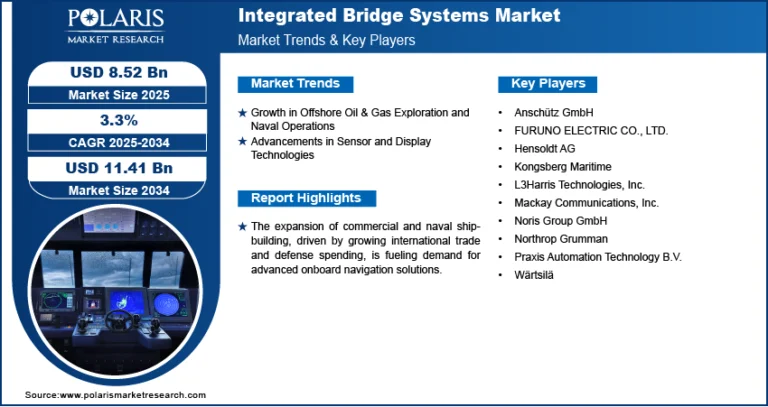

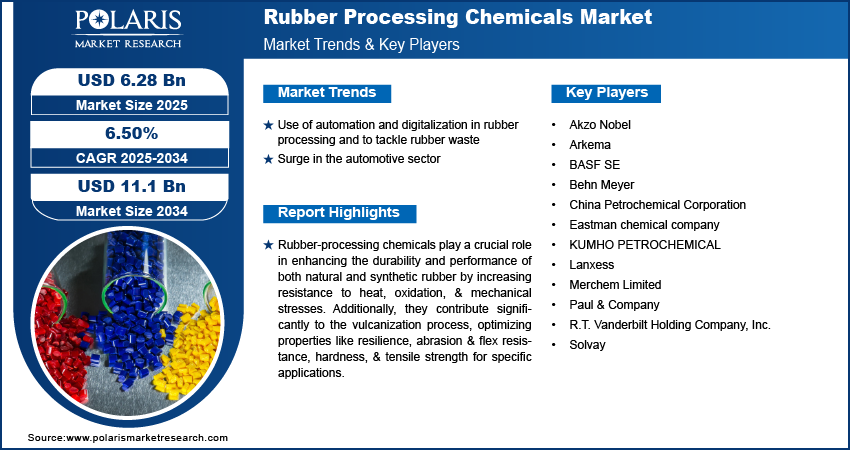

The Rubber Processing Chemicals Market is estimated to hit $11.1 billion by 2034, progressing at a CAGR of 6.50%.

The global rubber processing chemicals market was valued at USD 5.9 billion in 2024 and is projected to grow at a CAGR of 6.50% from 2025 to 2034. Growth is supported by increasing tire manufacturing and demand for durable rubber products.

Market Trends & Insights:

- Surge in Automotive Demand: With increased vehicle production and tire replacement needs, automotive applications continue to dominate the demand for rubber processing chemicals.

- Focus on Sustainability: Rising environmental concerns are driving the development of non-toxic, low-VOC, and bio-based chemical alternatives.

- Advanced Formulations: Innovations in specialty chemicals are improving heat resistance, flexibility, and wear properties in both natural and synthetic rubber.

- Regulatory Compliance: Stricter environmental and occupational safety regulations are influencing chemical selection and encouraging safer, compliant formulations.

- Integration with Smart Manufacturing: Automation and precision in rubber compounding are enhancing consistency and quality, supported by smart chemical additives.

Market Size & Forecast

Market size value in 2025 USD – 6.28 billion

Revenue forecast in 2034 USD – 11.1 billion

CAGR – 6.50% from 2025 – 2034

Request for Free Sample:

Market Overview:

The rubber processing chemicals market is expanding steadily, fueled by the growing demand for rubber products across automotive, construction, and industrial sectors. These chemicals—including accelerators, activators, anti-degradants, and processing aids—are essential in enhancing the strength, elasticity, durability, and aging resistance of rubber during manufacturing. As the global focus shifts toward performance optimization and sustainability, the market is evolving with innovations in eco-friendly and high-performance formulations.

Market Growth Drivers:

- Booming Tire and Automotive Industry: Increasing vehicle ownership and growth in commercial transportation are fueling demand for high-performance tires and rubber components.

- Infrastructure and Construction Activities: The use of rubber in seals, gaskets, roofing, and flooring materials is boosting chemical requirements across construction projects.

- Growth in Industrial Applications: Conveyor belts, hoses, and protective gear in industrial settings contribute significantly to rubber product consumption.

- Technological Advancements in Polymer Blending: Sophisticated blending of rubber with processing chemicals enables manufacturers to meet diverse performance specifications.

Market Challenges:

- Environmental and Health Concerns: Some traditional Rubber Processing Chemicals risks to workers and ecosystems, necessitating safer alternatives and increased regulatory oversight.

- Volatility in Raw Material Prices: Fluctuating costs of petrochemical-based raw materials can impact manufacturing economics and pricing strategies.

- Complex Regulatory Landscape: Complying with region-specific chemical safety standards and documentation can be costly and time-consuming for manufacturers.

- Disposal and Recycling Issues: Challenges in recycling rubber products with embedded chemicals highlight the need for greener, recyclable formulations.