Amphibious Vehicle Market Size, Share & Trends Analysis growing at a CAGR of 8.6% from 2025 to 2030

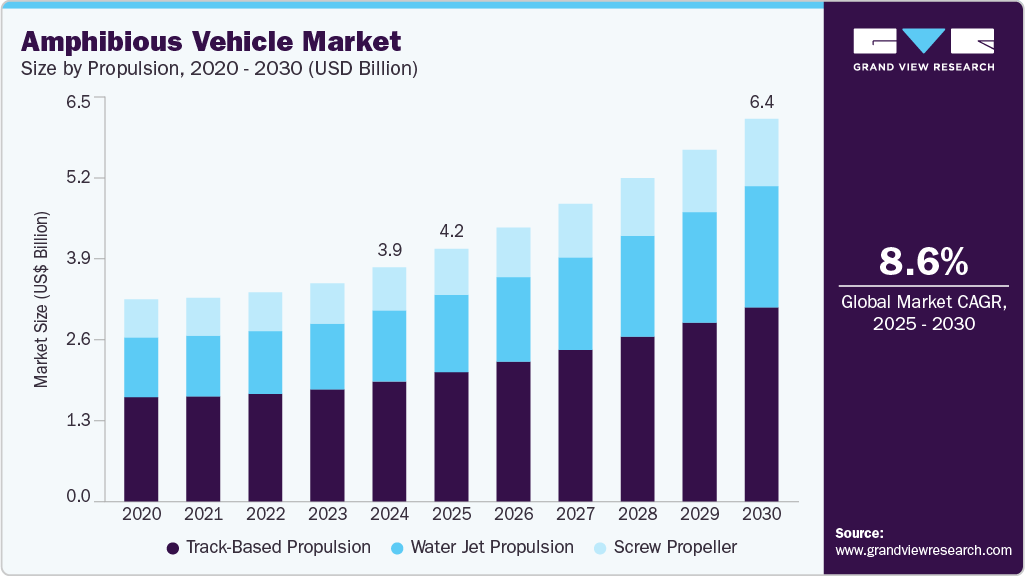

The global amphibious vehicle market size was estimated at USD 3.96 billion in 2024, and is projected to reach USD 6.47 billion by 2030, growing at a CAGR of 8.6% from 2025 to 2030. The market is gaining momentum, driven by expanding defense investments aimed at enhancing tactical mobility and command capabilities, and increasing deployment by disaster management agencies in response to more frequent climate-induced emergencies.

Key Market Trends & Insights

- The North America amphibious vehicle industry accounted for 45.8% of the global revenue share in 2024.

- The U.S. amphibious vehicle industry held a dominant position in 2024.

- By propulsion, the track-based propulsion segment held the largest revenue share of 51.3% in 2024.

- By vehicle, the armored amphibious vehicles segment held the largest revenue share in 2024.

- By application, the military combat & troop transport segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.96 Billion

- 2030 Projected Market Size: USD 6.47 Billion

- CAGR (2025-2030): 8.6%

- North America: Largest market in 2024.

- Asia-Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/amphibious-vehicle-market-report/request/rs1

In addition, rising infrastructure development in flood-prone and waterlogged regions is creating strong demand for amphibious excavators and utility vehicles among construction and dredging contractors.However, the market faces a key challenge due to the high production and operational costs associated with developing and maintaining versatile amphibious vehicles. The increasing interest in amphibious transport solutions for tourism and intermodal passenger mobility presents a promising growth opportunity, especially in regions investing in water-based transportation infrastructure.

The ongoing wave of defense modernization is steadily reinforcing demand for advanced armored amphibious vehicles tailored to multi-domain operations. In January 2025, the U.S. Marine Corps accepted delivery of the ACV-Command and Control (ACV-C) variant at Camp Lejeune, designed to function as a mobile battlefield command center. The vehicle improves tactical communication and situational coordination, aligning with the Corps’ Force Design 2030 initiative aimed at enhancing expeditionary warfare capabilities. Globally, similar modernization programs emphasize mobility, survivability, and digitized command infrastructure in amphibious platforms. As legacy fleets are phased out, defense procurement strategies are increasingly centered on modular, network-enabled vehicles capable of both sea and land operations. This has positioned next-generation amphibious armored units as critical assets within modern force structures, driving consistent demand across allied military agencies.

The growing frequency and severity of climate-related disasters are accelerating the deployment of amphibious vehicles for emergency response, particularly in flood-prone regions. According to the Asia-Pacific Disaster Report 2023 by the UN ESCAP, over 140 disaster events occurred across the region in 2022, impacting more than 64 million people and causing economic losses exceeding USD 57 billion. Flooding emerged as the deadliest hazard, responsible for over 4,800 fatalities, primarily in India, Pakistan, Afghanistan, Nepal, and Bangladesh, and affecting 33 million people in Pakistan alone. These conditions prompted governments and disaster management agencies to adopt amphibious rescue units capable of navigating submerged or damaged infrastructure during high-impact flood events. Their dual-terrain capability makes them indispensable for delivering relief supplies, evacuating stranded populations, and accessing remote or inundated areas when conventional vehicles fail.

Amphibious tour operations are gaining popularity for offering seamless land-to-water sightseeing experiences. For instance, Amsterdam and Singapore have introduced amphibious buses and boat tours to attract tourists seeking unique, multi-terrain travel. In addition, governments are exploring amphibious shuttles for last-mile connectivity across rivers and coastal zones, where fixed infrastructure is limited or impractical. As urban planners and transport operators seek innovative mobility solutions, amphibious vehicles offer both functional versatility and passenger appeal, supporting growth in commercial and recreational applications.

Amphibious Vehicle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.28 billion |

|

Revenue Forecast in 2030 |

USD 6.47 billion |

|

Growth rate |

CAGR of 8.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments Covered |

Propulsion, vehicle, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

BAE Systems plc; General Dynamics Corporation; Rheinmetall AG; Hanwha Aerospace; Hitachi Construction Machinery Co., Ltd.; EIK Engineering Sdn. Bhd.; Wetland Equipment Company; Wilco Manufacturing L.L.C.; Hydratrek, Inc.; Marsh Buggies Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |