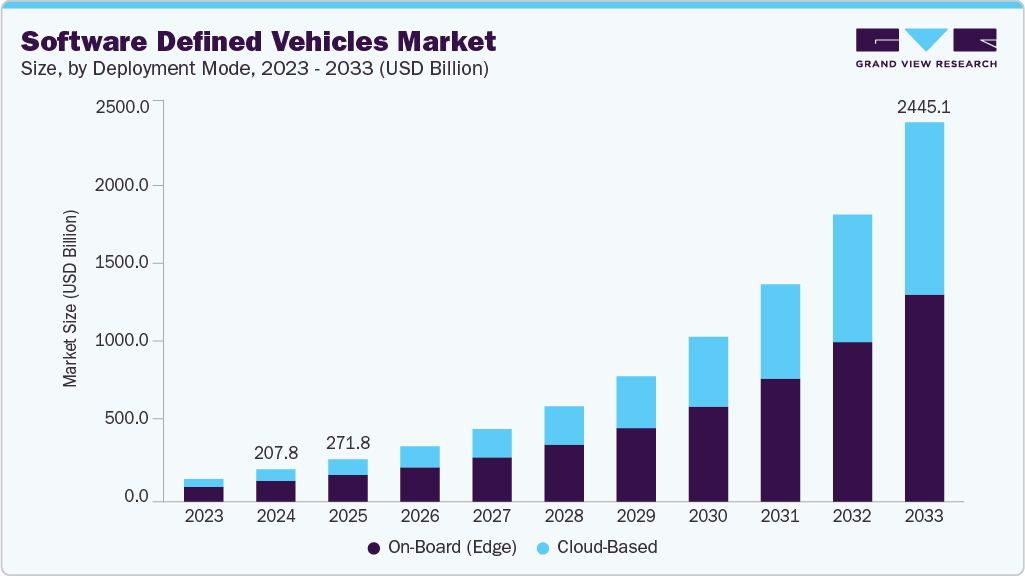

Software Defined Vehicles Market Size, Share & Trends Analysis growing at a CAGR of 31.6% from 2025 to 2033

The global software defined vehicles market size was estimated at USD 207.76 billion in 2024 and is projected to reach USD 2,445.10 billion by 2033, growing at a CAGR of 31.6% from 2025 to 2033. Automakers are transitioning from traditional distributed electronic control units to domain- and zonal-based architectures.

Key Market Trends & Insights

- Asia Pacific Software Defined Vehicles dominated the global market with the largest revenue share of 36.6% in 2024.

- The Software Defined Vehicles market in the U.S. led the North America and held the largest revenue share in 2024.

- By Deployment Mode, on-board (Edge) led the market and held the largest revenue share of 64.3% in 2024.

- By Type, the connected software-defined vehicles segment held the dominant position in the market and accounted for the largest revenue share of 27.4% in 2024.

- By Application, the autonomous driving segment is expected to grow at the fastest CAGR of 36.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 207.76 Billion

- 2033 Projected Market Size: USD 2,445.10 Billion

- CAGR (2025-2033): 31.6%

- Asia Pacific: Largest and Fastest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/software-defined-vehicles-market-report/request/rs1

This change allows for faster and more efficient real-time data processing within the vehicle. It also simplifies the implementation of over-the-air software updates and centralized control. These advancements are contributing to the steady growth of the software-defined vehicles market. Virtualization enables developers to simulate vehicle systems without physical prototypes, accelerating software design and testing. This reduces development time and cost, allowing automakers to launch feature-rich vehicles more quickly. Early validation of safety-critical functions improves reliability and lowers warranty risks for suppliers.

Continuous updates extend vehicle lifecycles and increase product value. Companies are adopting virtualization to streamline development and drive software-defined vehicle adoption. For instance, in January 2025, Intel Corporation, a U.S.-based Semiconductor manufacturing corporation, partnered with Amazon Web Services, Inc. to launch a virtual development environment for software-defined vehicles. This partnership enables seamless automotive software and hardware integration throughout the development cycle.

Software-defined vehicles are incorporating real-time AI analytics to improve overall driving experiences. These systems enable personalized driver support through continuous monitoring of vehicle and environmental data. Predictive maintenance powered by AI helps identify issues before failure, reducing downtime and costs. Remote diagnostics allow quicker service responses and streamlined vehicle upkeep. This trend shows the shift toward intelligent, connected, and proactive automotive systems. Companies are deploying AI-based solutions to enable smart remote assistance and real-time vehicle support. For instance, in January 2025, Valeo, an automotive technology company in France, and Amazon Web Services (AWS) partnered to advance software-defined vehicles with cloud-based tools that accelerate ECU development and autonomous mobility testing. Their solutions also enhance the driving experience through real-time AI-driven services.

The expansion of V2X and connected vehicle ecosystems is accelerating the adoption of Software-Defined Vehicles (SDVs) by enabling seamless communication between vehicles, infrastructure, and external networks. This connectivity requires advanced software platforms that can handle real-time data processing and decision-making. SDVs are uniquely positioned to support these requirements through centralized computing and flexible software-defined architectures. The integration of 5G and edge computing ensures low-latency communication, which is essential for safety-critical V2X applications. As vehicles exchange data with their surroundings, the need for adaptive, updateable software becomes more critical. Over-the-air (OTA) updates allow SDVs to continuously evolve and respond to changes in traffic systems and regulations.

Deployment Mode Insights

The On-Board (Edge) segment dominated the software defined vehicles market in 2024, accounting for a 64.3% share, due to their ability to process data locally with minimal latency. This is critical for real-time decision-making in applications such as autonomous driving, ADAS, and V2X communication. Edge computing reduces dependency on external networks, ensuring higher reliability in safety-critical operations. Automakers prefer on-board architectures for enhanced control over system performance and cybersecurity. These systems also directly support advanced sensor fusion and environmental mapping within the vehicle. Edge-based platforms remain essential for enabling immediate responses in dynamic driving conditions.

Cloud-Based solutions are growing rapidly in the SDV market as demand rises for scalable, updateable, and data-driven vehicle systems. They enable centralized fleet management, predictive maintenance, and continuous feature deployment through OTA updates. Cloud infrastructure supports large-scale AI training, software development, and integration of third-party services. The rise of connected and electric vehicles is driving cloud adoption for real-time traffic insights, route optimization, and infotainment. Cloud platforms also facilitate cross-vehicle data sharing, creating a foundation for vehicle-as-a-platform models.