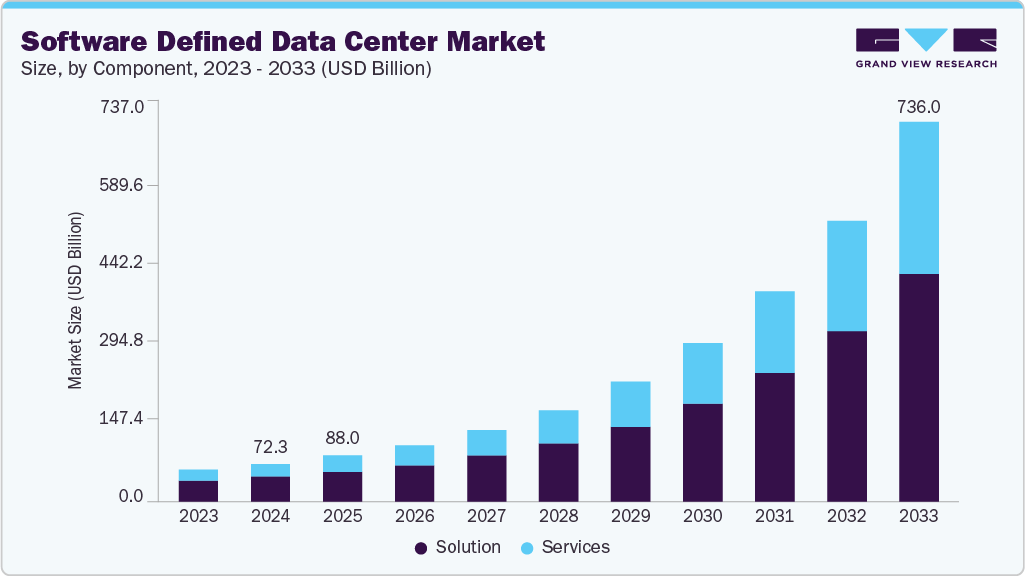

Software Defined Data Center Market Size, Share, & Trends Analysis growing at a CAGR of 30.4% from 2025 to 2033

The global software defined data center market size was estimated at USD 72.29 billion in 2024 and is projected to reach USD 736.00 billion by 2033, growing at a CAGR of 30.4% from 2025 to 2033 due to increasing demand for scalable and agile IT infrastructure to support digital transformation initiatives.

Key Market Trends & Insights

- North America software defined data center dominated the global market with the largest revenue share of 36.7% in 2024.

- The software defined data center industry in the U.S. is expected to grow significantly over the forecast period.

- By component, solution led the market and held the largest revenue share of 66.0% in 2024.

- By type, the software-defined compute (SDC) segment held the dominant position in the market and accounted for the largest revenue share in 2024.

- By end use, the IT and telecom segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 72.29 Billion

- 2033 Projected Market Size: USD 736.00 Billion

- CAGR (2025-2033): 30.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/software-defined-data-center-market-report/request/rs1

Enterprises across industries are shifting from traditional data centers to software-defined environments to improve automation, reduce hardware dependency, and increase resource utilization. With cloud computing, AI/ML workloads, and big data analytics requiring highly flexible and programmable infrastructure, software defined data center (SDDC) solutions are becoming vital. Moreover, organizations are adopting DevOps and continuous delivery models that rely on dynamic provisioning of compute, storage, and networking resources, capabilities that are native to SDDC frameworks. The rapid proliferation of edge computing and hybrid cloud strategies, which require a consistent and centralized approach to managing distributed IT environments, contributes to market growth. SDDCs offer seamless integration across public and private cloud platforms by abstracting hardware components and managing them via software-defined policies. This enables organizations to manage workloads across on-premises and cloud environments with better control, security, and visibility. Moreover, advancements in virtualization technologies and the adoption of containerized applications using Kubernetes and Docker further support the demand for SDDC architectures.

Cybersecurity and compliance pressures are also propelling the SDDC market forward. Software-defined infrastructures offer enhanced automation and orchestration capabilities that improve disaster recovery, fault tolerance, and policy enforcement. This is crucial in regulated industries such as finance, healthcare, and government, where data integrity and access control are mission-critical. Gigamon’s 2025 Hybrid Cloud Security Survey reveals breach rates have jumped to 55%, up 17% year-over-year, as AI-generated attacks increasingly strain hybrid cloud environments. The study surveyed over 1,000 IT and security leaders across six countries.

In addition, the emergence of AI-driven monitoring tools within SDDC platforms allows for proactive infrastructure management, helping reduce downtime and operational costs. As organizations look to future-proof their IT ecosystems, SDDC’s ability to deliver agility, automation, and operational efficiency will continue to fuel its adoption globally.

Component Insights

The solution segment dominated the market and accounted for the revenue share of 66.0% in 2024, driven by the rising need for agile, scalable, and cost-effective IT infrastructure to support modern digital transformation initiatives. Enterprises are increasingly adopting SDDC solutions to automate data center operations, enhance resource utilization, and reduce reliance on hardware-centric environments. The surge in hybrid cloud deployments, growing demand for unified management of computing, storage, and networking through software, and rising security concerns are further fueling adoption.

The service segment is anticipated to grow at the highest CAGR during the forecast period due to the increasing complexity of deploying and managing software-defined environments. This complexity drives demand for specialized consulting, integration, and support services. Organizations often lack the in-house expertise required to design and implement SDDC architectures efficiently, prompting them to rely on third-party service providers.