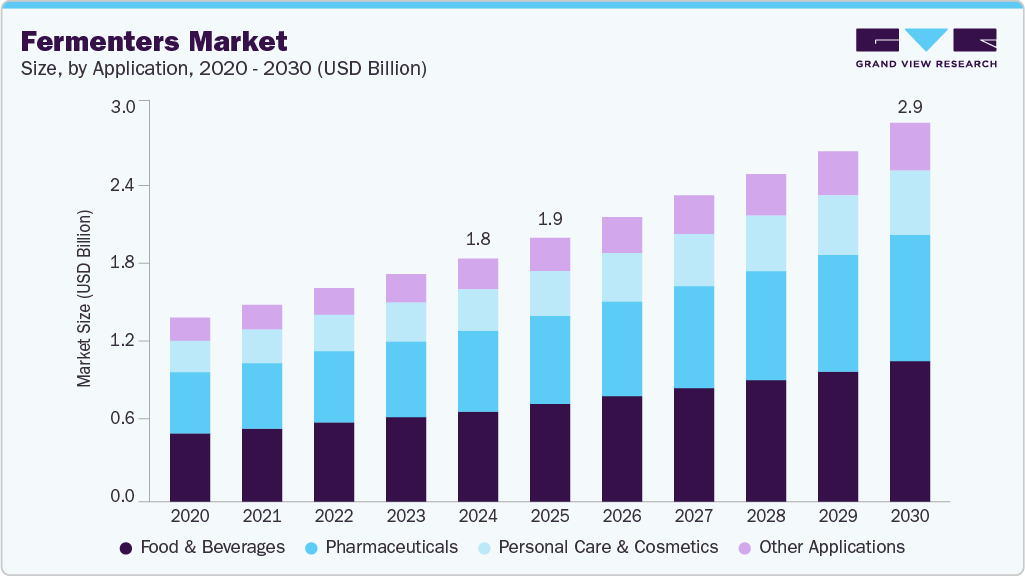

Fermenters Market Size, Share & Trends Analysis growing at a CAGR of 8.4% from 2025 to 2030.

The global fermenters market size was estimated at USD 1.83 billion in 2024, and is projected to reach USD 2.97 billion by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The rising prevalence of chronic diseases, such as cancer, cardiac disease, diabetes, and hypertension, has led to more focus on the development of innovative biological therapies.

Key Market Trends & Insights

- Europe dominated the market, is expected to grow with a significant rate during the forecast period.

- Germany contributed the highest revenue share within the regional market in 2024.

- By application, the food and beverage segment led the market with a significant revenue share in 2024.

- By mode of operation, automatic mode of operation segment dominated the market and accounted for a significant share in 2024.

- By microorganisms, the bacteria source segment dominated the market and accounted for a significant share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.83 Billion

- 2030 Projected Market Size: USD 2.97 Billion

- CAGR (2025-2030): 8.4%

- Europe: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/fermenters-market-report/request/rs1

Similarly, the demand for monoclonal antibodies and personalized medicines has increased bioproduction, accelerating the demand for fermenters. Furthermore, the rising usage of high-end technologies to simplify complex manufacturing is expected to boost the product demand during the forecast period. Besides, high investments in research and development activities by key biopharmaceutical companies are expected to drive industry growth. Fermenters are used for creating a proper environment for the growth of microorganisms or driving biochemically active substances derived from such organisms. They are basically utilized for the growth and maintenance of a population of bacterial or fungal cells in a controlled manner.

The expanding biopharmaceutical industry is a key growth driver for the fermenters market, as microbial fermentation is essential for producing vaccines, antibodies, and enzymes. According to the World Health Organization (WHO), biologics represent a significant portion of the pharmaceutical pipeline, indicating a growing reliance on fermentation processes in drug development. This rising demand has intensified the need for advanced fermentation systems that ensure scalability, sterility, and regulatory compliance.

Consistently growing investments in R&D for microbial fermentation processes have accelerated the adoption of fermenters in pharmaceuticals and industrial biotechnology. As industries prioritize efficiency, sustainability, and innovation, the fermenters industry is rapidly expanding globally. In addition, government-backed initiatives promoting domestic vaccine production are further accelerating fermenter adoption. These developments underscore the vital role of fermenters in meeting global healthcare challenges.

Innovation in fermenter technology, including the adoption of single-use systems and automation, enhances production efficiency and reduces contamination risks. The shift towards sustainable fermentation processes aligns with global environmental goals, encouraging the use of renewable feedstocks and waste valorization. Additionally, increasing investments in the developing regions of Asia Pacific, driven by expanding pharmaceutical and food industries, position the region as a key growth hub for fermenters. Such factors collectively shape the evolving dynamics of the fermenters market through 2030.

Fermenters Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.98 billion |

|

Revenue forecast in 2030 |

USD 2.97 billion |

|

Growth rate |

CAGR of 8.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, Company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, mode of operation, process, microorganisms, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Eppendorf AG; Sartorius, Pierre Guerin SAS; Applikon Biotechnology BV.; GEA Group; Cercell APS; ElectroLab Biotech Ltd.; Zeta Holding GmbH; Thermo Fisher Scientific Inc.; New Brunswick Scientific Co., Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |