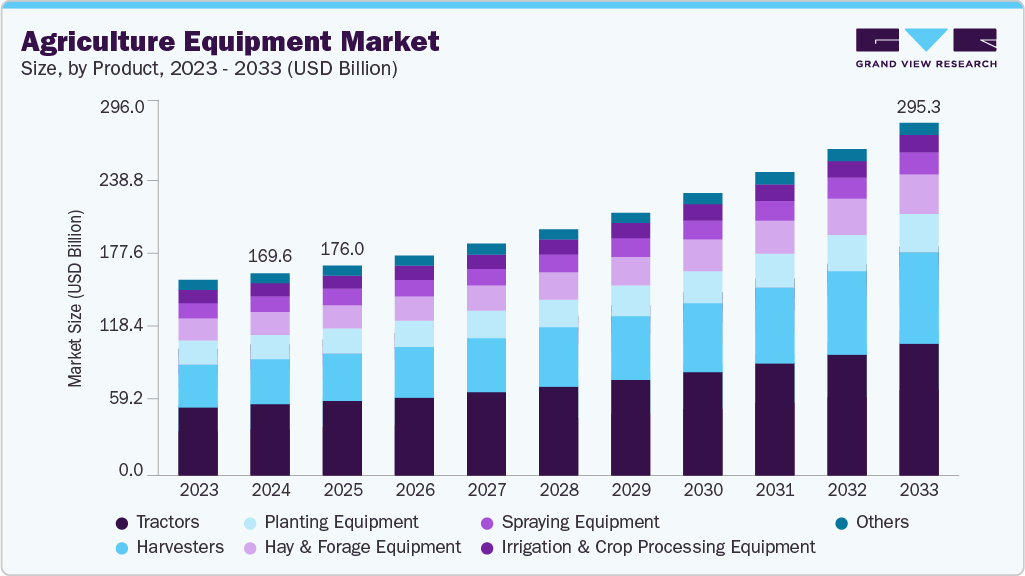

Agriculture Equipment Market Size, Share & Trends Analysis growing at a CAGR of 6.7% from 2025 to 2033

The global agriculture equipment market size was estimated at USD 169.55 billion in 2024 and is projected to reach USD 295.28 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033. Increasing mechanization in the agriculture sector, coupled with a surge in farmers’ income, is expected to be a primary factor driving the market growth.

Key Market Trends & Insights

- Asia Pacific held a 37.7% revenue share of the global agriculture equipment market.

- In China, the trend toward farm consolidation and the emergence of large agribusinesses is accelerating the demand for the agriculture equipment market.

- By product, the tractors segment held the largest revenue share of 34.9% in 2024.

- By application, the land development & seed bed preparation segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 169.55 Billion

- 2033 Projected Market Size: USD 295.28 Billion

- CAGR (2025-2033): 6.7%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/agriculture-equipment-market/request/rs1

The rise of sustainable agriculture, which is pushing manufacturers to develop eco-friendly and energy-efficient equipment, is accelerating market growth. In response to tightening emissions regulations and climate goals set by international bodies and national governments, there is an increasing push for electric tractors, biofuel-compatible engines, and hybrid farm equipment. These machines not only reduce greenhouse gas emissions but also offer lower operating costs in the long run. European countries are actively promoting low-carbon farming technologies, which has created demand for new products of agricultural machinery designed for minimal environmental impact. The integration of sustainability with profitability is creating a fresh wave of innovation within the industry.

The growth of custom hiring centers and machinery rental services is also expanding access to agriculture equipment, especially in developing markets, where purchasing large machines outright may be financially burdensome. These services allow small-scale farmers to rent modern machinery on a need-based basis, significantly lowering the barriers to mechanization. Governments, cooperatives, and private firms are increasingly investing in shared equipment hubs or pay-per-use platforms, fostering a more inclusive agricultural ecosystem. This trend is not only enabling higher productivity among resource-constrained farmers but also fueling demand for durable, multi-purpose machinery suitable for frequent rental usage.