ATM Market Size, Share & Trends Analysis growing at a CAGR of 3.6% from 2025 to 2030

The global ATM market size was estimated at USD 25.29 billion in 2024 and is projected to reach USD 31.64 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. Automated teller machines (ATMs) offer a reliable easy interface for cash withdrawal and features such as ease of fund transfer, withdrawal, deposit, and 24×7 availability of cash.

Key Market Trends & Insights

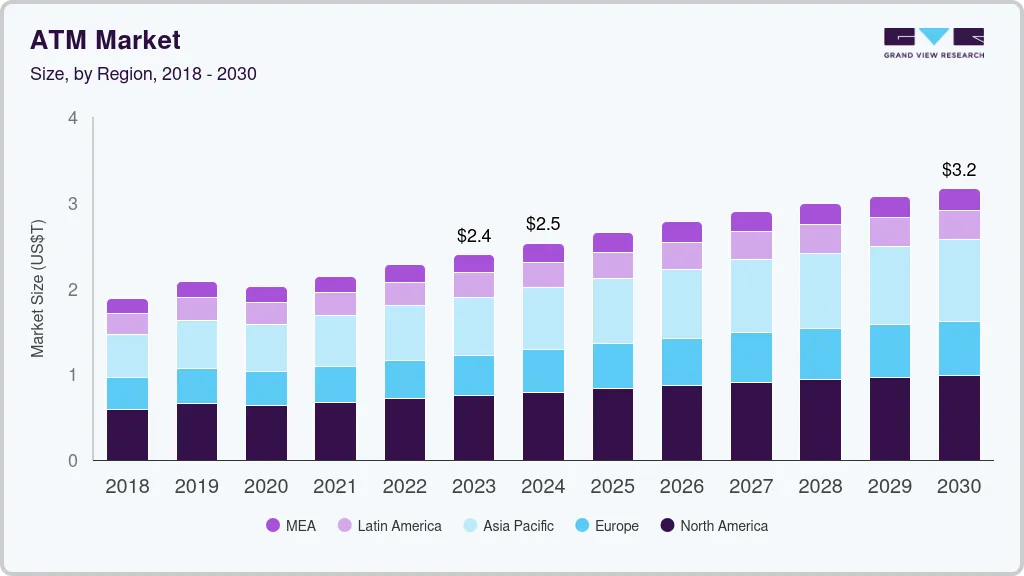

- North America ATM market held the largest share of 31.34% in 2024.

- The U.S. ATM market held a dominant position in 2024.

- Based on solution, ATM deployment solutions dominate the overall market with a revenue share of 54.11% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.29 Billion

- 2030 Projected Market Size: USD 31.64 Billion

- CAGR (2025-2030): 3.6%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/atm-market/request/rs1

With advancements in technology, customers seek secure, faster, more convenient, and reliable means of accessing cash, favoring the widespread adoption of ATMs globally. Furthermore, improved security measures, including biometric and one-time password authentication systems to prevent fraud, and the advent of Smart ATMs for users with special needs contribute to market growth. The increase in demand for automation in the banking sector in several developed and emerging countries is also expected to fuel the demand for ATMs.

The COVID-19 pandemic had significantly disrupted ATM manufacturing operations and supply chains, impacting the overall ATM market. While the stringent restrictions on movement and varying degrees of lockdowns across several countries affected business activities, many people shifted toward digital platforms for banking transactions. However, the demand for ATMs is expected to rise after the pandemic is over owing to the high demand in rural areas of developing countries such as China and India.

With the rise of cyber threats and ATM fraud, enhanced security features are becoming a top priority for the ATM market. Financial institutions are increasingly implementing advanced security measures, such as biometric authentication, end-to-end encryption, and real-time monitoring systems. These innovations aim to protect sensitive customer data and mitigate fraud risks, instilling greater confidence among users. Thus, the integration of improved security mechanisms such as fingerprint, biometrics, and double authentication adds an additional security layer to technologically advanced ATMs, which is expected to help prevent fraud and drive the adoption of ATMs.

The easy flow of cash, rising number of transactional benefits, easy withdrawal, quick and prompt service, and the viability of offline shopping have powered the usage of ATMs across the world, which positively reflects on the promising growth prospects of the global market. Growing urbanization, in both developed and emerging economies, is the primary factor driving the growth of the market. Furthermore, the 24X7 availability of cash, along with the provision of fund transfer and bill payment features are driving the demand for ATMs globally. An increase in installation base and maintenance activities has impacted revenue generation significantly.

Technological advancements such as digital convergence, integration of IoT data analysis, and biometrics & cybersecurity are expected to fuel the market growth. Technological advancement has also allowed for the introduction of contactless ATM kiosks, which have been marketed as a safer and risk-free way of withdrawing cash amid the COVID-19 pandemic. Contactless ATM kiosks allow users to withdraw cash from the ATM by scanning a QR code on the screen without touching the interface. The number of ATMs that offer contactless cash withdrawals has been on the rise globally.

Solution Insights

Based on solution, the automated teller machine (ATM) market is segmented into deployment and managed service. ATM deployment solutions dominate the overall market with a revenue share of 54.11% in 2024. The segment is expected to grow at the fastest CAGR over the forecast period. The deployment of an ATM consists of installing, setting up, testing, running, and implementing an ATM. The segment is further bifurcated into onsite, offsite, worksite, and mobile ATMs.

Onsite ATMs are located in or beside the bank, where both the physical branch and the ATM can be used. These ATMs reduce the work pressure of bank employees, avoiding long queues in bank premises for withdrawals, cash deposits, and transfers. These ATMs also reduce the probability of errors with withdrawals and deposits and allow banks to have smooth financial transactions. These factors are estimated to increase the demand for onsite ATMs in the near future.