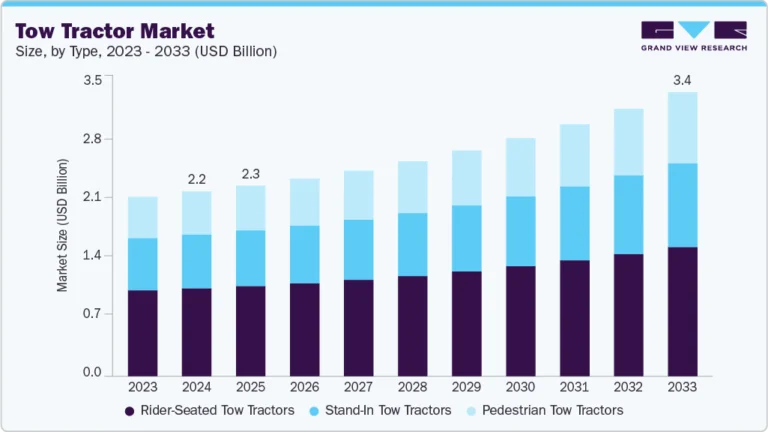

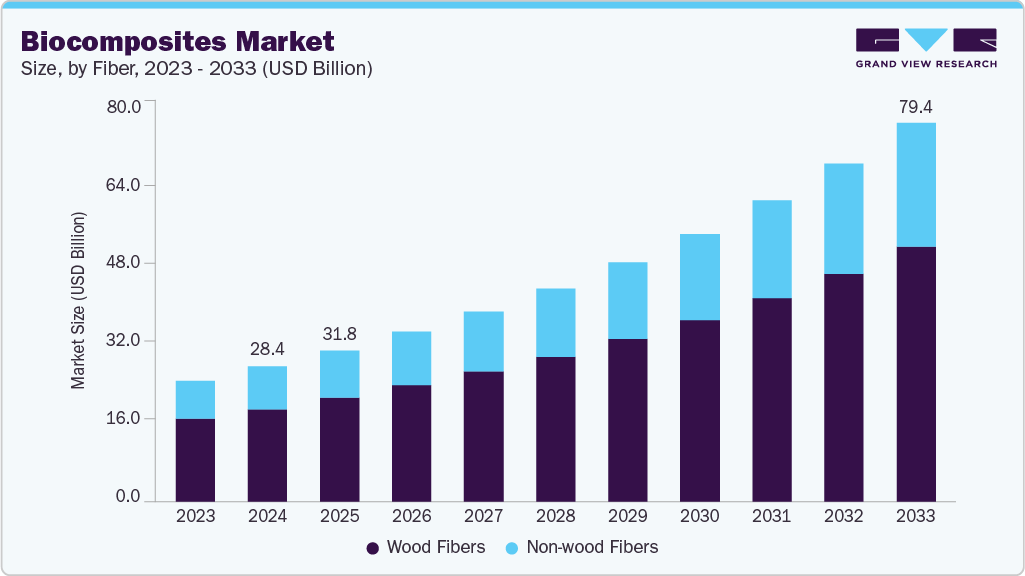

Biocomposites Market Size, Share & Trends Analysis growing at a CAGR of 12.1% from 2025 to 2033

The global biocomposites market size was estimated at USD 28.37 billion in 2024 and is projected to reach USD 79.35 billion by 2033, growing at a CAGR of 12.1% from 2025 to 2033, due to a strong global push toward sustainable, eco-friendly materials in industrial applications.

Key Market Trends & Insights

- North America dominated the biocomposites market with the largest revenue share of 50.4% in 2024.

- Asia Pacific biocomposites industry is expected to grow at the fastest CAGR over the forecast period.

- By product, the hybrid biocomposites segment is expected to grow at the fastest CAGR of 12.9% over the forecast period.

- By technology, the injection molding segment is expected to grow at fastest CAGR of 13.3% over the forecast period.

- By polymer, the biodegradable polymer segment is expected to grow at the fastest CAGR of 12.7% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 28.37 Billion

- 2033 Projected Market Size: USD 79.35 Billion

- CAGR (2025-2033): 12.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/biocomposites-market/request/rs1

As governments, corporations, and consumers aim to reduce carbon footprints and plastic dependency, biocomposites offer a renewable and biodegradable alternative to conventional composites. With rising awareness of environmental degradation and stricter disposal norms, industries such as automotive, construction, and packaging are actively adopting biocomposites. Moreover, rising global concern around microplastics and long-term pollution is encouraging the replacement with bio-based solutions. As sustainable design becomes mainstream, biocomposites are emerging as a preferred material choice. The overall value chain is also becoming more optimized, reducing costs and improving scalability.

Key drivers include government regulations on carbon emissions and single-use plastics, increasing petroleum prices, and customer preference for green products. The automotive sector is integrating biocomposites for weight reduction and emissions control. In construction, bio-based panels and insulation materials are gaining traction due to energy efficiency targets. Packaging players are shifting to biodegradable options to meet both consumer and legal expectations. Advancements in natural fiber technologies (such as hemp, flax, and jute) and resin systems are improving the mechanical properties of biocomposites, making them suitable for wider applications. These drivers are compounded by increasing R&D investment and collaborations across academia and industry.

Current trends include the development of high-strength natural fiber-reinforced biocomposites and hybrid bio-synthetic composites. Biocomposites are being integrated with nanocellulose for better performance in aerospace and electronics. 3D printing using biocomposite feedstock is expanding design possibilities in consumer goods. Companies are developing recyclable bio-resins and thermoplastic biocomposites to improve lifecycle sustainability. There is also increasing vertical integration where companies cultivate their raw materials (like hemp or flax) for controlled quality and supply. Startups are experimenting with agricultural waste such as coconut coir, rice husk, and banana fiber, for cost-efficient, high-performance bio-fillers.

Market Concentration & Characteristics

The market is moderately fragmented with both global material companies and regional players involved. While key players dominating the supply of engineered natural fibers and resins, numerous startups and small manufacturers serve local or niche markets. Strategic partnerships between material producers and end user industries are increasingly common. Europe and North America house most of the technology leaders, while Asia Pacific sees strong regional production growth due to abundant raw material and low-cost labor.

Biocomposites face competition from traditional synthetic composites like carbon and glass fiber-reinforced plastics, especially in high-load structural applications. Metal and engineered wood products are substitutes in the construction and transportation sectors. However, these alternatives often lack biodegradability or renewable sourcing advantages. Innovations in material strength and processing flexibility are helping biocomposites reduce this threat. Still, price sensitivity and performance constraints in certain applications remain challenging to full substitution.