce the strategic commitment by governments to scale hydrogen fuel cell mobility, which is expected to significantly drive the expansion of the fuel cell powertrain industry over the forecast period.

Fuel Cell Powertrain Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 961.6 million |

|

Revenue forecast in 2033 |

USD 22,498.1 million |

|

Growth rate |

CAGR of 48.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, product, application, end user, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Ballard Power Systems Inc.; Plug Power Inc.; Toyota Motor Corporation; Hyundai Motor Company; Cummins Inc.; Symbio (Faurecia & Michelin JV); Bosch Hydrogen Powertrain Systems (Bosch Group); AVL List GmbH; Horizon Fuel Cell Technologies Pte. Ltd.; Sinosynergy Hydrogen Energy Technology Co., Ltd. |