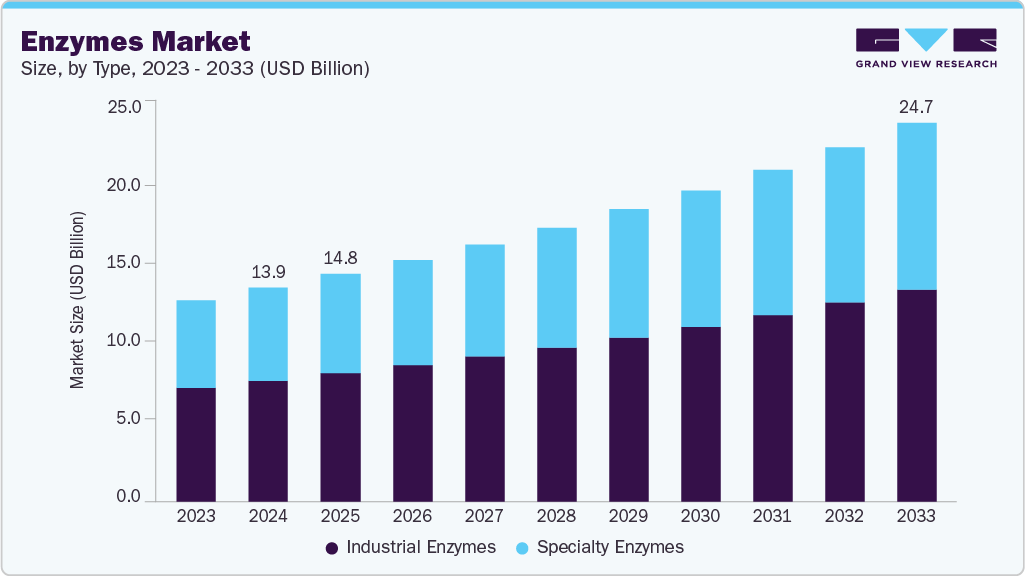

Enzymes Market Size, Share & Trends Analysis growing at a CAGR of 6.6% from 2025 to 2033

The global enzymes market size was estimated at USD 13,938.9 million in 2024 and is projected to reach USD 24,672.1 million by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The market is driven by rising demand across food processing, pharmaceuticals, and biofuels; increased adoption of sustainable and eco-friendly industrial processes; advancements in enzyme engineering; and growing use in animal feed and diagnostics.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 37.7% in 2024.

- The enzymes market in the U.S. is experiencing sustained momentum, due to increasing utilization in food and beverage processing.

- By type, the specialty enzymes segment is expected to grow at the fastest CAGR of 6.7% from 2025 to 2033 in terms of revenue.

- By product, the carbohydrase segment led the market with the largest revenue share of 47.8% in 2024.

- By source, the microorganisms segment is expected to grow at the fastest CAGR of 6.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 13,938.9 Million

- 2033 Projected Market Size: USD 24,672.1 Million

- CAGR (2025 – 2033): 6.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/enzymes-industry/request/rs1

Consumer preference for clean-label products and regulatory support further fuel market expansion. The enzymes industry is experiencing sustained growth due to the expanding applications across food processing, animal nutrition, pharmaceuticals, and industrial biotechnology. Key drivers include the rising adoption of enzymes as biocatalysts in manufacturing processes, reducing energy consumption, and chemical waste. The shift toward natural and clean-label ingredients in food and beverage products is accelerating demand for enzyme-based formulations. In animal feed, enzymes are enhancing nutrient absorption, improving animal health, and reducing environmental impact. In addition, increased R&D investment in enzyme engineering and recombinant DNA technologies is supporting efficient and scalable production.

One of the major restraints in the enzymes industry is the volatility in raw material availability and pricing, especially for animal-derived enzymes sourced from organs like the pancreas or stomach. This affects the cost structure and profit margins of manufacturers. Moreover, the production of enzymes often requires complex fermentation systems, sensitive to contamination and process variation, leading to inconsistent yield or efficacy. Regulatory hurdles around genetically modified organisms (GMOs), especially in enzyme-producing microorganisms, create barriers in certain regions. Intellectual property rights and biosafety concerns also limit the free development and distribution of new enzyme products.

There is a significant opportunity in the development of enzyme-based solutions tailored for green chemistry and sustainability. The growing interest in plant-based and microbial enzymes opens doors for enzyme manufacturers to reduce reliance on animal sources and align with ethical, halal, and kosher requirements. Industrial sectors such as textiles, detergents, pulp and paper, and biofuels are adopting enzyme technologies to reduce chemical load and waste generation. In food and beverage, emerging markets are seeking advanced enzymatic solutions for yield improvement and shelf-life enhancement. Further, synthetic biology and precision fermentation offer untapped potential for high-specificity enzyme development at a commercial scale.

Market Concentration & Characteristics

The enzymes industry is currently in a medium growth stage, with the pace of expansion steadily accelerating. Dominated by key players such as Novozymes A/S AG, DuPont Danisco, and DSM, the market exhibits a moderately concentrated supply structure. These leading companies play a pivotal role in shaping industry trends, particularly in the industrial enzymes segment, which is known for its high investment requirements and long development cycles. Growing demand for high-performance specialty enzymes is creating substantial opportunities across the supply chain, particularly for raw material providers and manufacturers capable of delivering consistent, high-quality enzyme formulations.