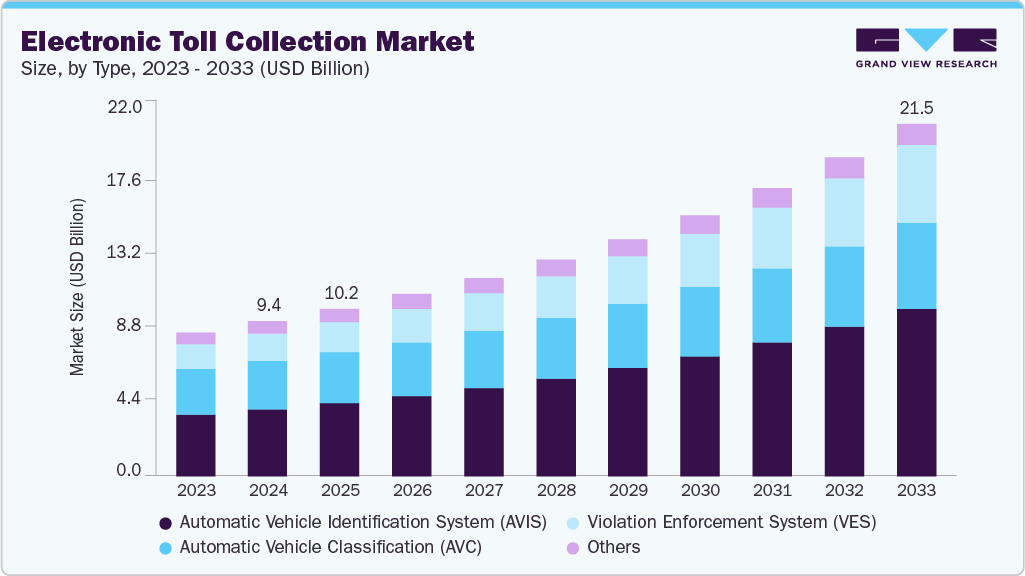

Electronic Toll Collection Market Size, Share & Trends Analysis growing at a CAGR of 9.7% from 2025 to 2033

The global electronic toll collection market size was estimated at USD 9.45 billion in 2024 and is projected to reach USD 21.50 billion by 2033, growing at a CAGR of 9.7% from 2025 to 2033. The Electronic Toll Collection (ETC) market has been driven by increasing traffic congestion, the need for efficient tolling solutions, and growing investments in transportation infrastructure.

Key Market Trends & Insights

- Asia Pacific dominated the electronic toll collection market and accounted for a share of 36.7% in 2024.

- The electronic toll collection industry in India is expected to grow significantly over the forecast period.

- By type, the Automatic Vehicle Identification System (AVIS) segment dominated the market in 2024, accounting for the largest share of 43.1%.

- By technology, the Radio Frequency Identification (RFID) segment dominated the market in 2024.

- By application, the highways segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.45 Billion

- 2033 Projected Market Size: USD 21.50 Billion

- CAGR (2025-2033): 9.7%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/electronic-toll-collection-market-report/request/rs1

Governments and transport authorities have prioritized the modernization of toll systems to reduce vehicular delays, minimize fuel consumption, and improve revenue collection efficiency. The widespread adoption of cashless transactions and real-time vehicle tracking has also accelerated the growth of the electronic toll collection industry. As urbanization intensifies and vehicle ownership rises, ETC systems have been positioned as key enablers of smart mobility and intelligent transportation networks globally. In addition, electronic tolling systems are increasingly being integrated into broader smart city frameworks and environmental pricing strategies. Cities use ETC to implement congestion pricing, low-emission zones, and dynamic tolling to reduce traffic volume and air pollution.

The market’s growth is further attributed to the increasing integration of advanced technologies such as Radio Frequency Identification (RFID), Dedicated Short-Range Communication (DSRC), and Global Navigation Satellite Systems (GNSS). These technologies have enabled vehicle identification, classification, and toll deduction automation with minimal human intervention. Mobile-based tolling, including cell phone tolling and app-integrated systems, has also gained traction in urban corridors. Moreover, AI-powered analytics and cloud-based platforms are integrated into ETC solutions to support dynamic pricing and predictive maintenance.

The regulatory landscape surrounding ETC systems has become more structured and supportive, with mandates and compliance standards being enforced to ensure uniformity and accountability. Initiatives such as the European Electronic Toll Service (EETS) and India’s FASTag mandate have been rolled out to streamline tolling across regions. Standardization of protocols and interoperability guidelines has been emphasized to facilitate seamless toll collection across multiple jurisdictions. In several countries, national transport authorities have introduced incentives or deadlines to accelerate ETC adoption among vehicle owners and operators.

Despite its rapid adoption, the electronic toll collection market has faced challenges such as high initial deployment costs, legacy system compatibility issues, and data privacy concerns. Limited digital infrastructure and low consumer awareness have hampered large-scale rollouts in developing economies. Moreover, resistance to technological change and concerns over surveillance and personal data usage have slowed adoption in certain regions. Operational disruptions, cyber threats, and maintenance complexities have also posed challenges for ETC system integrators and stakeholders.

Electronic Toll Collection Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.22 billion |

|

Revenue forecast in 2033 |

USD 21.50 billion |

|

Growth rate |

CAGR of 9.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Kapsch TrafficCom AG; Conduent Incorporated; EFKON GmbH; TransCore; Thales; Mitsubishi Heavy Industries, Ltd.; Neology, Inc.; Toshiba Infrastructure Systems & Solutions Corporation; STAR Systems International; VaaaN |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |