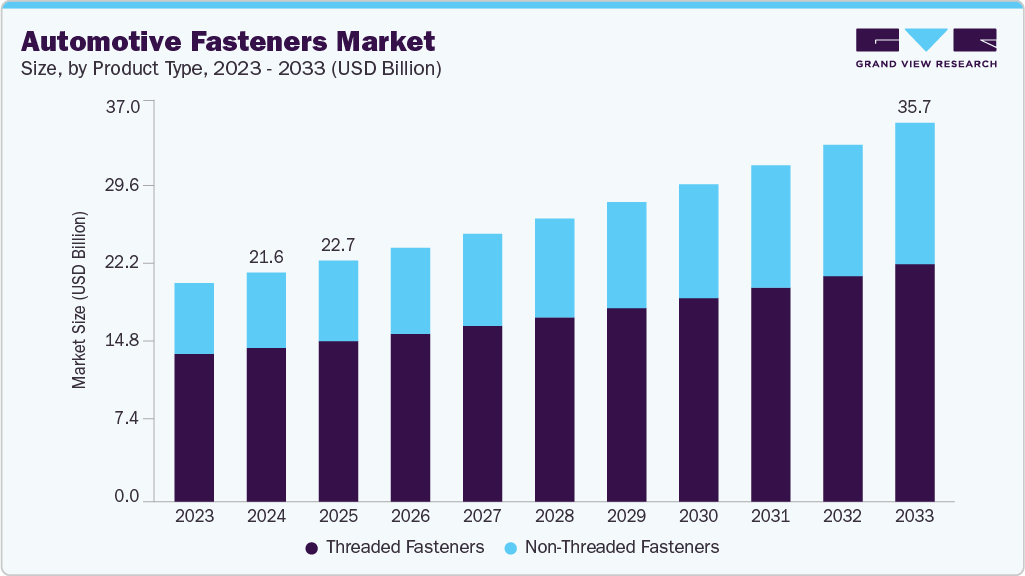

Automotive Fasteners Market Size, Share & Trends Analysis growing at a CAGR of 5.8% from 2025 to 2033

The global automotive fasteners market size was estimated at USD 21.61 billion in 2024 and is projected to reach USD 35.73 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The automotive fasteners industry is gaining momentum, driven by increasing electric vehicle (EV) production and the growing use of plastics and composites in vehicle interiors and electrical systems.

Key Market Trends & Insights

- The Asia Pacific automotive fasteners market accounted for a 38.6% share of the overall market in 2024.

- The China automotive fasteners market held a substantial revenue share in 2024.

- By product type, the threaded fasteners segment accounted for the largest share of 67.1% in 2024.

- By material, the metal segment held the largest market share in 2024.

- By application, the powertrain & chassis segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.61 Billion

- 2030 Projected Market Size: USD 35.73 Billion

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/automotive-fasteners-market-report/request/rs1

Expanding vehicle production in Asia Pacific and re-shoring trends in North America are further supporting demand. The rising adoption of modular vehicle architectures is also contributing to the increased need for advanced fastening solutions. The development of smart and self-locking fasteners tailored for autonomous and connected vehicles presents significant opportunities for manufacturers to innovate and differentiate. However, maintaining fastening integrity in multi-material vehicle designs remains a key challenge due to varying thermal and mechanical properties.

According to the India Brand Equity Foundation, the Indian EV battery market is projected to grow from USD 16.77 billion in 2023 to USD 27.70 billion by 2028, underscoring the scale of electrification in the country. India has outlined aggressive EV adoption targets by 2030, including 30% penetration in private cars and up to 80% in two-wheelers and three-wheelers. This shift is being accelerated by the ‘Make in India’ initiative, which promotes full-scale domestic EV production.

As OEMs worldwide prepare to launch a diverse range of EV models in 2025, the automotive fasteners segment is expected to witness rising demand for application-specific solutions. EVs require more fasteners per vehicle due to modular battery packs, thermal management systems, and high-voltage wiring assemblies. Moreover, the push for lightweighting to offset battery weight is increasing the adoption of advanced materials such as aluminum and composites, driving demand for compatible fasteners with enhanced corrosion resistance, mechanical integrity, and electrical insulation properties.

As automakers shift toward lightweight, durable, and aesthetically versatile materials to improve fuel efficiency and design flexibility, traditional metal fasteners are often unsuitable. This has led to the growing adoption of engineered fasteners designed specifically for plastic and composite assemblies, offering controlled installation torque, thermal expansion compatibility, and vibration resistance. For instance, interior components such as instrument panels, center consoles, and seat structures are now predominantly built using glass fiber-reinforced plastics (GFRP) and polymer blends, requiring fasteners that prevent cracking or loosening under thermal cycling. Similarly, electronic housings and connectors demand non-conductive, high-precision fastening to ensure reliability and safety.

Automotive Fasteners Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 22.72 billion |

|

Revenue forecast in 2033 |

USD 35.73 billion |

|

Growth rate |

CAGR of 5.8% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, material, application, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Illinois Tool Works Inc.; Stanley Black & Decker, Inc.; Würth Group; ARaymond Network (ARaymond); Norma Group SE; Bulten AB; KAMAX Holding GmbH & Co. KG; LISI Automotive (LISI Group); Bossard Holding AG (Bossard Group); Sundram Fasteners Limited. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |