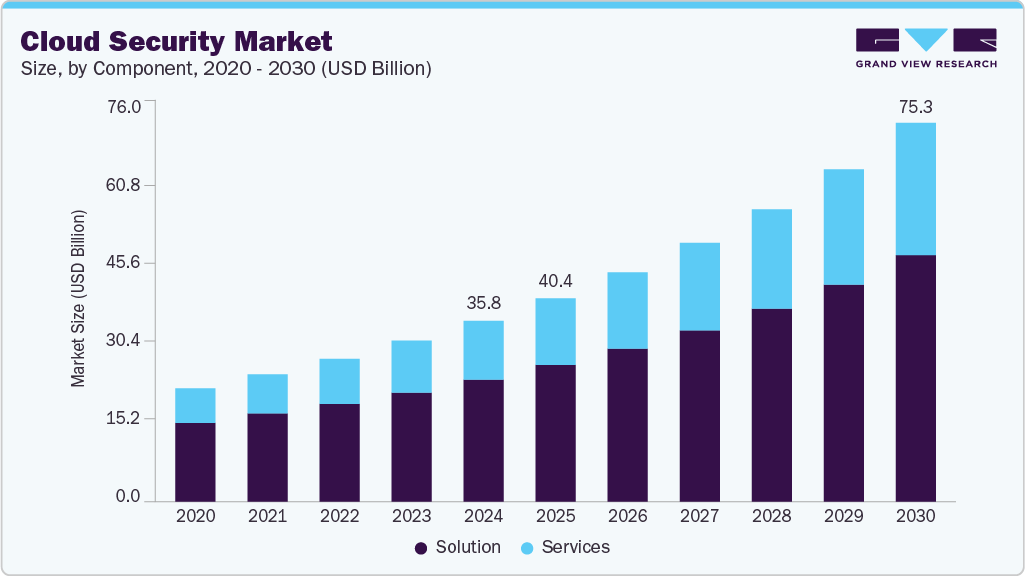

Cloud Security Market Size, Share, & Trends Analysis growing at a CAGR of 13.3% from 2025 to 2030

The global cloud security market size was estimated at USD 35.84 billion in 2024 and is projected to reach USD 75.26 billion by 2030, growing at a CAGR of 13.3% from 2025 to 2030. Driven by the accelerating global adoption of cloud computing across enterprises of all sizes.

Key Market Trends & Insights

- North America dominated the market with a revenue share of over 33.0% in 2024.

- The cloud security market in the U.S. is expected to grow significantly at a CAGR of 10.6% from 2025 to 2030.

- By component, the solution segment dominated the market and accounted for the revenue share of over 67.0% in 2024.

- By deployment, the private segment dominated the market and accounted for the revenue share of over 48.0% in 2024.

- By enterprise size, the large enterprises segment dominated the market and accounted for the revenue share of over 74.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.84 Billion

- 2030 Projected Market Size: USD 75.26 Billion

- CAGR (2025-2030): 13.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/cloud-security-market/request/rs1

As organizations increasingly migrate critical workloads and data to public, private, and hybrid cloud environments, the need to secure these assets has become paramount. This transition has elevated cloud security from a secondary IT concern to a central strategic imperative. Moreover, the proliferation of remote work models and hybrid workplace environments has expanded the threat surface, necessitating more sophisticated security frameworks and controls tailored to cloud infrastructure.

The rising frequency and sophistication of cyber threats targeting cloud-based assets also contributes to the growth of cloud security industry. High-profile data breaches and ransomware attacks have underscored the vulnerabilities inherent in cloud platforms, prompting both regulatory scrutiny and heightened enterprise investments in cloud-native security solutions. In response, vendors are innovating rapidly, developing tools that incorporate advanced technologies such as artificial intelligence (AI), machine learning (ML), and automation to deliver real-time threat detection, automated incident response, and behavioral analytics. These innovations are enhancing the effectiveness and appeal of modern cloud security solutions. According to the Thales Cloud Security Study 2024, stated that cloud data encryption remains low, with fewer than 10% of enterprises encrypting 80% or more of their cloud data, despite 44% reporting cloud security incidents and 14% experiencing breaches in the past year.

Moreover, increasing regulatory mandates such as the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and industry-specific compliance frameworks are compelling organizations to implement rigorous cloud security measures. These compliance requirements are particularly critical in sectors such as healthcare, banking, and government, where data sensitivity is high. Furthermore, the growth of multi-cloud and hybrid cloud strategies is adding complexity to cloud environments, thereby fueling demand for unified, policy-driven security architectures that ensure consistency across platforms.