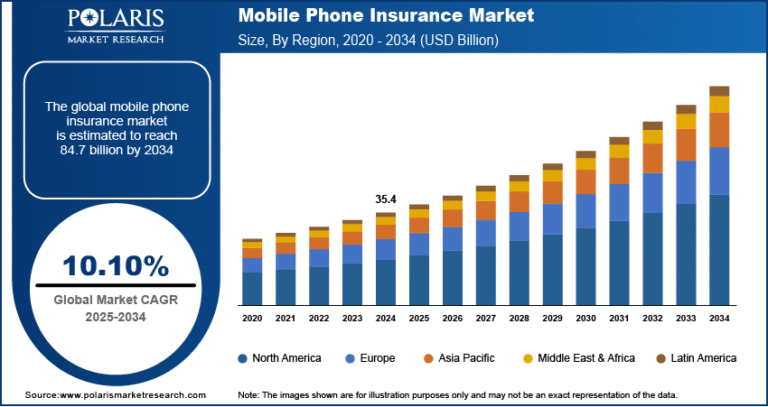

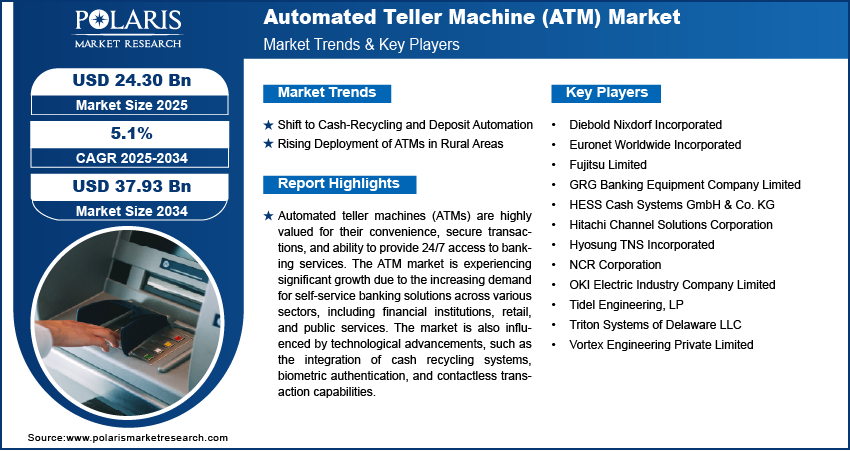

Automated Teller Machine (ATM) Market Analysis: Opportunities, Innovations, and Growth Potential Through 2034

The automated teller machine (ATM) market size was valued at USD 23.23 billion in 2024. It is projected to grow from USD 24.30 billion in 2025 to USD 37.93 billion by 2034, exhibiting a CAGR of 5.1% during 2024–2034.

This upward trajectory is largely fueled by an automated teller machine (ATM) is a self-service electronic banking terminal that enables users to perform routine financial tasks such as cash withdrawals, deposits, fund transfers, and balance inquiries. The convenience, quick access to cash, enhanced customer satisfaction, and compatibility with offline shopping have significantly contributed to the widespread adoption of ATMs globally.

Market Definition

Automated Teller Machine (ATM) Market: Encompasses the manufacturing and deployment of ATMs that provide 24/7 access to banking services like cash withdrawal, deposits, and balance inquiries.

Key Report Highlights

- The report highlights the key region that accounts for the highest revenue share in the global Automated Teller Machine (ATM) market.

- It identifies the leading country within this region that makes a significant contribution to the market’s overall performance.

- The report outlines the dominant segment that holds a major share of the market.

- It also emphasizes the fastest-growing segment projected to gain strong traction during the forecast period.

- Qualitative and quantitative market analysis have been used to provide an in-depth understanding of the market.

Market Overview: Key Figures at a Glance

- Market Value in 2024: USD 23.23 Billion

- Projected Market Size in 2034: USD 37.93 Billion

- Anticipated CAGR 2034: 5.1%

Get access to the full report or request a complimentary sample for in-depth analysis: https://www.polarismarketresearch.com/industry-analysis/automated-teller-machine-atm-market

Market Growth Drivers

Shift to Cash‑Recycling and Deposit Automation

The growing adoption of cash-recycling ATMs is significantly transforming ATM operations by enhancing efficiency and reducing manual cash handling costs. These advanced machines accept, authenticate, and dispense deposited cash, streamlining cash management processes, especially in high-traffic areas. For instance, in August 2023, Diebold Nixdorf expanded its DN Series with the launch of the DN Series 600V teller cash recycler and the DN Series 430V outdoor cash recycler. The 600V automates up to 90% of transactions with high note capacity, while the 430V is built for extreme outdoor conditions, catering to users needing 24/7 cash access. These innovations reflect the trend toward multifunctional ATMs that deliver improved customer service, boost operational efficiency, and lower costs—key drivers fueling market growth.

Market Key Players

The competitive landscape features a mix of long-standing companies and emerging contenders. Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

Add key players by referring to the RD for the market available on our website.

- Diebold Nixdorf Incorporated

- Euronet Worldwide Incorporated

- Fujitsu Limited

- GRG Banking Equipment Company Limited

- HESS Cash Systems GmbH & Co. KG

- Hitachi Channel Solutions Corporation

- Hyosung TNS Incorporated

- NCR Corporation

- OKI Electric Industry Company Limited

- Tidel Engineering, LP

- Triton Systems of Delaware LLC

- Vortex Engineering Private Limited