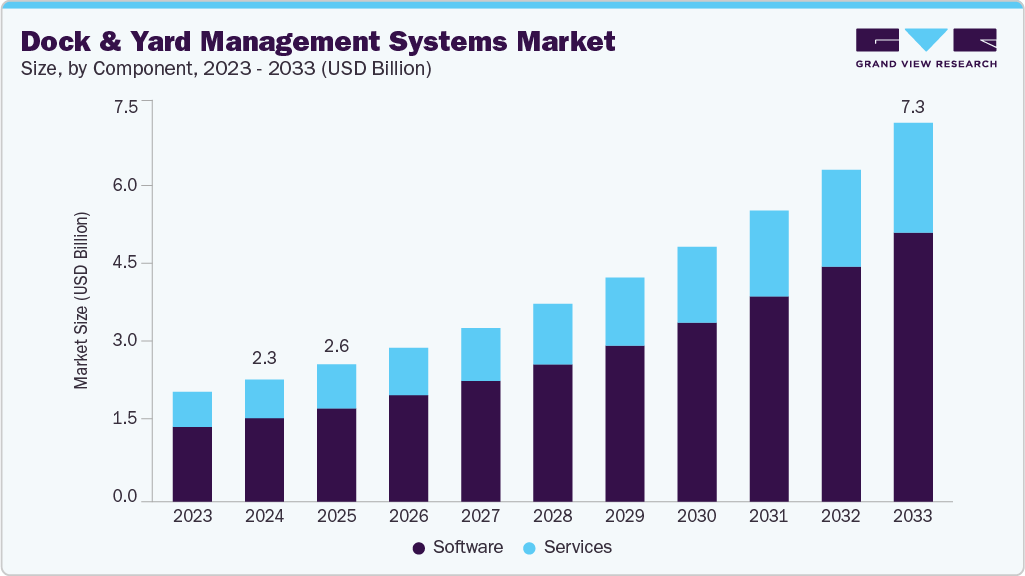

Dock And Yard Management Systems Market Size, Share & Trends Analysis growing at a CAGR of 13.6% from 2025 to 2033

The global dock and yard management systems market size was estimated at USD 2.34 billion in 2024, and is projected to reach USD 7.27 billion by 2033, growing at a CAGR of 13.6% from 2025 to 2033. The dock and yard management systems market is gaining momentum, driven by the rising demand for real-time supply chain visibility, particularly in high-throughput logistics environments.

Key Market Trends & Insights

- North America dock and yard management systems market accounted for a 38.6% share of the overall market in 2024.

- The dock and yard management systems industry in the U.S. held a dominant position in 2024.

- By component, the software segment accounted for the largest share of 68.2% in 2024.

- By deployment, the on-premise segment held the largest market share in 2024.

- By functionality, the yard visibility & asset tracking segment dominated the market in 2024.

- By End User, the transportation & logistics segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.34 Billion

- 2033 Projected Market Size: USD 7.27 Billion

- CAGR (2025-2033): 13.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/dock-yard-management-systems-market-report/request/rs1

Growth in e-commerce and the need for rapid, accurate fulfillment are pushing businesses to invest in automated dock scheduling and yard tracking tools. Also, ongoing labor shortages across warehousing and yard operations are accelerating the adoption of digital task and shunter management solutions to reduce manual dependency and errors. AI-powered predictive scheduling and dynamic dock assignment present strong opportunities for next-generation systems that optimize throughput and reduce congestion. However, high initial implementation and integration costs remain a critical challenge, especially for small and mid-sized facilities lacking advanced IT infrastructure.

The growth of e-commerce and the increasing need for high-velocity fulfillment are driving demand for advanced dock and yard management systems. As online retail expands, so does the pressure on distribution centers to process higher volumes of goods with shorter turnaround times. In 2024, U.S. e-commerce sales reached USD 1.19 trillion, representing 16.1% of total retail sales, according to the U.S. Census Bureau. Similarly, India’s e-commerce market is expected to surge from USD 123 billion in 2024 to USD 292.3 billion by 2028, growing at a CAGR of 18.7%, as per India Brand Equity Foundation. These trends necessitate more efficient scheduling, gate operations, and yard visibility to meet tight delivery windows and ensure seamless last-mile fulfillment.

Warehouses and yard facilities across North America and Europe continue to face high turnover and difficulty in recruiting shunters, yard jockeys, and gate operators. This has created a strong demand for systems that can optimize resource allocation, automate scheduling, and enable real-time coordination among limited staff. For instance, in August 2024, FourKites integrated EAIGLE’s AI and computer vision technology into its Dynamic Yard and Appointment Manager solutions. The platform enables autonomous gate operations, AI-driven yard audits, and continuous trailer monitoring, thereby reducing reliance on manual labor for gate checks and yard moves. This shift toward automation underscores how digital yard management systems are helping companies mitigate operational bottlenecks caused by labor shortages, especially during peak logistics cycles.

The integration of AI and computer vision is opening new opportunities for predictive scheduling and dynamic dock assignment in yard and dock management systems. These technologies can analyze real-time conditions such as inbound truck ETAs, dock availability, and resource constraints to automatically adjust dock allocations and prioritize high-urgency loads. This results in reduced dwell times, optimized labor deployment, and minimized bottlenecks. For instance, in February 2025, Loadsmar launched a Yard Management System integrated with Opendock and NavTrac to unify gate, yard, and dock operations. The platform digitizes truck movement tracking, driver check-ins, and asset visibility using AI, OCR, and computer vision. Thus, enabling real-time dynamic scheduling and automated resource allocation.

One of the major challenges in the dock and yard management systems market is the high upfront cost associated with implementing advanced solutions, particularly those leveraging AI, IoT, computer vision, and real-time tracking. These systems often require significant infrastructure upgrades, integration with legacy warehouse management systems (WMS), transportation management systems (TMS), and training for staff, making adoption difficult for small to mid-sized enterprises. For example, many AI-enabled solutions, such as those recently introduced by FourKites, Loadsmart, and EPG require not only software investment but also hardware installations including yard cameras, sensors, and RFID systems. Also, aligning these platforms with multiple internal and external IT systems often involves custom development work and extended deployment timelines.

Dock And Yard Management Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.62 billion |

|

Revenue forecast in 2033 |

USD 7.27 billion |

|

Growth rate |

CAGR of 13.6% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, functionality, end user, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Manhattan Associates, Inc., Blue Yonder Group, Inc., C3 Solutions, Inc., Descartes Systems Group Inc., 4SIGHT Connect (4sight Solution), Epicor Software Corporation, Oracle Corporation, SAP SE, Infor, Inc., Zebra Technologies Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |