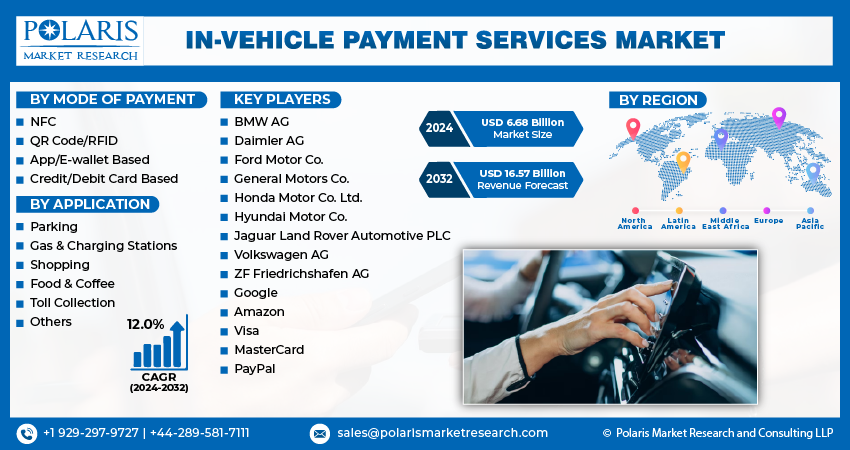

In-Vehicle Payment Services Market Projected to Reach $50.4 Billion by 2034, Growing at a CAGR of 25.60%

The global in-vehicle payment services market was valued at USD 5.2 billion in 2024 and is expected to grow at a CAGR of 25.60% from 2025 to 2034, driven by rapid advancements in automotive connectivity and the rising adoption of contactless payment technologies.

Key Market Trends & Insights:

- Rise of Connected Vehicles: Growing integration of infotainment systems with digital payment technologies.

- Expansion of Contactless Payments: Increasing adoption of NFC, RFID, and mobile wallets enabling seamless in-car transactions.

- Automaker–Fintech Collaborations: Strategic partnerships between car manufacturers and payment service providers driving innovation.

- Growth of Smart Infrastructure: Development of tolls, fuel stations, EV chargers, and parking systems supporting in-vehicle payments.

- Personalized User Experience: AI-powered systems offering customized payment options based on driver behavior and preferences.

- Regulatory Push for Secure Transactions: Emphasis on data privacy, cybersecurity, and compliance with standards like GDPR and PCI-DSS.

- High Adoption in Urban Mobility: Growing demand for convenience in ride-hailing, car rentals, and fleet services boosting market growth.

Market Size & Forecast

- Market size value in 2025 – USD 6.53 billion

- Revenue forecast in 2034 – USD 50.4 billion

- CAGR – 25.60% from 2025 – 2034

Request for Free Sample: https://www.polarismarketresearch.com/industry-analysis/in-vehicle-payment-services-market/request-for-sample

Key Market Growth Drivers –

1. Rising Adoption of Connected Vehicles

Modern vehicles are increasingly equipped with internet connectivity, advanced infotainment systems, and integrated GPS technologies. This connectivity is a foundation for enabling seamless, in-vehicle digital payment experiences.

2. Expansion of Contactless Payment Technologies

The widespread acceptance of contactless and mobile payment solutions—such as NFC, RFID, and QR-based systems—has led automakers and tech providers to integrate these features directly into vehicle systems for safe and quick transactions.

3. Growing Demand for Convenience and Driver Experience

Consumers are seeking frictionless and personalized driving experiences. In-vehicle payments allow drivers to pay for fuel, tolls, parking, EV charging, and food without leaving the vehicle, enhancing user satisfaction and loyalty.

4. Partnerships Between Automakers and Fintech Companies

Collaborations between automakers, payment service providers, and technology companies (e.g., Visa, Mastercard, Apple Pay, Google Pay) are rapidly expanding. These partnerships are key to offering secure, scalable, and innovative payment systems in cars.

5. Proliferation of Electric Vehicles (EVs)

As EV adoption accelerates, so does the need for integrated EV charging payment systems. In-vehicle payments simplify this process by enabling automated billing and location-based payment at charging stations.

Market Challenges –

The in-vehicle payment services market faces key challenges, starting with high integration costs and a fragmented ecosystem. Automakers must invest heavily to embed payment systems into vehicle hardware and software while navigating interoperability issues across various platforms and providers. This complexity increases development time and slows down scalability.

Additionally, concerns around data security, user privacy, and consumer trust pose major hurdles. Many users are hesitant to adopt in-vehicle payments due to fears of fraud or unauthorized access. At the same time, limited infrastructure support—especially in developing regions—restricts the availability of smart tolls, fuel stations, and EV chargers, limiting the system’s functionality and reach.