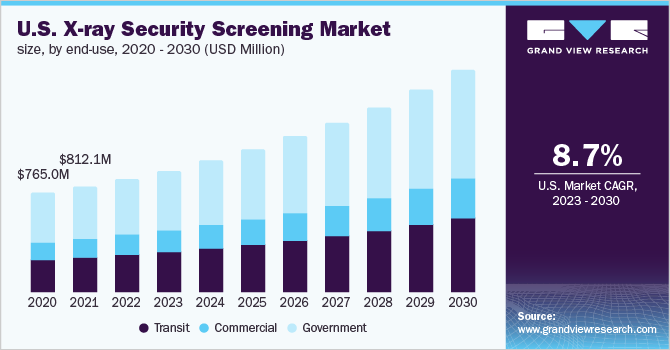

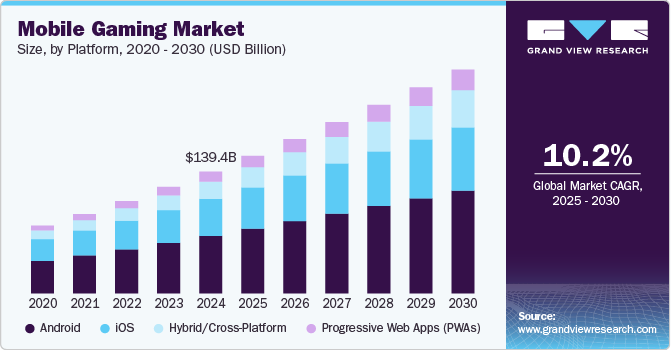

Mobile Gaming Market Size, Share & Trends Analysis growing at a CAGR of 10.2% from 2025 to 2030

The global mobile gaming market size was estimated at USD 139.38 billion in 2024 and is projected to reach USD 256.19 billion by 2030, growing at a CAGR of 10.2% from 2025 to 2030. The rapid global increase in smartphone usage is the cornerstone of the mobile gaming industry exponential growth.

Key Market Trends & Insights

- Asia Pacific dominated the mobile gaming market with the largest revenue share of 52.30% in 2024.

- The U.S. accounted for the largest market revenue share in North America in 2024

- Based on platform, the android segment led the market with the largest revenue share of 47.2% in 2024

- Based on device, the tablet segment accounted for the largest market in 2024.

- Based on distribution channel, the app stores segment accounted for the largest market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 139.38 Billion

- 2030 Projected Market Size: USD 256.19 Billion

- CAGR (2025-2030): 10.2%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/mobile-games-market/request/rs1

Affordable smartphones, coupled with enhanced processing power, are democratizing gaming and making it accessible to a wider audience than ever before.

In many emerging markets, where access to traditional gaming consoles and PCs may be limited, mobile devices often serve as the primary or sole gaming platform. This widespread accessibility has led to a surge in game downloads, higher user engagement, and more frequent in-game purchases, fostering a robust monetization ecosystem. As smartphone adoption continues to expand, especially in developing regions, the user base for mobile gaming is poised to grow even further, ensuring the industry remains a dominant force in the global entertainment sector.

The free-to-play model has revolutionized mobile gaming by removing the upfront cost barrier, significantly broadening its audience. By offering full access without initial payment, developers attract massive install rates and build large user communities. Monetization is skillfully integrated through in-app purchases, ads, and gated premium features that enhance user experience without compromising core gameplay. Successful titles like Clash Royale and Genshin Impact exemplify how compelling content and monetization can coexist. The continued dominance of F2P is reshaping development priorities, placing greater emphasis on long-term user retention, engagement loops, and recurring revenue streams.

In many emerging markets, where access to traditional gaming consoles and PCs may be limited, mobile devices often serve as the primary or sole gaming platform. This widespread accessibility has led to a surge in game downloads, higher user engagement, and more frequent in-game purchases, fostering a robust monetization ecosystem. As smartphone adoption continues to expand, especially in developing regions, the user base for mobile gaming is poised to grow even further, ensuring the industry remains a dominant force in the global entertainment sector.

Mobile Gaming Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 157.60 billion |

|

Revenue forecast in 2030 |

USD 256.19 billion |

|

Growth rate |

CAGR of 10.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Platform, device, game genre, distribution channel, monetization model, age group, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Tencent Holdings Limited; Apple Inc.; Google LLC; NetEase Inc.; Activision Blizzard Inc.; Electronic Arts Inc.; Nintendo Co, Ltd.; Take-Two Interactive Software Inc.; Roblox Corporation; Supercell Oy; Playrix Holding Ltd; Niantic Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |