Non-destructive Testing Market Size, Share & Trends Analysis growing at a CAGR of 7.9% from 2024 to 2030

The global non-destructive testing (ndt) market size was estimated at USD 20,019.5 million in 2023 and is projected to reach USD 34,148.1 million by 2030, growing at a CAGR of 7.9% from 2024 to 2030. The growing manufacturing activities across the developing and the developed nations is estimated to drive the market over the forecast period.

Key Market Trends & Insights

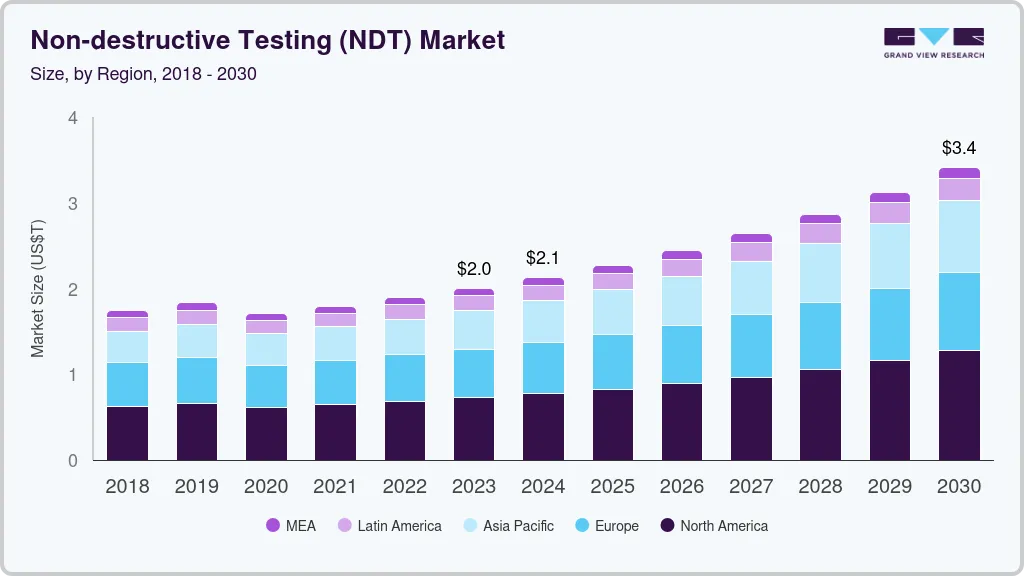

- North America emerged as the dominant segment in 2022 with a revenue share exceeding 36%.

- Country-wise, France is expected to register the highest CAGR from 2024 to 2030.

- By offering, the services segment dominated the market and accounted for the largest revenue share of over 75% in 2022.

- By test methods, the non-destructive testing methods include traditional NDT methods and digital/advanced NDT methods.

- By vertical, manufacturing vertical segment dominated the NDT market and accounted for the largest revenue share of more than 22% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 20,019.5 Million

- 2030 Projected Market Size: 34,148.1 Million

- CAGR (2024-2030): 7.9%

- North America: Largest market in 2023

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/non-destructive-testing-equipment-services-market/request/rs1

Furthermore, the increasing technological innovations pace have enable the development of advanced non-destructive testing processes with improved & precise safety & fault detection. Furthermore, increasing awareness amongst the manufacturers regarding the use of Non-destructive Testing (NDT) is expected to improve the penetration of NDT techniques in the coming years.

The utilization of NDT techniques in projects allows for quicker completion due to the detection of faults in complex areas and irregular surfaces. This reduction in the possibility of failures is expected to drive the demand for non-destructive testing in the coming years. Additionally, the ease of operating and efficiency in fault detection provided by ultrasonic equipment, compared to other NDT equipment, is a significant factor contributing to the increasing adoption of the ultrasonic test method. Moreover, advancements in ultrasonic technology anticipated within the next eight years are likely to further boost the adoption of this testing procedure due to its simplicity.

The market is projected to experience significant growth during the forecast period. This growth can be attributed to the increasing urbanization in developing countries like India and China, which involves extensive construction and manufacturing projects. The fast pace of such projects necessitates the implementation of testing processes to ensure the quality of work. This trend is expected to have a positive impact on the growth of non-destructive testing (NDT) in these countries, consequently enhancing its global market penetration.

Increasing oil and gas projects in the Middle East and North America are expected to deploy NDT techniques in order to complete the projects in prescribed timelines and with finesse, thus fueling the demand for NDT equipment over the regions. Besides, the advancements in non-destructive testing technology have led to the development of radiographic testing equipment such as industrial CT scanners, which precisely detect faults in machinery and components. However, the cost of the NDT equipment and the expertise required to perform the tests increases the complexity and difficulty of deploying the radiographic testing method.

The global COVID-19 pandemic has had detrimental and unexpected consequences for various industries worldwide, such as automotive, construction, airlines, and manufacturing, among others. To mitigate the spread of the novel coronavirus and its negative impacts, governments around the world implemented lockdowns as a precautionary measure. This led to disruptions in the global supply chain and a decline in industrial productivity, placing a strain on the global economy. Furthermore, the sudden outbreak of the virus also caused disruptions in companies’ production and manufacturing capabilities.

Moreover, the influence of the pandemic on the non-destructive testing (NDT) market arises from the combined response of interconnected industries that utilize NDT for their operations. One such example is the defense industry, which has experienced a relatively mild impact compared to other sectors. This can be attributed to government budget allocations that safeguard the supply and demand ecosystem. While certain defense companies have been significantly affected by the financial shock, the impact is comparatively lesser than that observed in the aerospace sector.