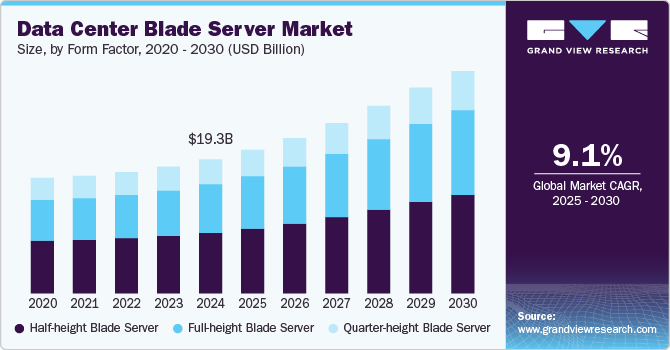

Data Center Blade Server Market Size, Share & Trends Analysis growing at a CAGR of 9.1% from 2025 to 2030

The global data center blade server market size was estimated at USD 19,256,103.6 million in 2024 and is projected to reach USD 31,939,269.6 million by 2030, growing at a CAGR of 9.1% from 2025 to 2030. The growth of the market is driven by increasing demand for high-density, energy-efficient computing solutions to support evolving enterprise IT and cloud infrastructure needs.

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, half-height blade server accounted for a revenue of USD 9,296.1 million in 2024.

- Full-height Blade Server is the most lucrative form factor segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 19,256,103.6 Million

- 2030 Projected Market Size: USD 31,939,269.6 Million

- CAGR (2025-2030): 9.1%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/data-center-blade-server-market-report/request/rs1

Organizations prioritize modular server architectures to enhance scalability, optimize space utilization, and reduce power consumption, making blade servers a preferred choice. In addition, the rising adoption of artificial intelligence (AI), big data analytics, and virtualization technologies is accelerating the deployment of high-performance computing environments, further fueling market expansion. The shift toward hybrid and multi-cloud strategies also increases the demand for blade servers as businesses seek flexible, cost-effective solutions to manage diverse workloads.

Furthermore, advancements in server management software and automation tools improve operational efficiency and minimize downtime, making blade server deployments more attractive. Regulatory requirements for data security and sustainability further influence investments in energy-efficient blade server solutions, reinforcing their role in modern data center infrastructures.

The increasing demand for high-density and energy-efficient computing solutions is a key driver of the data center blade server industry. As enterprises and cloud service providers seek to maximize computing power while minimizing physical space requirements, blade servers offer a compact, modular architecture that optimizes space utilization. Their shared power and cooling infrastructure significantly reduces energy consumption compared to traditional rack-mounted servers, aligning with sustainability goals and cost-saving initiatives.

Another major factor is the growing adoption of artificial intelligence (AI), big data analytics, and virtualization technologies. Organizations increasingly deploy AI-driven applications and large-scale data processing workloads that require high-performance computing infrastructure. Blade servers, with their ability to support powerful processors, large memory capacities, and high-speed interconnects, are well-suited for these demanding applications. In addition, the widespread use of virtualization in enterprise IT environments enhances the efficiency of blade servers by enabling resource consolidation and workload optimization.