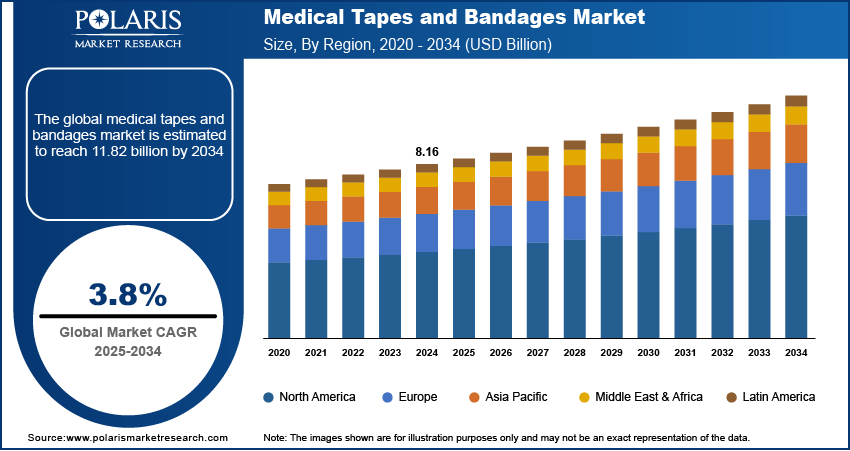

Medical Tapes and Bandages Market on Track for USD 11.82 Billion by 2034 | CAGR: 3.8%

The global medical tapes and bandages market was valued at USD 8.16 billion in 2024 and is projected to reach approximately USD 11.82 billion by 2034, according to the latest report by Polaris Market Research. The market is expected to grow at a steady compound annual growth rate (CAGR) of 3.8% during the forecast period from 2025 to 2034. A key driver of this growth is the rising prevalence of chronic diseases such as diabetes, which often result in complications like diabetic foot ulcers, thereby increasing the demand for advanced wound care products.

The medical tapes and bandages market involves the production of adhesive tapes and wound dressings used in surgical, injury, and post-operative care. Rising incidents of chronic wounds, surgeries, and sports injuries drive market demand. Increasing healthcare spending and awareness of advanced wound care proaducts support market growth. The development of hypoallergenic and waterproof materials enhances product performance. Hospitals, clinics, and homecare settings are major end-users.

Key Report Highlights:

- By product, the adhesive subsegment currently holds the largest market share globally due to its versatile applications in securing dressings, medical devices, and providing basic wound support across various healthcare settings and for personal use.

- By application, the surgical wounds application segment accounts for the largest market share, primarily fueled by the high volume of surgical procedures performed worldwide, which necessitate significant use of medical tapes and bandages for post-operative care and infection prevention in hospitals and surgical centers globally.

- By end-user, the hospitals segment currently commands the largest market share as the primary point of care for a wide range of medical conditions and surgical procedures, leading to a consistent and high demand for medical tapes and bandages for various applications.

- By region, North America currently holds the largest market share in the medical tapes and bandages market. The Asia Pacific region is exhibiting the highest growth rate in the medical tapes and bandages market.

Market Overview: Key Figures at a Glance

- Market Value in 2024: USD 8.16 billion

- Projected Market Size in 2034: USD 11.82 billion

- Anticipated CAGR 2025-2034: 3.8%

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Market Growth Drivers:

Rising Geriatric Population:

- Aging skin is more prone to injuries and chronic wounds like pressure and venous leg ulcers.

- WHO projects the global population aged 60+ to reach 2.1 billion by 2050.

- Increased elderly care needs boost demand for wound care products, including tapes and bandages.

- Higher risk of falls and mobility issues further fuels market growth.

Increasing Number of Surgical Procedures:

- Rising global surgical volumes drive demand for tapes and bandages for wound dressing and recovery.

- Used to secure dressings, prevent infections, and support healing post-surgery.

- Advancements in complex and minimally invasive surgeries increase product usage.

- Improved healthcare access worldwide contributes to higher surgical demand.

Growing Prevalence of Chronic Diseases:

- Conditions like diabetes and cardiovascular diseases lead to chronic wounds.

- Diabetic foot ulcers and vascular ulcers require ongoing wound management.

- CDC reported 37.3 million Americans had diabetes in 2020, many needing wound care.

- Long-term care needs sustain high demand for medical tapes and bandages.

Market Key Players:

The competitive landscape features a mix of long-standing companies and emerging contenders. Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

- 3M Company

- BSN medical GmbH (Essity AB)

- Cardinal Health

- Hartmann Group

- Johnson & Johnson (Johnson & Johnson Consumer Inc.)

- Lohmann GmbH & Co. KG

- Medtronic (Covidien LLC)

- Mölnlycke Health Care AB

- Nitto Denko Corporation

- Smith+Nephew