5G Base Station Market Size, Share & Trends Analysis growing at a CAGR of 33.5% from 2024 to 2030

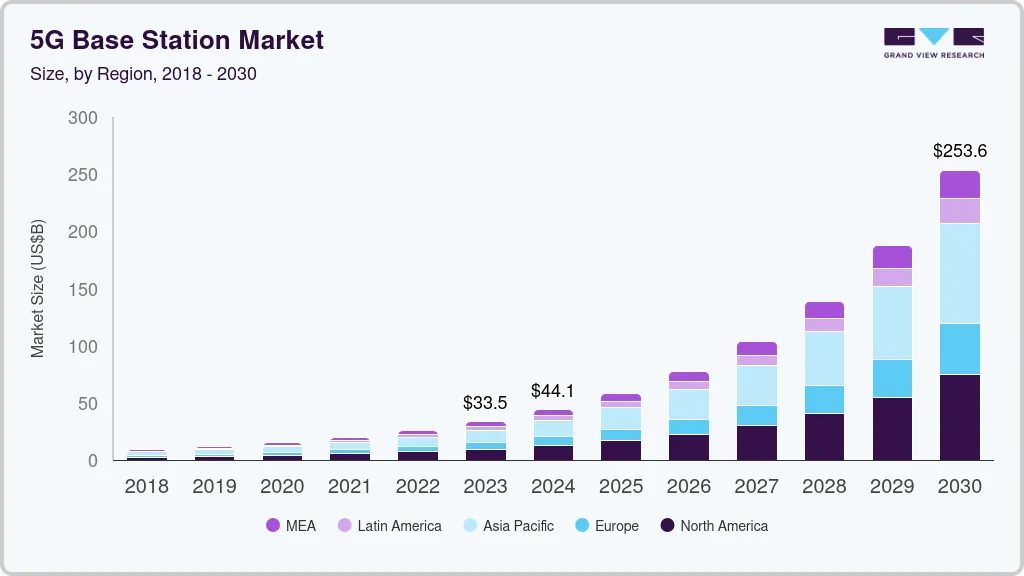

The global 5G base station market size was estimated at USD 33,472.5 million in 2023 and is projected to reach USD 253,624.3 million by 2030, growing at a CAGR of 33.5% from 2024 to 2030. The surging demand for high-speed connectivity is a significant factor driving the growth of the 5G base station market.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, hardware accounted for a revenue of USD 33,472.5 million in 2023.

- Hardware is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 33,472.5 Million

- 2030 Projected Market Size: USD 253,624.3 Million

- CAGR (2024-2030): 33.5%

- Asia Pacific: Largest market in 2023

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/5g-base-station-market-report/request/rs1

In today’s increasingly digital world, there is an ever-growing need for faster, more reliable internet connections to support a wide range of activities, from streaming high-definition videos to playing online games, conducting video conferences, and using cloud-based applications. As more devices become connected to the internet, particularly with the rise of smart homes, autonomous vehicles, and advanced mobile applications, the limitations of existing 4G networks are becoming more apparent.

5G technology addresses these limitations by offering significantly higher data speeds, lower latency, and the ability to connect many devices simultaneously. These advantages are essential for enabling new technologies and services, such as virtual and augmented reality, telemedicine, and autonomous systems, which require near-instantaneous data transmission and processing. To meet the increasing demand for these capabilities, telecom operators invest heavily in deploying 5G base stations, the backbone of 5G networks, facilitating faster data transmission over wider areas.

Moreover, the expansion of the Internet of Things (IoT) and the development of smart cities are pivotal factors driving the growth of the 5G base station market. IoT refers to the interconnected network of devices communicating with each other and central systems to collect, share, and analyze data. These devices include everything from household appliances to industrial machines, requiring constant, high-speed connectivity to function effectively.

5G technology is crucial for the IoT as it provides the necessary infrastructure to support millions of connected devices simultaneously, offering high-speed data transfer and low latency. As the number of IoT devices continues to grow, particularly in sectors such as healthcare, agriculture, transportation, and manufacturing, there is an increasing need for a robust and expansive 5G network. This demand is driving the installation of more 5G base stations to ensure that IoT systems can operate efficiently and reliably.

Consumer and business expectations for seamless connectivity continue to rise, driven by the proliferation of data-intensive applications. As a result, the need for a robust and expansive 5G infrastructure becomes critical. This demand is propelling the rapid expansion of 5G base stations as telecom companies strive to deliver the high-speed, low-latency networks that modern digital activities require.

Component Insights

Based on component, the hardware segment led the market and accounted for 66.94% of the global revenue in 2023. Telecom operators and governments invest heavily in the infrastructure required to support 5G networks. These investments are not limited to software and spectrum but extend significantly to hardware, as robust and reliable equipment is essential for successfully deploying and operating 5G networks. Government initiatives and incentives to accelerate the 5G rollout are driving telecom companies to procure the necessary hardware, thereby fueling the growth of the hardware segment.

The services segment is expected to register significant growth from 2024 to 2030. Once 5G base stations are deployed, they require continuous maintenance and optimization to ensure peak performance. The demand for services related to network monitoring, troubleshooting, and upgrades is rising as operators strive to maintain the high standards expected from 5G networks. In addition, with the introduction of new features and capabilities, ongoing optimization services are essential to adapt the infrastructure to evolving technological requirements and user demands.